4 Analysts Have This To Say About PAR Technology

4 analysts have shared their evaluations of PAR Technology (NYSE:PAR) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

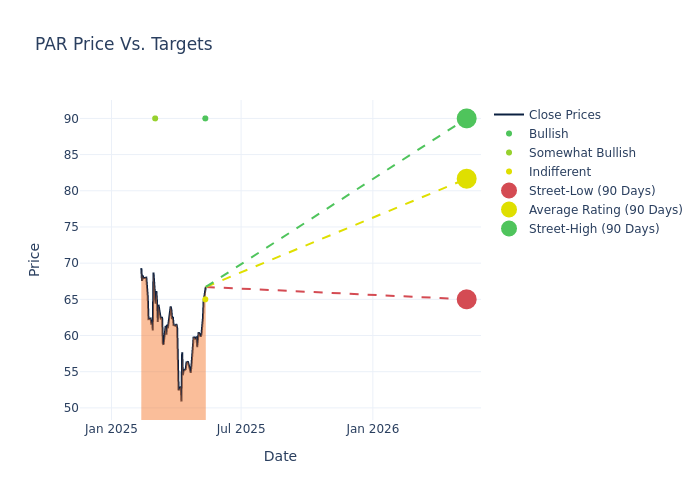

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $83.75, with a high estimate of $90.00 and a low estimate of $65.00. This upward trend is evident, with the current average reflecting a 2.45% increase from the previous average price target of $81.75.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive PAR Technology. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Will Nance | Goldman Sachs | Raises | Neutral | $65.00 | $57.00 |

| Mayank Tandon | Needham | Maintains | Buy | $90.00 | $90.00 |

| Charles Nabhan | Stephens & Co. | Maintains | Overweight | $90.00 | $90.00 |

| Mayank Tandon | Needham | Maintains | Buy | $90.00 | $90.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to PAR Technology. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of PAR Technology compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of PAR Technology's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on PAR Technology analyst ratings.

Unveiling the Story Behind PAR Technology

PAR Technology Corp is a foodservice technology company providing omnichannel cloud-based software and hardware solutions to the restaurant industry in three restaurant categories - quick service, fast casual, and table service - and the retail industry, including convenience and fuel retailers (C-Stores). The company's product and service offerings include point-of-sale, customer engagement and loyalty, digital ordering and delivery, operational intelligence, payment processing, hardware, and related technologies, solutions, and services. The company generates revenue from subscription service, Sale of Hardware products, and Professional Service.

PAR Technology: Delving into Financials

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining PAR Technology's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 50.22% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: PAR Technology's net margin excels beyond industry benchmarks, reaching -20.05%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): PAR Technology's ROE excels beyond industry benchmarks, reaching -2.69%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): PAR Technology's ROA stands out, surpassing industry averages. With an impressive ROA of -1.57%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.43.

The Significance of Analyst Ratings Explained

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.