Analyst Expectations For Hasbro's Future

4 analysts have shared their evaluations of Hasbro (NASDAQ:HAS) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

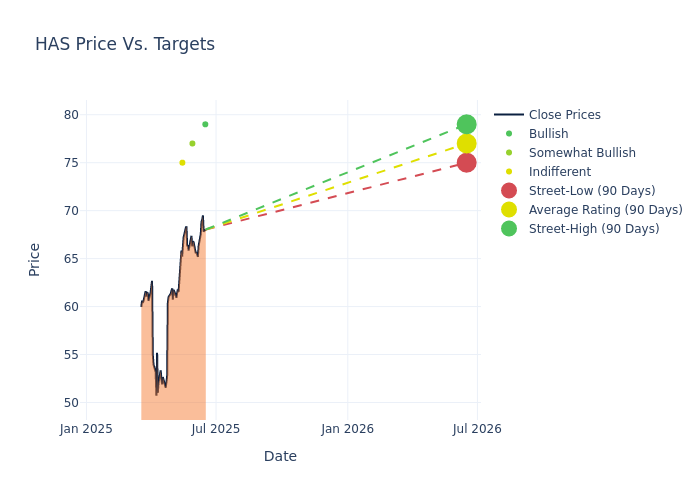

Analysts have set 12-month price targets for Hasbro, revealing an average target of $75.75, a high estimate of $79.00, and a low estimate of $72.00. Surpassing the previous average price target of $72.67, the current average has increased by 4.24%.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive Hasbro is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Hardiman | Citigroup | Raises | Buy | $79.00 | $72.00 |

| Megan Alexander | Morgan Stanley | Raises | Overweight | $77.00 | $71.00 |

| Keegan Cox | DA Davidson | Maintains | Neutral | $75.00 | $75.00 |

| James Hardiman | Citigroup | Announces | Buy | $72.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Hasbro. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Hasbro compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Hasbro's stock. This analysis reveals shifts in analysts' expectations over time.

Capture valuable insights into Hasbro's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Hasbro analyst ratings.

All You Need to Know About Hasbro

Hasbro is a branded play company providing children and families around the world with entertainment offerings based on a world-class brand portfolio. From toys and games to television programming, motion pictures, and a licensing program, Hasbro reaches customers by leveraging its well-known brands such as Transformers, Nerf, and Magic: The Gathering. The firm acquired EOne in 2019, bolting on popular family properties like Peppa Pig and PJ Masks, and since has divested noncore lines from the tie-up. Furthermore, the addition of Dungeons & Dragons Beyond in 2022, offers the firm access to 19 million digital tabletop players.

Breaking Down Hasbro's Financial Performance

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Positive Revenue Trend: Examining Hasbro's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 17.14% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Hasbro's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 11.11% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Hasbro's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 8.47%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Hasbro's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.59%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 2.87, caution is advised due to increased financial risk.

Analyst Ratings: Simplified

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.