Cathie Wood's $21.5 Million Shopify Grab Defies Post-Earnings Dip, Ark Continues Dumping Palantir, Also Chops Jack Dorsey's Block

On Thursday, Cathie Wood-led Ark Invest made significant moves in the stock market, focusing on Shopify Inc. (NASDAQ:SHOP), Palantir Technologies Inc. (NASDAQ:PLTR), and Block Inc. (NYSE:XYZ).

The Shopify Trade

Ark Invest’s funds, including Ark Fintech Innovation ETF (BATS:ARKF), ARK Innovation ETF (BATS:ARKK), and ARK Next Generation Internet ETF (BATS:ARKW), collectively acquired 228,824 shares in Shopify. This move comes after Shopify reported a 26.8% year-over-year increase in revenue for its fiscal first quarter, reaching $2.36 billion, which surpassed analyst expectations of $2.33 billion. Despite this revenue growth, Shopify’s stock experienced a decline following the announcement due to a contraction in gross margins. On Thursday, the shares ended 0.5% lower at $94. The Ark purchase amounted to $21.5 million.

The Palantir Trade

Ark Invest trimmed its position in the Alex Karp-led company across its ARKF, ARKK, and ARKW funds, offloading a total of 135,572 shares. Based on Thursday's closing price of $119.15—up 7.85% on the day—the trades were valued at approximately $16.1 million.

This decision follows Palantir’s recent earnings report, which showed a 39% increase in revenue year-over-year, reaching $883.86 million and surpassing analyst expectations. The company’s U.S. revenue saw a significant 55% rise, driven by a 71% surge in commercial revenue. Despite the positive earnings, Ark Invest has been trimming its position in Palantir. On Wednesday, the firm offloaded shares worth $38.8 million, while on Tuesday it had sold $41 million worth. Palantir makes up 6.01% of Ark's portfolio by weight, with total holdings valued at $301.3 million.

The Block Trade

Ark Invest also decreased its stake in the Jack Dorsey-led company, selling a total of 256,593 shares across its ARKF, ARKK, and ARKW funds. This decision follows Block’s disappointing first-quarter earnings report, which revealed earnings of 56 cents per share, missing the analyst consensus estimate of 87 cents. Additionally, the Bitcoin (CRYPTO: BTC)-focused company’s quarterly revenue of $5.77 billion fell short of the expected $6.2 billion.

Other Key Trades:

- ARKK and ARKG purchased shares of Veracyte Inc.

- ARKK acquired shares of GitLab Inc.

- ARKG sold shares of Adaptive Biotechnologies Corp.

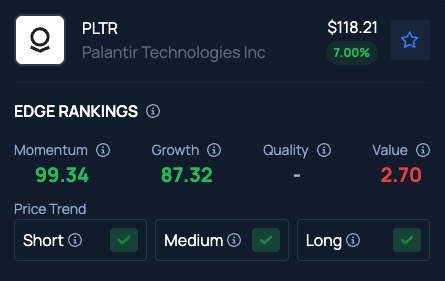

Benzinga Edge Stock Rankings show that Palantir has a Momentum in the 99th percentile and Growth in the 87th percentile. Want to know how your favorite stock ranks up? Click here.

Photo Courtesy: Ira Lichi On Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal