UMS hums with activity

UMS Integration Ltd is a Singapore-listed company but it is also a key player in the semiconductor ecosystem in Penang.

The precision engineering company, which is headed for a dual listing on Bursa Malaysia in August, was founded by Andy Luong who had emigrated to the United States from Vietnam in the late 1970s – on a boat, no less.

It also has production facilities in Singapore and California in the United States.

Luong, who is also CEO, says the strategy this year is manifold, including to ramp up production and buy new machinery.

“We want to quickly ramp up production at the new Penang plant to meet the demand of Customer H,” he tells StarBiz 7.

Last year, the company completed a new production facility at the Penang Science Park North at a cost of RM234mil. This is currently serving a leading US semiconductor equipment manufacturer, listed on the Nasdaq.

UMS started its operations in Penang way back in 2009 at a 400,000 sq ft production facility in Simpang Ampat.

This was when it also started shifting a high volume of its production of semiconductor precision components to Malaysia.

There are plans for further expansion in production capacity in Penang over the next few years, with land already acquired for this purpose.

Luong says the overall plan is to produce more high-precision components used in edge computing, deposition and advanced packaging solutions to capture new growth opportunities.

“UMS is one of the few suppliers in the region with the capability to support key customers achieve leadership positions in the advanced packaging tools segment,” he says.

“For example, in advanced packaging, we can perform electroplating of copper and other metals that are used for a number of advanced wafer-level packaging applications.”

On top of these fresh plans, Luong says UMS will continue to work closely with other existing customers to support their growth.

“We also plan to buy more advanced machines to further expand capabilities,” he adds.

Luong says the ongoing geopolitical tensions have caused global companies to shift their manufacturing operations elsewhere, including to the South-East Asian region.

“Both Malaysia and Singapore are well-positioned to benefit from this.”

Singapore and Malaysia’s skilled workforce is also equipped to handle precision engineering tasks, further lending strong support to the industry, he adds.

UMS, which launched its prospectus this week, will become the first Singapore public company to ever have a secondary listing on the Main Market of Bursa come Aug 1.

The company’s move to dual-list in Malaysia will be a litmus test to see if Singapore-listed precision engineering companies, which are typically accorded lower valuations in the city-state, can enjoy higher valuations across the Causeway,

Generally, UMS has been trading at about a 30% discount compared to its Malaysian peers such as SAM Engineering & Equipment (M) Bhd and UWC Bhd, which trade at around 23 times their forward estimated earnings.

“Shareholders can look forward to greater equity market access with UMS’ secondary listing as upon listing, shares will be fully fungible whereby shareholders can trade UMS shares on either market,” Luong says.

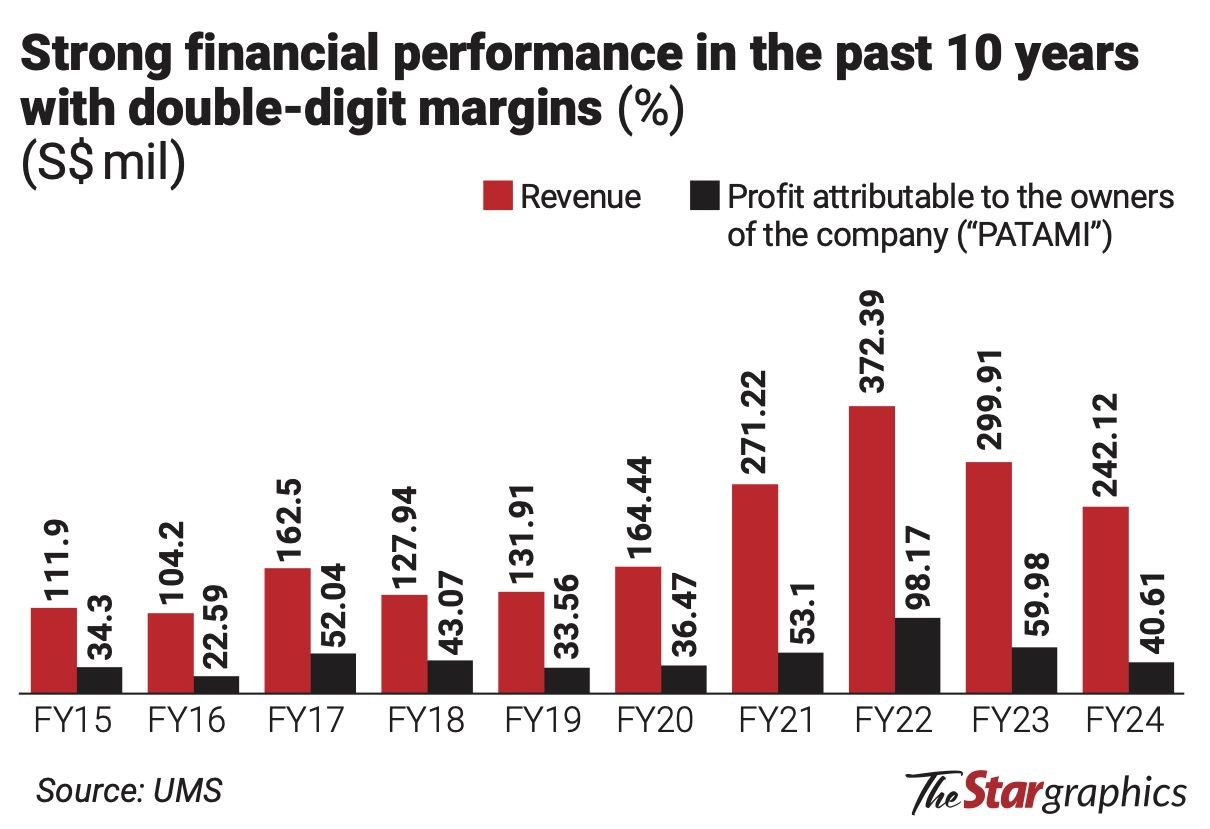

Better financial performanceOver the years, UMS has been consistent in the generation of a positive net operating cash flow.

The company made a lower revenue of S$242.1mil for the financial year ended Dec 31, 2024 (FY24), while profit after tax stood at S$40.6mil, translating into a PAT margin of 16.8%.

The lower FY24 revenue, when compared to revenue over the last few years, was due to a moderated demand from the semiconductor segment, particularly from one of its major customers, amid a softer industry environment, the company says.

It says the material and tooling distribution business also saw lower activity in the last fiscal year.

Luong says that this year, shareholders can expect the company to sustain its double-digit net profit margin performance.

“In fact, they can expect a better financial performance this year based on forecasts and feedback from key customers,” he says.

Moving forward, shareholders can also expect to continue to receive quarterly dividends with a yield of about 4%, he adds.

As at Dec 31, 2024, UMS had cash and bank balances of S$79.93mil versus S$67.46mil in FY23, while total borrowings stood at S$750,000 against FY23’s S$22.54mil.

The company, via its subsidiaries, offers complex precision machining, sheet metal fabrication, surface treatment, as well as sub-module and full-module assembly services, with a focus on serving high-tech industries such as semiconductor and aerospace.

UMS’ clientele includes Fortune 500 companies and multinational companies listed on, among others, the New York Stock Exchange, Nasdaq, SGX and Euronext Paris, according to a company statement.

According to reports, global sales of total semiconductor manufacturing equipment are expected to hit a new record high of US$121bil this year and US$139bil by 2026, supported by growing demand.