Analyst Expectations For Extra Space Storage's Future

10 analysts have expressed a variety of opinions on Extra Space Storage (NYSE:EXR) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 3 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

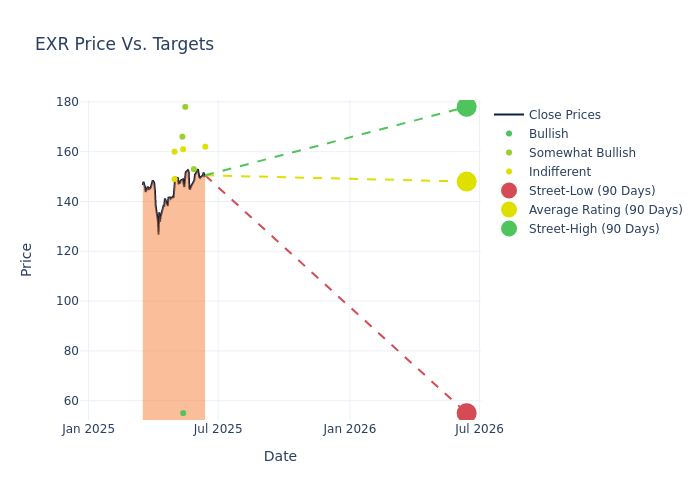

Analysts have set 12-month price targets for Extra Space Storage, revealing an average target of $147.4, a high estimate of $178.00, and a low estimate of $55.00. Marking an increase of 0.57%, the current average surpasses the previous average price target of $146.56.

Investigating Analyst Ratings: An Elaborate Study

The standing of Extra Space Storage among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Mueller | JP Morgan | Raises | Neutral | $162.00 | $160.00 |

| Ravi Vaidya | Mizuho | Raises | Outperform | $153.00 | $141.00 |

| Brendan Lynch | Barclays | Lowers | Overweight | $178.00 | $181.00 |

| Mark Zgutowicz | Benchmark | Lowers | Buy | $55.00 | $61.00 |

| Jeffrey Spector | B of A Securities | Raises | Neutral | $161.00 | $155.00 |

| Nicholas Yulico | Scotiabank | Raises | Sector Outperform | $166.00 | $149.00 |

| Brad Heffern | RBC Capital | Lowers | Sector Perform | $160.00 | $163.00 |

| Steve Sakwa | Evercore ISI Group | Raises | In-Line | $149.00 | $144.00 |

| Nicholas Yulico | Scotiabank | Lowers | Sector Outperform | $149.00 | $165.00 |

| Ravi Vaidya | Mizuho | Announces | Outperform | $141.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Extra Space Storage. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Extra Space Storage compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Extra Space Storage's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Extra Space Storage's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Extra Space Storage analyst ratings.

Delving into Extra Space Storage's Background

Extra Space Storage is a fully integrated real estate investment trust that owns, operates, and manages almost 4,000 self-storage properties in 42 states, with over 300 million net rentable square feet of storage space. Of these properties, approximately one half is wholly owned, while some facilities are owned through joint ventures and others are owned by third parties and managed by Extra Space Storage in exchange for a management fee.

Breaking Down Extra Space Storage's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Extra Space Storage's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 2.56%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: Extra Space Storage's net margin is impressive, surpassing industry averages. With a net margin of 32.98%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.94%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Extra Space Storage's ROA excels beyond industry benchmarks, reaching 0.94%. This signifies efficient management of assets and strong financial health.

Debt Management: Extra Space Storage's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.95.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.