Analyst Expectations For Phinia's Future

Analysts' ratings for Phinia (NYSE:PHIN) over the last quarter vary from bullish to bearish, as provided by 4 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 0 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

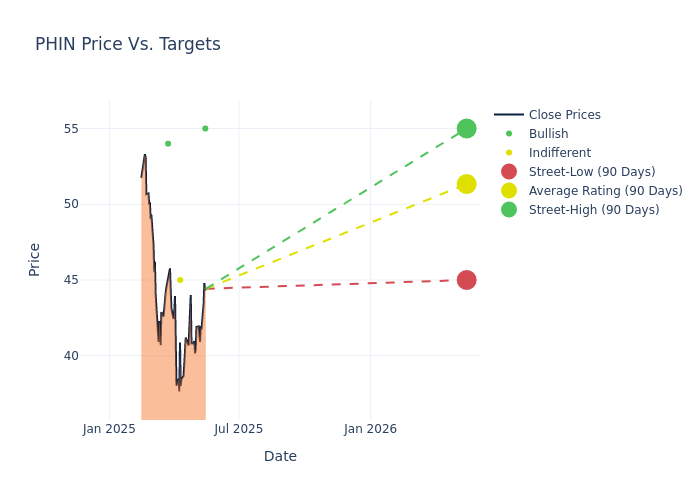

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $51.75, along with a high estimate of $55.00 and a low estimate of $45.00. A decline of 5.05% from the prior average price target is evident in the current average.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Phinia's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Federico Merendi | B of A Securities | Raises | Buy | $55.00 | $53.00 |

| Joseph Spak | UBS | Lowers | Neutral | $45.00 | $56.00 |

| Federico Merendi | B of A Securities | Announces | Buy | $53.00 | - |

| David Silver | CL King | Announces | Buy | $54.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Phinia. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Phinia compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Phinia's stock. This analysis reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Phinia's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Phinia analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Phinia

Phinia Inc is engaged in the development, design, and manufacture of integrated components and systems that optimize performance, increase efficiency, and reduce emissions in combustion and hybrid propulsion for commercial vehicles, industrial applications, and light vehicles. Its product portfolio includes alternative fuel systems, fuel delivery modules, evaporative canisters, diesel fuel injection systems, electrical systems, hydrogen solutions, associated software, and others. The company's reportable segments are; the Fuel Systems segment, which derives key revenue, and the Aftermarket segment. Geographically, the company generates maximum revenue from the United States and the rest from the United Kingdom, China, Poland, Romania, Brazil, and other regions.

Key Indicators: Phinia's Financial Health

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Phinia's revenue growth over a period of 3M has faced challenges. As of 31 March, 2025, the company experienced a revenue decline of approximately -7.76%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 3.27%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.67%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Phinia's ROA stands out, surpassing industry averages. With an impressive ROA of 0.69%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Phinia's debt-to-equity ratio is below the industry average. With a ratio of 0.68, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.