What to Expect from Life Time Group Hldgs's Earnings

Life Time Group Hldgs (NYSE:LTH) will release its quarterly earnings report on Tuesday, 2025-08-05. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Life Time Group Hldgs to report an earnings per share (EPS) of $0.33.

Investors in Life Time Group Hldgs are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

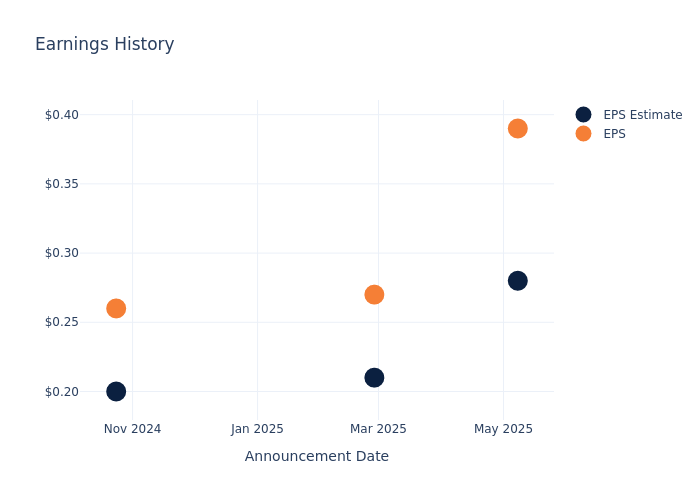

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.11, leading to a 7.51% drop in the share price on the subsequent day.

Here's a look at Life Time Group Hldgs's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.28 | 0.21 | 0.20 | 0.15 |

| EPS Actual | 0.39 | 0.27 | 0.26 | 0.25 |

| Price Change % | -8.0% | -3.0% | 1.0% | 1.0% |

Performance of Life Time Group Hldgs Shares

Shares of Life Time Group Hldgs were trading at $27.85 as of August 01. Over the last 52-week period, shares are up 16.32%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Life Time Group Hldgs

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Life Time Group Hldgs.

Analysts have provided Life Time Group Hldgs with 4 ratings, resulting in a consensus rating of Buy. The average one-year price target stands at $37.75, suggesting a potential 35.55% upside.

Peer Ratings Comparison

In this comparison, we explore the analyst ratings and average 1-year price targets of Vail Resorts, Six Flags Entertainment and Dave & Buster's Enter, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Vail Resorts, with an average 1-year price target of $186.17, suggesting a potential 568.47% upside.

- Analysts currently favor an Outperform trajectory for Six Flags Entertainment, with an average 1-year price target of $43.0, suggesting a potential 54.4% upside.

- Analysts currently favor an Neutral trajectory for Dave & Buster's Enter, with an average 1-year price target of $31.83, suggesting a potential 14.29% upside.

Key Findings: Peer Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for Vail Resorts, Six Flags Entertainment and Dave & Buster's Enter, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Life Time Group Hldgs | Buy | 18.32% | $335.05M | 2.85% |

| Vail Resorts | Neutral | 0.96% | $751.53M | 55.08% |

| Six Flags Entertainment | Outperform | 98.85% | $180.46M | -11.34% |

| Dave & Buster's Enter | Neutral | -3.47% | $485.60M | 14.83% |

Key Takeaway:

Life Time Group Hldgs ranks highest in revenue growth among its peers. It has the lowest gross profit and return on equity compared to others.

Unveiling the Story Behind Life Time Group Hldgs

Life Time Group Holdings Inc is a lifestyle and leisure brand offering health, fitness, and wellness experiences to a community. It is engaged in designing, building, and operating distinctive and large, multi-use sports and athletic, professional fitness, family recreation, and spa centers in a resort-like environment, principally in residential locations of metropolitan areas in the United States and Canada.

Life Time Group Hldgs: A Financial Overview

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Life Time Group Hldgs displayed positive results in 3 months. As of 31 March, 2025, the company achieved a solid revenue growth rate of approximately 18.32%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Life Time Group Hldgs's net margin excels beyond industry benchmarks, reaching 10.78%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Life Time Group Hldgs's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.85%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Life Time Group Hldgs's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.05% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.47.

To track all earnings releases for Life Time Group Hldgs visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.