Expert Outlook: Intuit Through The Eyes Of 15 Analysts

Ratings for Intuit (NASDAQ:INTU) were provided by 15 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 10 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 4 | 5 | 1 | 0 | 0 |

| 2M Ago | 0 | 3 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

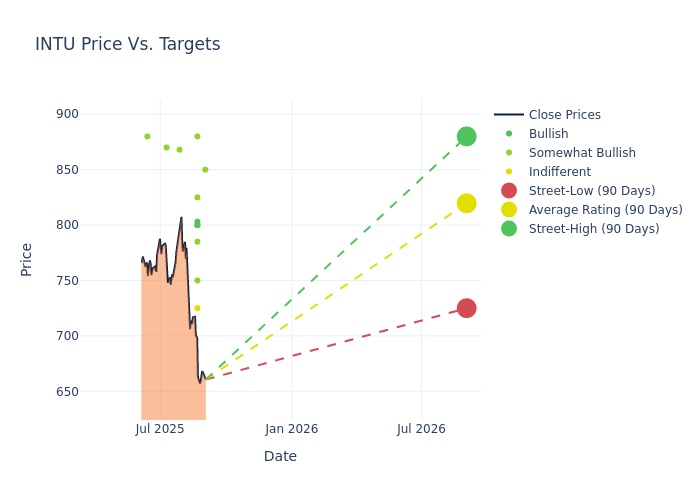

Insights from analysts' 12-month price targets are revealed, presenting an average target of $826.73, a high estimate of $900.00, and a low estimate of $725.00. Witnessing a positive shift, the current average has risen by 0.94% from the previous average price target of $819.07.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Intuit's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Rishi Jaluria | RBC Capital | Maintains | Outperform | $850.00 | $850.00 |

| Keith Weiss | Morgan Stanley | Lowers | Overweight | $880.00 | $900.00 |

| Steven Enders | Citigroup | Lowers | Buy | $803.00 | $815.00 |

| Brad Sills | B of A Securities | Lowers | Buy | $800.00 | $875.00 |

| Mark Murphy | JP Morgan | Lowers | Overweight | $750.00 | $770.00 |

| Taylor McGinnis | UBS | Lowers | Neutral | $725.00 | $750.00 |

| Rishi Jaluria | RBC Capital | Maintains | Outperform | $850.00 | $850.00 |

| Brad Reback | Stifel | Lowers | Buy | $800.00 | $850.00 |

| Raimo Lenschow | Barclays | Lowers | Overweight | $785.00 | $815.00 |

| Alex Markgraff | Keybanc | Lowers | Overweight | $825.00 | $850.00 |

| Steven Enders | Citigroup | Raises | Buy | $815.00 | $789.00 |

| Scott Schneeberger | Oppenheimer | Raises | Outperform | $868.00 | $742.00 |

| Daniel Jester | BMO Capital | Raises | Outperform | $870.00 | $820.00 |

| Keith Weiss | Morgan Stanley | Raises | Overweight | $900.00 | $785.00 |

| Michael Turrin | Wells Fargo | Raises | Overweight | $880.00 | $825.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Intuit. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Intuit compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Intuit's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Intuit's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Intuit analyst ratings.

About Intuit

Intuit serves small and midsize businesses with accounting software QuickBooks and online marketing platform Mailchimp. The company also operates retail tax filing tool TurboTax, personal finance platform Credit Karma, and a suite of professional tax offerings for accountants. Founded in the mid-1980s, Intuit enjoys a dominant market share for small business accounting and do-it-yourself tax filing in the US.

A Deep Dive into Intuit's Financials

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Decline in Revenue: Over the 3M period, Intuit faced challenges, resulting in a decline of approximately -50.59% in revenue growth as of 31 July, 2025. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Intuit's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 9.95%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.91%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Intuit's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.04%, the company showcases efficient use of assets and strong financial health.

Debt Management: Intuit's debt-to-equity ratio is below the industry average at 0.33, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.