Forecasting The Future: 5 Analyst Projections For Simon Property Group

Analysts' ratings for Simon Property Group (NYSE:SPG) over the last quarter vary from bullish to bearish, as provided by 5 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

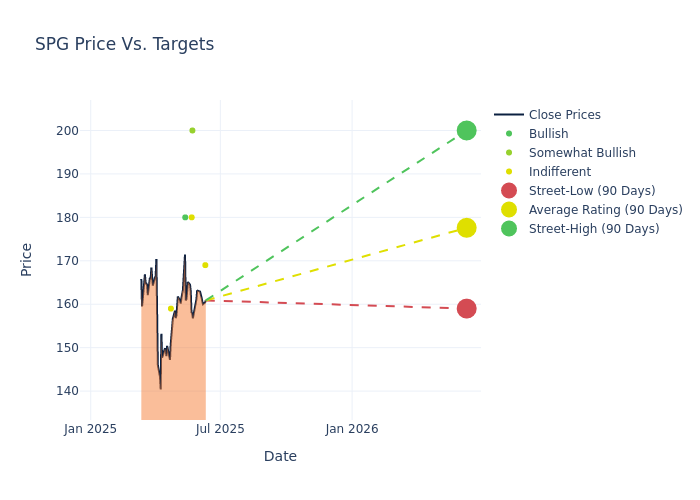

In the assessment of 12-month price targets, analysts unveil insights for Simon Property Group, presenting an average target of $177.6, a high estimate of $200.00, and a low estimate of $159.00. A decline of 4.87% from the prior average price target is evident in the current average.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Simon Property Group. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Vikram Malhorta | Mizuho | Lowers | Neutral | $169.00 | $182.00 |

| Alexander Goldfarb | Piper Sandler | Lowers | Overweight | $200.00 | $205.00 |

| Anthony Paolone | JP Morgan | Lowers | Neutral | $180.00 | $192.00 |

| Simon Yarmak | Stifel | Raises | Buy | $180.00 | $168.50 |

| Nicholas Yulico | Scotiabank | Lowers | Sector Perform | $159.00 | $186.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Simon Property Group. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Simon Property Group compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Simon Property Group's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Simon Property Group analyst ratings.

Unveiling the Story Behind Simon Property Group

Simon Property Group is the largest retail real estate investment trust in the United States. Its portfolio includes an interest in 232 properties: 134 traditional malls, 73 premium outlets, 14 Mills centers (a combination of a traditional mall, outlet center, and big-box retailers), six lifestyle centers, and five other retail properties. Simon's portfolio averaged $733 in sales per square foot over the trailing 12 months. The company also owns a 22% interest in Klépierre, a European retail company with investments in shopping centers in 14 countries, and joint-venture interests in 33 premium outlets across 11 countries.

Financial Milestones: Simon Property Group's Journey

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Simon Property Group's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 2.11%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: Simon Property Group's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 28.09%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Simon Property Group's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 15.14%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Simon Property Group's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.27%, the company showcases efficient use of assets and strong financial health.

Debt Management: Simon Property Group's debt-to-equity ratio is notably higher than the industry average. With a ratio of 9.85, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: Simplified

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.