Demystifying Tenet Healthcare: Insights From 10 Analyst Reviews

During the last three months, 10 analysts shared their evaluations of Tenet Healthcare (NYSE:THC), revealing diverse outlooks from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 3 | 2 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

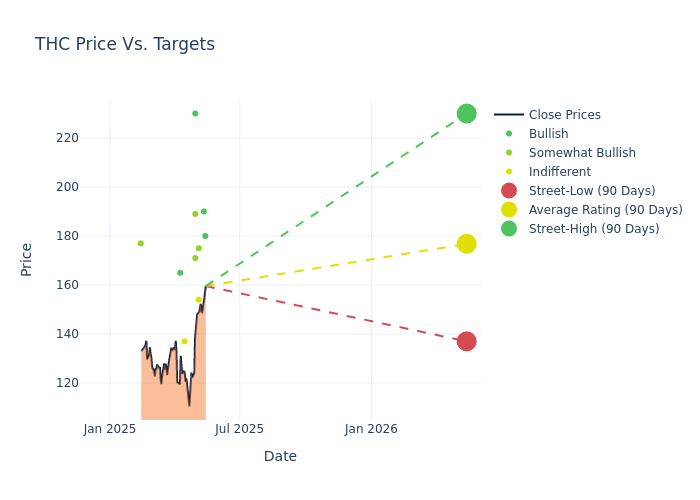

The 12-month price targets, analyzed by analysts, offer insights with an average target of $175.6, a high estimate of $230.00, and a low estimate of $137.00. This current average reflects an increase of 3.83% from the previous average price target of $169.12.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Tenet Healthcare. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kevin Fischbeck | B of A Securities | Raises | Buy | $180.00 | $165.00 |

| David Macdonald | Truist Securities | Raises | Buy | $190.00 | $175.00 |

| Jamie Perse | Goldman Sachs | Raises | Neutral | $154.00 | $134.00 |

| Craig Hettenbach | Morgan Stanley | Raises | Overweight | $175.00 | $165.00 |

| Andrew Mok | Barclays | Raises | Overweight | $171.00 | $161.00 |

| Ben Hendrix | RBC Capital | Raises | Outperform | $189.00 | $183.00 |

| A.J. Rice | UBS | Raises | Buy | $230.00 | $217.00 |

| Michael Ha | Baird | Lowers | Neutral | $137.00 | $153.00 |

| Jason Cassorla | Guggenheim | Announces | Buy | $165.00 | - |

| Craig Hettenbach | Morgan Stanley | Announces | Overweight | $165.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Tenet Healthcare. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Tenet Healthcare compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Tenet Healthcare's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Tenet Healthcare's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Tenet Healthcare analyst ratings.

Get to Know Tenet Healthcare Better

Tenet Healthcare is a Dallas-based healthcare services organization. It operates acute and specialty hospitals (47 as of December 2024) and over 500 ambulatory surgery centers and other outpatient facilities across the US, primarily in the South. Through its Conifer segment, Tenet also provides revenue cycle management solutions.

Tenet Healthcare: Delving into Financials

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Tenet Healthcare's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -2.7%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Tenet Healthcare's net margin excels beyond industry benchmarks, reaching 7.77%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Tenet Healthcare's ROE stands out, surpassing industry averages. With an impressive ROE of 9.72%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Tenet Healthcare's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.4%, the company showcases efficient use of assets and strong financial health.

Debt Management: Tenet Healthcare's debt-to-equity ratio is below the industry average. With a ratio of 3.15, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.