What 5 Analyst Ratings Have To Say About NexPoint Residential

Throughout the last three months, 5 analysts have evaluated NexPoint Residential (NYSE:NXRT), offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 2 | 0 | 0 |

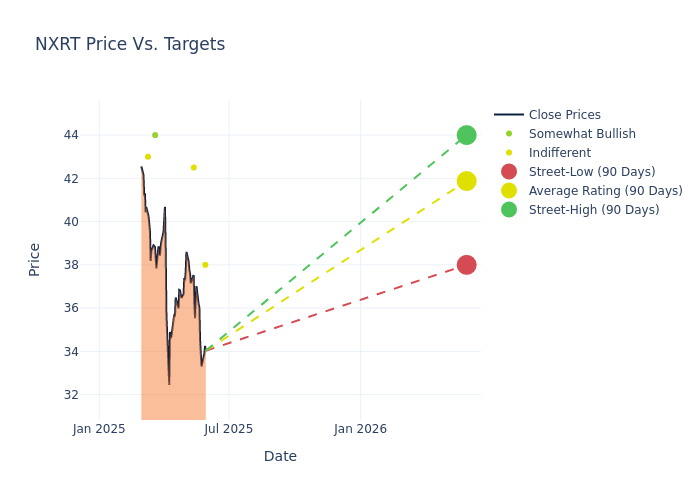

The 12-month price targets, analyzed by analysts, offer insights with an average target of $41.9, a high estimate of $44.00, and a low estimate of $38.00. This current average has decreased by 6.47% from the previous average price target of $44.80.

Exploring Analyst Ratings: An In-Depth Overview

The standing of NexPoint Residential among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Lewis | Truist Securities | Lowers | Hold | $38.00 | $42.00 |

| Merrill Ross | Compass Point | Lowers | Neutral | $42.50 | $50.00 |

| Buck Horne | Raymond James | Lowers | Outperform | $44.00 | $50.00 |

| Linda Tsai | Jefferies | Raises | Hold | $43.00 | $41.00 |

| Michael Lewis | Truist Securities | Raises | Hold | $42.00 | $41.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to NexPoint Residential. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of NexPoint Residential compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into NexPoint Residential's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on NexPoint Residential analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering NexPoint Residential: A Closer Look

NexPoint Residential Trust Inc is a real estate investment trust company. Its objectives are to maximize the cash flow and value of properties owned, acquire properties with cash flow growth potential, provide quarterly cash distributions, and achieve long-term capital appreciation for stockholders. The company seeks to achieve these objectives through targeted management and a capex value-add program. It focuses on acquiring multifamily properties in markets with attractive job growth and household formation fundamentals predominantly in the Southeastern and Southwestern United States. The company generates revenue from the rental of multifamily properties.

NexPoint Residential's Financial Performance

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, NexPoint Residential faced challenges, resulting in a decline of approximately -6.45% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -10.91%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): NexPoint Residential's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -1.75%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): NexPoint Residential's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -0.36%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a high debt-to-equity ratio of 3.86, NexPoint Residential faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.