Demystifying Brunswick: Insights From 8 Analyst Reviews

Brunswick (NYSE:BC) underwent analysis by 8 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 4 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 3 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

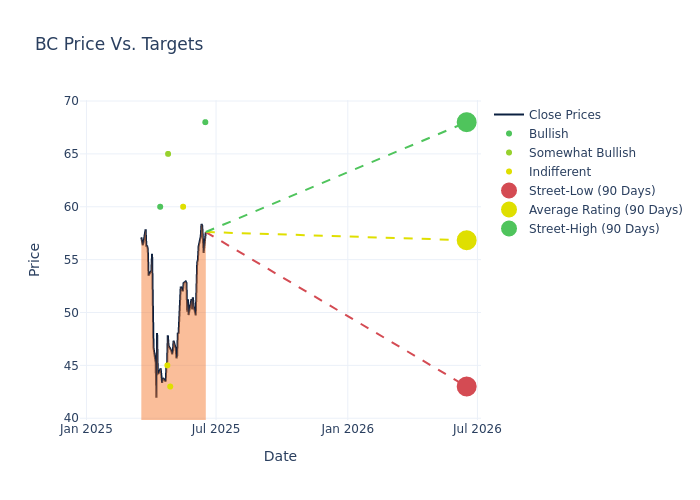

In the assessment of 12-month price targets, analysts unveil insights for Brunswick, presenting an average target of $57.0, a high estimate of $68.00, and a low estimate of $43.00. A 20.83% drop is evident in the current average compared to the previous average price target of $72.00.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Brunswick among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Hardiman | Citigroup | Raises | Buy | $68.00 | $61.00 |

| Craig Kennison | Baird | Raises | Neutral | $60.00 | $56.00 |

| Brandon Rolle | DA Davidson | Lowers | Neutral | $43.00 | $64.00 |

| Gerrick Johnson | BMO Capital | Lowers | Outperform | $65.00 | $75.00 |

| Anna Glaessgen | Jefferies | Lowers | Hold | $45.00 | $64.00 |

| James Hardiman | Citigroup | Lowers | Buy | $59.00 | $81.00 |

| Michael Swartz | Truist Securities | Lowers | Buy | $60.00 | $85.00 |

| Craig Kennison | Baird | Lowers | Neutral | $56.00 | $90.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Brunswick. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Brunswick compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Brunswick's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Brunswick's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Brunswick analyst ratings.

About Brunswick

Brunswick is a leading manufacturer in the marine recreation industry. The firm has more than 60 brands delivering products across propulsion (outboard, sterndrive, and inboard engines, propulsion-related controls, rigging, and propellers), parts, accessories, and technology, and boats (including well-known brands like Boston Whaler and Sea Ray). It also owns numerous Freedom Boat Club locations as well as Boateka, which facilitates transactions in the used-boat market. Brunswick's focus surrounds building the innovative marine and recreational experiences, technologies, and connections supported by quality and innovation.

Unraveling the Financial Story of Brunswick

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Decline in Revenue: Over the 3M period, Brunswick faced challenges, resulting in a decline of approximately -10.49% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Brunswick's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 1.65%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Brunswick's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.07% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Brunswick's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.35%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.4, caution is advised due to increased financial risk.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.