Where Autoliv Stands With Analysts

Analysts' ratings for Autoliv (NYSE:ALV) over the last quarter vary from bullish to bearish, as provided by 9 analysts.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 3 | 2 | 0 | 0 |

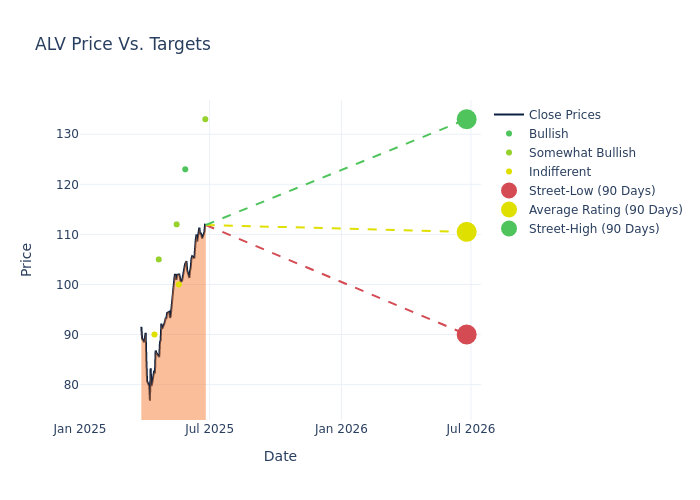

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $104.11, a high estimate of $133.00, and a low estimate of $82.00. This current average has increased by 5.7% from the previous average price target of $98.50.

Interpreting Analyst Ratings: A Closer Look

The standing of Autoliv among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tom Narayan | RBC Capital | Announces | Outperform | $133.00 | - |

| Juan Perez-Carrascosa | UBS | Raises | Buy | $123.00 | $103.00 |

| Colin Langan | Wells Fargo | Raises | Equal-Weight | $100.00 | $82.00 |

| Vijay Rakesh | Mizuho | Raises | Outperform | $112.00 | $95.00 |

| Dan Levy | Barclays | Raises | Overweight | $105.00 | $97.00 |

| Colin Langan | Wells Fargo | Lowers | Equal-Weight | $82.00 | $84.00 |

| Luke Junk | Baird | Lowers | Neutral | $90.00 | $105.00 |

| Dan Levy | Barclays | Lowers | Overweight | $97.00 | $110.00 |

| Vijay Rakesh | Mizuho | Lowers | Outperform | $95.00 | $112.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Autoliv. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Autoliv compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Autoliv's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Autoliv's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Autoliv analyst ratings.

All You Need to Know About Autoliv

Autoliv Inc is the world-wide leader in passive safety components and systems for the auto industry. Products include seat belts, frontal air bags, side-impact air bags, air bag inflators, and steering wheels. The Renault-Nissan-Mitsubishi alliance is the company's largest customer at 10% of 2023 revenue, with Stellantis accounting for 10% and Volkswagen 9%. At 34% of 2023 revenue, the Americas was Autoliv's largest geographic region, followed by Europe at 27%, China at 20%, and rest of world at 19%.

Autoliv: Financial Performance Dissected

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Challenges: Autoliv's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -1.41%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Autoliv's net margin is impressive, surpassing industry averages. With a net margin of 6.48%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Autoliv's ROE stands out, surpassing industry averages. With an impressive ROE of 7.22%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Autoliv's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.1% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Autoliv's debt-to-equity ratio is below the industry average at 0.96, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.