Analyst Expectations For PPG Indus's Future

Providing a diverse range of perspectives from bullish to bearish, 11 analysts have published ratings on PPG Indus (NYSE:PPG) in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 5 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 4 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

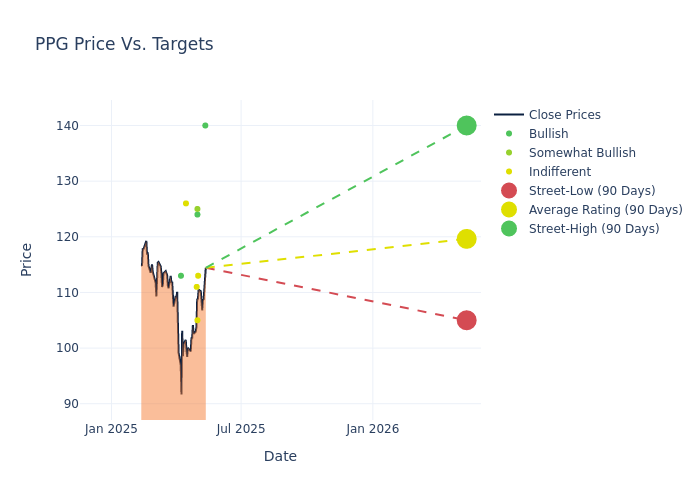

Analysts have recently evaluated PPG Indus and provided 12-month price targets. The average target is $119.73, accompanied by a high estimate of $140.00 and a low estimate of $105.00. A decline of 5.18% from the prior average price target is evident in the current average.

Diving into Analyst Ratings: An In-Depth Exploration

In examining recent analyst actions, we gain insights into how financial experts perceive PPG Indus. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Begleiter | Deutsche Bank | Raises | Buy | $140.00 | $125.00 |

| Arun Viswanathan | RBC Capital | Raises | Sector Perform | $113.00 | $112.00 |

| Frank Mitsch | Fermium Research | Maintains | Buy | $124.00 | $124.00 |

| Jeffrey Zekauskas | JP Morgan | Lowers | Neutral | $105.00 | $115.00 |

| Michael Sison | Wells Fargo | Raises | Overweight | $125.00 | $115.00 |

| Joshua Spector | UBS | Raises | Neutral | $111.00 | $110.00 |

| Steve Byrne | B of A Securities | Lowers | Neutral | $126.00 | $143.00 |

| Michael Sison | Wells Fargo | Lowers | Overweight | $115.00 | $130.00 |

| Patrick Cunningham | Citigroup | Lowers | Buy | $113.00 | $135.00 |

| Michael Sison | Wells Fargo | Lowers | Overweight | $130.00 | $135.00 |

| Jeffrey Zekauskas | JP Morgan | Lowers | Neutral | $115.00 | $145.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to PPG Indus. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of PPG Indus compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for PPG Indus's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into PPG Indus's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on PPG Indus analyst ratings.

Discovering PPG Indus: A Closer Look

PPG is a global producer of coatings. The company is the world's largest producer of coatings after the purchase of selected Akzo Nobel assets. PPG's products are sold to a wide variety of end users, including the automotive, aerospace, construction, and industrial markets. The company has a footprint in many regions around the globe, with less than half of sales coming from North America in recent years. PPG is focused on its coatings and specialty products and expansion into emerging regions, as exemplified by the Comex acquisition.

Key Indicators: PPG Indus's Financial Health

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: PPG Indus's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -4.29%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Materials sector.

Net Margin: PPG Indus's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.12% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 5.44%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): PPG Indus's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.84%, the company showcases efficient use of assets and strong financial health.

Debt Management: PPG Indus's debt-to-equity ratio surpasses industry norms, standing at 1.13. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.