AMD Stocks Rips 9% Amid Possible AWS Partnership: Should You Buy or Sell? Key Metrics Reveal the Answer

Shares of Advanced Micro Devices Inc. (NASDAQ:AMD) jumped by nearly 9%, moving above the key support level after seven months on Monday. This was driven by a possible partnership with Amazon.com Inc.‘s (NASDAQ:AMZN) Amazon Web Services (AWS).

What Happened: On Monday, AMD gained 8.81% to jump above its 200-day simple daily moving average of $116.98 apiece.

This was fueled by a positive update from Piper Sandler and unconfirmed rumors that the company scored a "GPU win" with Amazon Web Services.

The stock moved higher than its 200-day SMA for the first time in over seven months.

The stock was still below its 50-day SMA with a relative strength index in the neutral zone at 57.68.

Meanwhile, the current MACD reading for AMD shows a bullish signal. The MACD line of 0-2.43 is above the signal line of -6.82, and the positive histogram value of 4.39 confirms this bullish cross.

While the technical indicators point towards a buying opportunity, about 37 analysts tracked by Benzinga have a consensus ‘buy’ rating and average price target of 140.94 apiece. The targets range from $95 to $200. Recent ratings from Piper Sandler, Stifel, and Roth Capital imply a 12.48% upside for the stock.

Why It Matters: On June 16, Piper Sandler’s Harsh Kumar reiterated an ‘overweight’ rating on AMD, raising the price target to $140.

Kumar is optimistic about AMD’s GPU business, expecting a fourth quarter rebound after China-related charges. He forecasts third-quarter 2025 AI business growth to offset these charges.

Notably, Kumar highlighted AMD’s strong, multi-level relationship with Amazon, a key customer for both CPUs and GPUs. This unconfirmed GPU deal with AWS likely fueled Monday’s AMD stock surge. Amazon’s prior $84.4 million stake in AMD, from the ZT Group acquisition, further underscores this relationship.

According to Benzinga Pro data, AMD’s forward price-to-earnings ratio stood at 33.898 times the 2026 earnings, whereas the industry average was at 37.030 times. This meant that the stock was trading at a forward price of 0.92 times in comparison with its peers.

| Stocks | Forward P/E | Industry Average |

| Advanced Micro Devices Inc. (NASDAQ:AMD) | 33.898 | 37.03 |

| Nvidia Corp. (NASDAQ:NVDA) | 33.784 | 37.03 |

| Broadcom Inc. (NASDAQ:AVGO) | 38.462 | 37.03 |

| Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) | 22.523 | – |

| Texas Instruments Inc. (NASDAQ:TXN) | 36.232 | 37.03 |

The shares have risen 4.77% on a year-to-date basis, and dropped by -20.21% over a year.

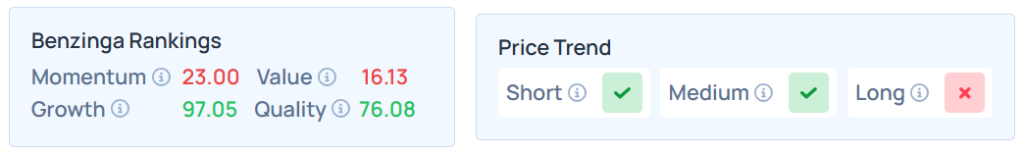

Benzinga Edge Stock Rankings shows that AMD had a stronger price trend over the short and medium term but a weaker price trend over the long term. Its momentum ranking was weak; however, its value ranking was poor at the 16.13th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, advanced on Monday. The SPY was up 0.95% at $602.68, while the QQQ advanced 1.39% to $534.29, according to Benzinga Pro data.

The futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were trading lower on Tuesday.

Read Next:

Photo courtesy: JHVEPhoto / Shutterstock.com