Where Civitas Resources Stands With Analysts

Analysts' ratings for Civitas Resources (NYSE:CIVI) over the last quarter vary from bullish to bearish, as provided by 11 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 6 | 3 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 2 | 2 | 0 | 0 |

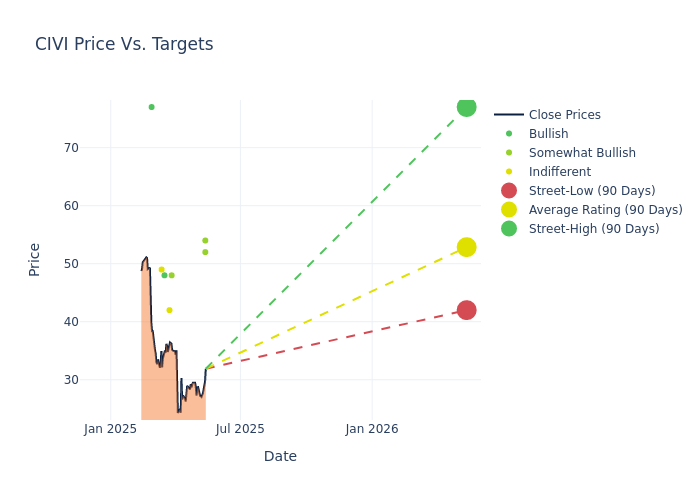

In the assessment of 12-month price targets, analysts unveil insights for Civitas Resources, presenting an average target of $57.45, a high estimate of $77.00, and a low estimate of $42.00. A 14.37% drop is evident in the current average compared to the previous average price target of $67.09.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Civitas Resources among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Lear | Piper Sandler | Lowers | Overweight | $54.00 | $62.00 |

| William Janela | Mizuho | Lowers | Outperform | $52.00 | $58.00 |

| Mark Lear | Piper Sandler | Lowers | Overweight | $62.00 | $66.00 |

| Devin McDermott | Morgan Stanley | Lowers | Overweight | $48.00 | $70.00 |

| Phillip Jungwirth | BMO Capital | Lowers | Market Perform | $42.00 | $50.00 |

| Lloyd Byrne | Jefferies | Lowers | Buy | $48.00 | $73.00 |

| Zach Parham | JP Morgan | Lowers | Neutral | $49.00 | $62.00 |

| Mark Lear | Piper Sandler | Lowers | Overweight | $66.00 | $71.00 |

| Neal Dingmann | Truist Securities | Lowers | Buy | $77.00 | $80.00 |

| Zach Parham | JP Morgan | Lowers | Neutral | $62.00 | $68.00 |

| William Janela | Mizuho | Lowers | Outperform | $72.00 | $78.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Civitas Resources. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Civitas Resources compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Civitas Resources's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Civitas Resources's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Civitas Resources analyst ratings.

About Civitas Resources

Civitas Resources Inc is an independent exploration and production company engaged in the acquisition, development, and production of oil and associated liquids-rich natural gas in the Rocky Mountain region, in the Denver-Julesburg Basin of Colorado - DJ Basin. The company's operations are focused on developing the horizontal Niobrara and Codell formations that have a low-cost structure, mature infrastructure, production efficiencies, multiple producing horizons, multiple service providers, established reserves, and prospective drilling opportunities.

Civitas Resources: Financial Performance Dissected

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining Civitas Resources's financials over 3M reveals challenges. As of 31 March, 2025, the company experienced a decline of approximately -10.24% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Energy sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Civitas Resources's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 15.6% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Civitas Resources's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.79%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Civitas Resources's ROA excels beyond industry benchmarks, reaching 1.23%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.76, caution is advised due to increased financial risk.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.