Coinbase Not In Competition With Visa, Mastercard In Crypto Payments Landscape: 'We Actually Partner With Them In Many Ways'

Coinbase Global Inc. (NASDAQ:COIN) CEO Brian Armstrong said Thursday that the company views Visa Inc. (NYSE:V) and Mastercard Inc. (NYSE:MA) as partners in the growing cryptocurrency-powered payments industry, rather than competitors.

What Happened: During Coinbase’s second-quarter earnings call, Armstrong was asked if the company is planning to build an “alternative network” to the fintech behemoths, to which he replied, “Not really.”

“We actually partner with them in many ways on the cards that we put out there,” the CEO added.

Armstrong stated that Visa and Mastercard are “very involved” in stablecoins and cryptocurrencies, building projects, some in collaboration with Coinbase and others independently. He stressed that the top companies will eventually adapt to this significant shift.

See Also: How Coinbase And Michael Saylor’s Strategy Stack Up: Crypto Stock Check-Up Ahead Of Q2 Earnings

Why It Matters: Coinbase has been actively expanding into the payments market, with a focus on stablecoin-based solutions. Last month, it partnered with Shopify Inc. (NYSE:SHOP) and Stripe to facilitate USDC (CRYPTO: USDC) stablecoin payments for merchants through the Layer-2 blockchain Base.

It also has a partnership with PayPal Holdings Inc. (NASDAQ:PYPL), allowing its users greater access to the latter’s U.S. dollar-backed stablecoin PayPal USD (CRYPTO: PYUSD).

Coinbase reported a significant hit to its revenue and transaction volume in the second quarter, although its derivatives trading volume reached new highs.

Price Action: Shares of Coinbase plunged 9.20% in after-hours trading after closing 0.07% higher at $377.76 during Thursday’s regular trading session, according to data from Benzinga Pro.

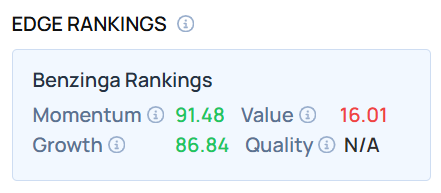

As of this writing, COIN ranked high on growth, an indicator of a stock’s combined historical expansion in earnings and revenue across multiple periods. Find out how payment giants like Visa and Mastercard stack up against COIN using Benzinga Edge Stock Rankings.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock