Padini keeps it simple and solid

WHILE many retailers are still finding their footing after the pandemic and rising competition from online fashion platforms, Padini Holdings Bhd continues to keep things simple – and solid.

The homegrown brand, known for its affordable pricing and wide retail footprint, is inching towards a record year.

Revenue of RM1.55bil for the nine months of financial year ended March 31, 2025 (9M25) already places the group close to its full-year target of RM2bil – a goal it set a year ago.

In the third quarter of this financial year (3Q25) alone, Padini delivered a strong performance on the back of dual festive season demand and favourable foreign exchange movements.

“It was a very good 3Q25 for Padini – Chinese New Year and Hari Raya boosted sales,” an analyst who covers the stock tells StarBiz 7.

“Margins expanded too, thanks to a stronger ringgit.”

While the seasonal bump is expected to ease in the final quarter, analysts believe margins will remain healthy as long as the ringgit stays firm.

Despite this strong showing, the stock has remained largely unmoved.

Year-to-date, Padini’s shares have slipped 2.73% to RM2.13 apiece, giving the group a market capitalisation of RM2.1bil.

It currently trades at a price-to-earnings (PE) ratio of 12.07 times – higher than peers like Bonia Corp Bhd (9.95 times), Carlo Rino Group Bhd (7.09 times), and Teo Guan Lee Corp Bhd (7.61 times).

Looking back, Padini has long charted a steady and profitable path.

Listed in 1998, the group was originally founded as a sole proprietorship in 1971.

In its listing year on financial year 1998 (FY98), it posted RM70.8mil in revenue and RM6.5mil in net income, with RM3.5mil in cash and a market cap of RM77.1mil.

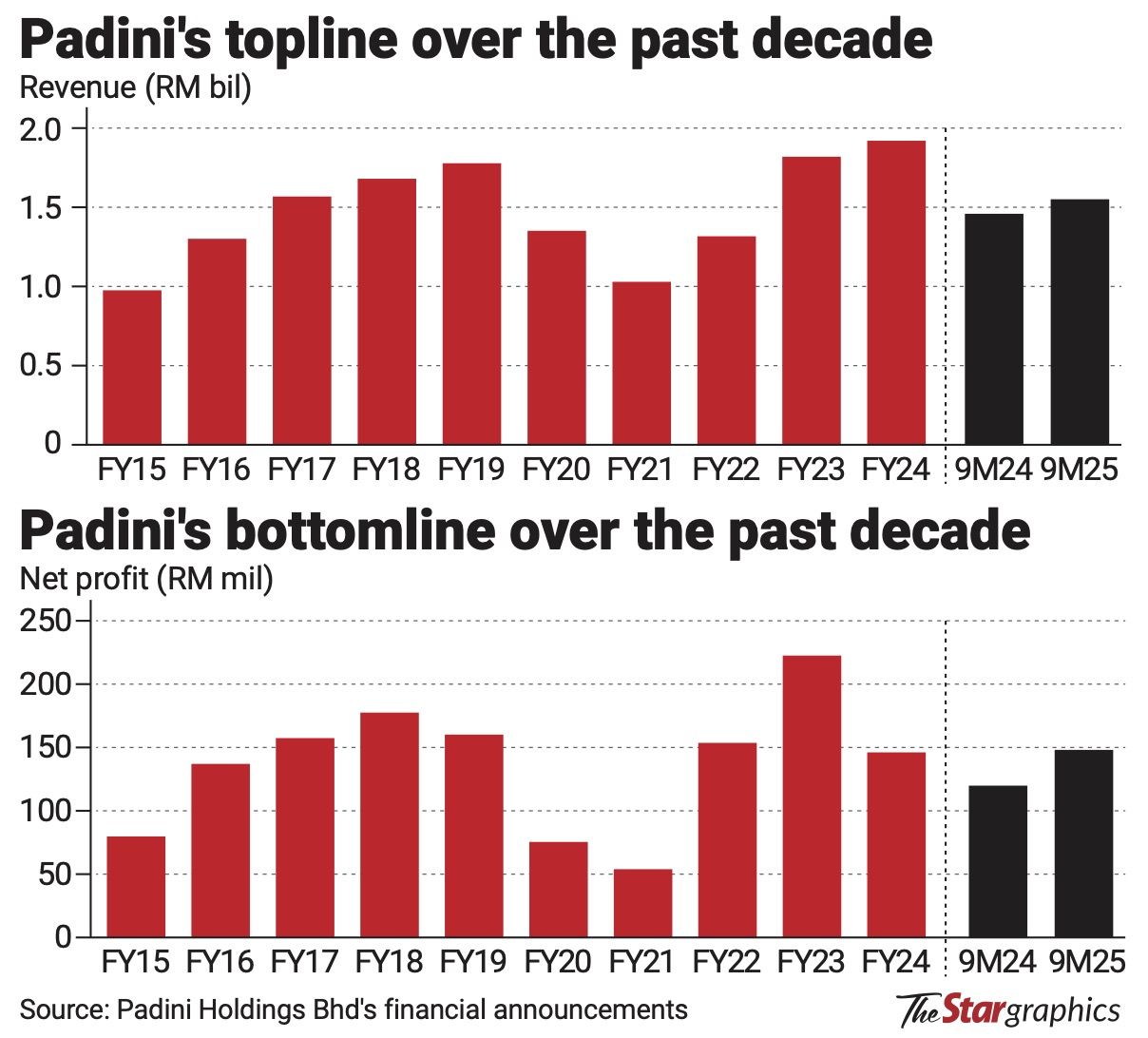

Since then, revenue has climbed almost every year – breaching the RM1bil mark in FY16 and peaking at RM1.78bil in FY19. (see chart)

The pandemic in FY20 caused its first revenue decline since listing, dropping to RM1.35bil and then falling further to RM1.03bil in FY21.

But the rebound was quick – revenue jumped 28.1% to RM1.32bil in FY22, rose another 38.1% to RM1.82bil in FY23, and grew 5.3% to RM1.92bil in FY24 – partly driven by post-pandemic revenge spending.

Padini is also sitting on RM835.9mil in cash as at March 31, 2025, against total debt of RM644.7mil, made up entirely of lease liabilities, according to Bloomberg data.

It is noteworthy that post-pandemic, Padini’s debt has surged from RM23.9mil in FY2019 – almost a 27-fold increase to RM644.7mil now.

Still, analysts are largely upbeat.

Eight have “buy” calls on the stock, with two “hold” and no “sell” ratings.

The 12-month consensus target price is RM2.54 – implying an upside of nearly 20% from current levels.

Some, however, wonder if Padini should do more with its cash reserves.

“They’re sitting on a big pile of cash – maybe they could return more to shareholders via dividends,” says one analyst.

“But management sees it as a buffer, especially after going through the Covid-19 pandemic,” another analyst notes.

Padini remains focused on brick-and-mortar retail, with online sales contributing only about 1% of total revenue in FY24.

The group runs Padini Concept Stores and Brands Outlet chains across Malaysia, as well as in Cambodia and Thailand.

It carries in-house labels such as Vincci, Seed, Padini Authentics, PDI, Miki Kids, P&Co.

Internationally, Padini also has franchise outlets in Brunei, Bahrain, Oman, Qatar, and the United Arab Emirates.

As at March 31, the group operated 142 locally owned stores — 56 Brands Outlet, 51 Padini Concept Stores, and 35 freestanding outlets – along with 11 consignment counters.

Overseas, it has 11 stores, bringing its total store count to 164 – a net increase of 11 stores from the 153 it had at end-FY24.

Local sales still dominate, accounting for over 90% of group revenue.

“They’re value-driven, targeting the mass market.

“Their designs have improved and they’re staying relevant to younger consumers,” says an analyst. “The business is domestic-focused, and that makes it more defensive amid global uncertainty.”

The analyst says Padini’s inventory cycles are tight, typically lasting three to four months.

“The group places emphasis on fast-moving stock keeping units, while promotional discounts are used strategically to clear slower-moving inventory.”

Padini’s cautious expansion strategy – occasionally opening and closing stores – signals a deliberate focus on operational efficiency rather than aggressive growth, the analyst adds.

Overseas forays have remained limited due to stiff competition.

As one analyst summarised: “Padini is not a growth rocket, but it’s solid. It’s defensive, reliable – and for now, it’s still delivering.”

RHB Research analyst Tai Yu Jie, who covers the stock, says Padini remains firmly committed to its value-for-money proposition.

“Management has opted to keep its pricing affordable as they believe competitive pricing especially during festive seasons helps drive volume and retain customer loyalty, even in a soft consumer environment,” she notes in a reply to StarBiz 7.

On financials, she points out that Padini’s 9M25 results came in above expectations, thanks to a stronger-than-anticipated recovery in gross profit margin, which rose to 39.3%.

This was driven by a better product mix, fewer markdowns and improved inventory turn-over.

She also points to operating expenses which climbed 8.9% year-on-year, outpacing revenue growth of 5.6% (with same-store sales growth of 1%), as staff costs and bonus payouts rose.

Looking ahead, Tai believes competitive pressures remain high, both from traditional and online players.

With rising operating costs – particularly in a tight labour market – Tai says “pricing remains a sensitive lever” for Padini.

“Pricing remains a sensitive lever for the group and management typically treats price hikes as a last resort in order to preserve its value-for-money positioning and maintain affordability for its customer base,” she concludes.

Padini’s founder and managing director Yong Pang Chaun is still the biggest shareholder through Yong Pang Chaun Holdings Sdn Bhd, which owns 43.7% of the company.

Other major shareholders include the Retirement Fund with 10%, the Employees Provident Fund with 7.8%, PRUlink Equity Fund with 3.7%, and Lembaga Tabung Haji with 3.6%.