Louisiana-Pacific Stock: A Deep Dive Into Analyst Perspectives (6 Ratings)

In the latest quarter, 6 analysts provided ratings for Louisiana-Pacific (NYSE:LPX), showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 2 | 0 | 0 |

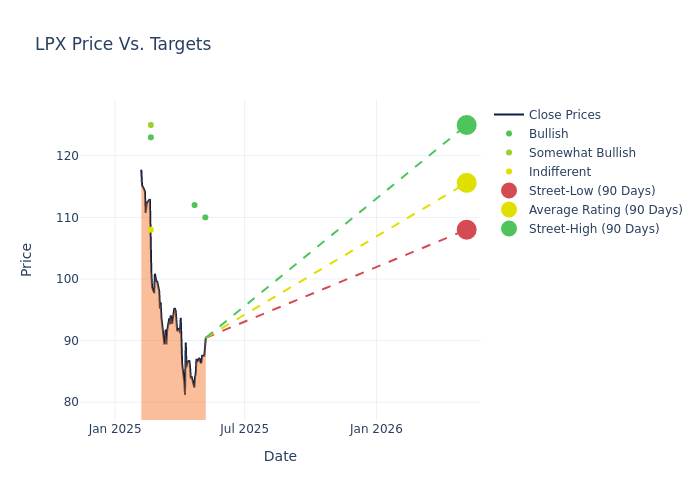

The 12-month price targets, analyzed by analysts, offer insights with an average target of $114.67, a high estimate of $125.00, and a low estimate of $108.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 2.82%.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Louisiana-Pacific is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeffrey Stevenson | Loop Capital | Maintains | Buy | $110.00 | $110.00 |

| Michael Roxland | Truist Securities | Lowers | Buy | $112.00 | $126.00 |

| Jeffrey Stevenson | Loop Capital | Lowers | Hold | $110.00 | $117.00 |

| Steven Chercover | DA Davidson | Lowers | Buy | $123.00 | $125.00 |

| Matthew McKellar | RBC Capital | Maintains | Outperform | $125.00 | $125.00 |

| Ketan Mamtora | BMO Capital | Raises | Market Perform | $108.00 | $105.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Louisiana-Pacific. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Louisiana-Pacific compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Louisiana-Pacific's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into Louisiana-Pacific's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Louisiana-Pacific analyst ratings.

Get to Know Louisiana-Pacific Better

Louisiana-Pacific is primarily an oriented strand board producer and also offers engineered wood siding used in home construction and repair and remodel projects. The company is largely exposed to the North American housing market but has also established capacity in Brazil and Chile.

Louisiana-Pacific: Delving into Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Louisiana-Pacific displayed positive results in 3M. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 3.34%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Louisiana-Pacific's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 9.12%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Louisiana-Pacific's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.72% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Louisiana-Pacific's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.41%, the company showcases efficient use of assets and strong financial health.

Debt Management: Louisiana-Pacific's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.23.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.