Assessing Ally Financial: Insights From 9 Financial Analysts

In the latest quarter, 9 analysts provided ratings for Ally Financial (NYSE:ALLY), showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 2 | 0 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 1 | 0 |

| 3M Ago | 4 | 1 | 0 | 0 | 0 |

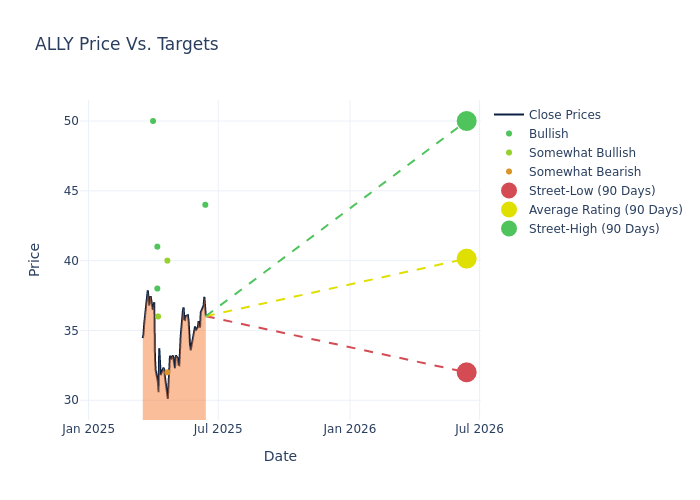

Analysts have recently evaluated Ally Financial and provided 12-month price targets. The average target is $40.78, accompanied by a high estimate of $50.00 and a low estimate of $32.00. Highlighting a 1.88% decrease, the current average has fallen from the previous average price target of $41.56.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive Ally Financial. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Smith | Truist Securities | Raises | Buy | $44.00 | $41.00 |

| David Smith | Truist Securities | Lowers | Buy | $41.00 | $45.00 |

| Jon Arfstrom | RBC Capital | Maintains | Outperform | $40.00 | $40.00 |

| Donald Fandetti | Wells Fargo | Lowers | Underweight | $32.00 | $34.00 |

| Richard Shane | JP Morgan | Lowers | Overweight | $36.00 | $43.00 |

| Brandon Berman | B of A Securities | Lowers | Buy | $38.00 | $42.00 |

| Giuliano Bologna | Compass Point | Raises | Buy | $41.00 | $37.00 |

| David Smith | Truist Securities | Lowers | Buy | $45.00 | $47.00 |

| Ryan Nash | Goldman Sachs | Raises | Buy | $50.00 | $45.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Ally Financial. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Ally Financial compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Ally Financial's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Ally Financial's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Ally Financial analyst ratings.

Unveiling the Story Behind Ally Financial

Formerly the captive financial arm of General Motors, Ally Financial became an independent publicly traded firm in 2014 and is one of the largest consumer auto lenders in the country. While the firm has expanded its product offerings over time, it remains primarily focused on auto lending, with more than 70% of its loan book in consumer auto loans and dealer financing. Ally also offers auto insurance, commercial loans, credit cards, and holds a portfolio of mortgage debt, giving the bank a diversified business model, which includes brokerage services.

Financial Insights: Ally Financial

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Challenges: Ally Financial's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -20.15%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Ally Financial's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -14.42%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Ally Financial's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -2.15%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Ally Financial's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.13%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Ally Financial's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.6.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.