Warren Buffett Has 56% Of His $258 Billion Portfolio's Value Exposed To AI: Here Are The 5 Stocks That Are Leveraging AI Within Berkshire's Holdings

The ‘Oracle of Omaha’ — Warren Buffett is not invested in any pure-play artificial intelligence (AI) companies, but he holds these five stocks via Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK), which leverage AI in their businesses on scale.

Check out the BRK-B stock price here.

What Happened: While the companies that Buffett holds via Berkshire don’t directly make or create AI-related products or services, about 55.77% of the value of its total $258.701 billion portfolio is invested in these five firms, leveraging AI heavily on a day-to-day basis.

Out of the total 36 holdings as of the end of the first quarter, Berkshire holds about $114.423 billion worth of shares in Apple Inc. (NASDAQ:AAPL), American Express Co. (NYSE:AXP), Visa Inc. (NYSE:V), Mastercard Inc. (NYSE:MA), and Amazon.com Inc. (NASDAQ:AMZN).

| Company | Holdings (as of March 31) | % In The Portfolio | Value (as of March 31) |

| Apple Inc. (NASDAQ:AAPL) | 300,000,000 | 26% | $66.639 billion |

| American Express Co. (NYSE:AXP) | 151,610,700 | 16% | $40.79 billion |

| Visa Inc. (NYSE:V) | 8,297,460 | 1.1% | $2.907 billion |

| Mastercard Inc. (NYSE:MA) | 3,986,648 | 0.8% | $2.185 billion |

| Amazon.com Inc. (NASDAQ:AMZN) | 10,000,000 | 0.7% | $1.902 billion |

Apple

- Not an AI stock in the traditional sense, but Apple heavily integrates AI into its products and services.

- Features like Siri, on-device machine learning for Face ID, photo processing, and Apple Intelligence (AI-driven features in iOS) show deep AI investment.

- Its focus on privacy-preserving AI and custom silicon (e.g., Neural Engine in A-series chips) positions it as a leader in consumer AI applications.

American Express

- Also, not an AI stock, Amex uses AI for credit risk assessment, fraud detection, and personalized marketing.

- Its data-driven approach leverages machine learning to enhance customer experiences, but its core business is financial services and payments, not AI development.

Amazon

- While primarily an e-commerce and cloud computing giant, Amazon is a major AI player through Amazon Web Services (AWS), which offers AI and machine learning tools like SageMaker, Bedrock, and Titan models.

- AI powers Amazon's recommendation algorithms, logistics optimization, and Alexa. Its cloud dominance makes it a backbone for many AI companies, so it's closer to an AI stock than most.

Visa

- Not an AI stock, but Visa uses AI extensively for fraud detection, risk management, and transaction personalization.

- Its VisaNet processes massive data sets, leveraging machine learning to enhance security and efficiency. However, AI is a tool for Visa, not its core business, which remains payment processing.

Mastercard

- Similar to Visa, Mastercard is not an AI stock but employs AI for fraud prevention, cybersecurity, and customer insights.

- Its AI-driven Decision Intelligence platform analyzes transaction patterns in real time. Like Visa, AI supports its payment network but isn't the primary focus.

Why It Matters: Other prominent stocks within Berkshire’s portfolio as of the end of the first quarter include Coca-Cola Co. (NYSE:KO), Bank of America Corp. (NYSE:BAC), Chevron Corp. (NYSE:CVX), Occidental Petroleum Corp. (NYSE:OXY), and Moody’s Corp. (NYSE:MCO).

As he remains the chairman of the Board, Buffett announced during Berkshire’s 60th annual shareholders meeting that he will be retiring by the end of the year.

Berkshire's board has voted to appoint Greg Abel as the CEO, effective Jan. 1, 2026.

Price Action: Berkshire’s Class B shares were 0.098% higher in premarket on Tuesday. The stock has risen by 6.78% year-to-date and 9.90% over the past year.

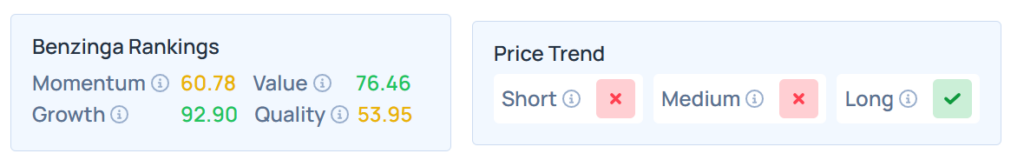

Benzinga's Edge Stock Rankings indicate that BRK-B maintains solid momentum in the long term, but it had a weaker price trend over the short- and medium-term periods. However, while the stock scores well on value rankings, its quality rating remains relatively moderate. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were trading higher in premarket on Tuesday. The SPY was up 0.24% at $638.47, while the QQQ advanced 0.48% to $570.84, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Shutterstock