The Analyst Verdict: Quanta Services In The Eyes Of 12 Experts

Quanta Services (NYSE:PWR) underwent analysis by 12 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 4 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 2 | 0 | 0 |

| 2M Ago | 4 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

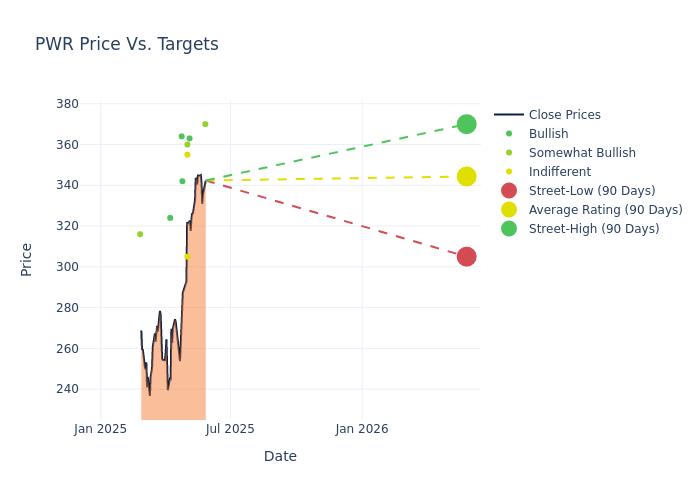

In the assessment of 12-month price targets, analysts unveil insights for Quanta Services, presenting an average target of $334.67, a high estimate of $370.00, and a low estimate of $286.00. This current average represents a 1.2% decrease from the previous average price target of $338.73.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Quanta Services's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kashy Harrison | Piper Sandler | Raises | Overweight | $370.00 | $360.00 |

| Kashy Harrison | Piper Sandler | Raises | Overweight | $360.00 | $286.00 |

| Brian Brophy | Stifel | Raises | Buy | $363.00 | $306.00 |

| Brent Thielman | DA Davidson | Raises | Neutral | $305.00 | $295.00 |

| Liam Burke | B. Riley Securities | Raises | Neutral | $355.00 | $300.00 |

| Durgesh Chopra | Evercore ISI Group | Raises | Outperform | $360.00 | $331.00 |

| Andrew Kaplowitz | Citigroup | Lowers | Buy | $342.00 | $366.00 |

| Atidrip Modak | Goldman Sachs | Lowers | Buy | $364.00 | $418.00 |

| Stanley Elliott | Stifel | Lowers | Buy | $287.00 | $323.00 |

| Jamie Cook | Truist Securities | Lowers | Buy | $324.00 | $398.00 |

| Kashy Harrison | Piper Sandler | Announces | Overweight | $286.00 | - |

| Alex Rygiel | B. Riley Securities | Lowers | Neutral | $300.00 | $343.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Quanta Services. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Quanta Services compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Quanta Services's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Quanta Services's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Quanta Services analyst ratings.

Unveiling the Story Behind Quanta Services

Quanta Services is a leading provider of specialty contracting services, delivering comprehensive infrastructure solutions for the electric and gas utility, communications, pipeline, and energy industries in the United States, Canada, and Australia. Quanta reports its results under two segments: electric infrastructure and underground utility and infrastructure.

Quanta Services: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Quanta Services displayed positive results in 3M. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 23.88%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Quanta Services's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 2.31%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Quanta Services's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.95%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Quanta Services's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.76%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Quanta Services's debt-to-equity ratio is below the industry average at 0.64, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.