Delta Faces Lawmaker Backlash Over AI-Powered Ticket Pricing — Senators Warn It Could Exploit Travelers With Personalized Fare Hikes

Delta Air Lines Inc. (NYSE:DAL) is facing scrutiny from U.S. lawmakers over its plans to use artificial intelligence (AI) for setting ticket prices.

What Happened: Sen. Ruben Gallego (D-AZ), Sen. Mark Warner (D-VA) and Sen. Richard Blumenthal (D-CT), have raised concerns about Delta’s AI-based pricing strategy. The senators are worried that this approach could lead to personalized fare increases, potentially impacting travelers.

Check out the current price of DAL stock here.

The senators highlighted Delta’s intention to roll out AI-powered revenue management technology, developed in partnership with AI pricing firm Fetcherr, across 20% of its domestic network by the end of 2025. They raised concerns that the system could potentially use personal data to determine fares based on each consumer's perceived willingness to pay for premium services.

"Consumers have no way of knowing what data and personal information your company and Fetcherr plan to collect or how the AI algorithm will be trained," stated the Senators in the letter.

They also added, "Prices could be dictated not by supply and demand, but by individual need. While Delta has stated that the airline will ‘maintain strict safeguards to ensure compliance with federal law,' your company has not shared what those safeguards are or how you plan to protect American families against pricing discrimination in the evolving AI landscape,”

Delta has denied employing any fare system that targets customers with personalized offers based on individual data. The airline clarified that its dynamic pricing model, in place for over 30 years, relies on broader factors like overall customer demand rather than specific consumer information, Reuters reported.

The airline further explained that it is experimenting with AI technology to simplify fare adjustments based on demand for specific routes and flights, as well as to enhance future pricing strategies.

Why It Matters: Delta’s AI pricing strategy comes on the heels of a recent $8.1 million settlement with the U.S. Department of Justice over alleged misuse of pandemic relief funds. This controversy adds to the challenges the airline is facing amidst a turbulent economic climate.

Earlier this month, Delta reported a 1% year-over-year increase in June-quarter revenue, driven by a rise in premium cabin sales and loyalty revenue. The airline’s confidence in its financial future was reflected in its decision to reinstate its full-year 2025 guidance.

Delta posted stronger-than-expected second-quarter results, with operating revenue of $16.65 billion, above the consensus estimate. The airline’s decision to test AI technology for fare adjustments could be a strategic move to further improve its financial performance, despite the controversy it has sparked.

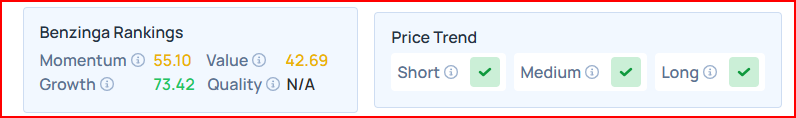

Benzinga Edge Stock Rankings shows that Delta Airways stock had a strong price trend over the short, medium and long term as per Benzinga’s Proprietary Edge Rankings.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.