Insights into Smith & Wesson Brands's Upcoming Earnings

Smith & Wesson Brands (NASDAQ:SWBI) is gearing up to announce its quarterly earnings on Thursday, 2025-09-04. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Smith & Wesson Brands will report an earnings per share (EPS) of $-0.12.

Investors in Smith & Wesson Brands are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

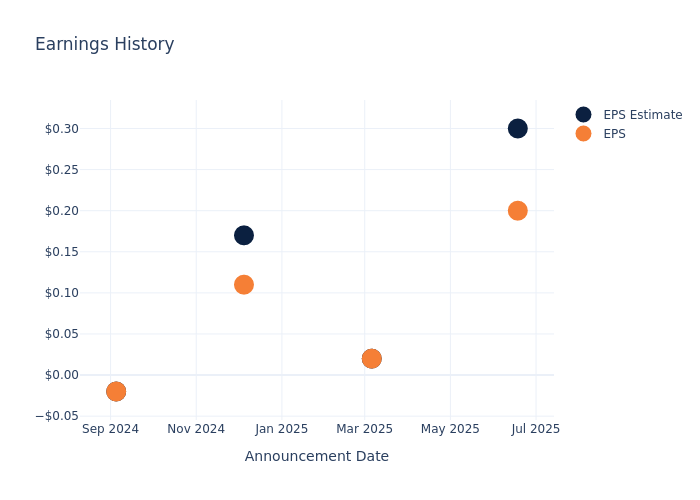

Historical Earnings Performance

Last quarter the company missed EPS by $0.10, which was followed by a 0.0% drop in the share price the next day.

Here's a look at Smith & Wesson Brands's past performance and the resulting price change:

| Quarter | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 |

|---|---|---|---|---|

| EPS Estimate | 0.3 | 0.02 | 0.17 | -0.02 |

| EPS Actual | 0.2 | 0.02 | 0.11 | -0.02 |

| Price Change % | 4.0% | -11.0% | -20.0% | -9.0% |

Market Performance of Smith & Wesson Brands's Stock

Shares of Smith & Wesson Brands were trading at $8.13 as of September 02. Over the last 52-week period, shares are down 42.99%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

Analyst Observations about Smith & Wesson Brands

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Smith & Wesson Brands.

Smith & Wesson Brands has received a total of 1 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $11.0, the consensus suggests a potential 35.3% upside.

Comparing Ratings with Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of MasterCraft Boat Hldgs, Jakks Pacific and Funko, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for MasterCraft Boat Hldgs, with an average 1-year price target of $24.0, suggesting a potential 195.2% upside.

- Analysts currently favor an Buy trajectory for Jakks Pacific, with an average 1-year price target of $40.0, suggesting a potential 392.0% upside.

- Analysts currently favor an Buy trajectory for Funko, with an average 1-year price target of $4.75, suggesting a potential 41.57% downside.

Insights: Peer Analysis

The peer analysis summary provides a snapshot of key metrics for MasterCraft Boat Hldgs, Jakks Pacific and Funko, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Smith & Wesson Brands | Buy | -11.55% | $40.55M | 2.64% |

| MasterCraft Boat Hldgs | Neutral | 46.39% | $18.41M | 3.12% |

| Jakks Pacific | Buy | -19.87% | $39.02M | -0.99% |

| Funko | Buy | -21.88% | $62.04M | -20.55% |

Key Takeaway:

Smith & Wesson Brands ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit and Return on Equity.

About Smith & Wesson Brands

Smith & Wesson Brands Inc is a U.S.-based leader in firearm manufacturing. It operates under one reportable segment: Firearms, which includes firearms distribution and manufacturing services. The company manufactures handguns, long guns, sporting rifles, shooting gear, and suppressor products. The firm's brand portfolio consists of Smith and Wesson, M&P, Thompson/Center Arms, Performance Center, and Gemtech; which are used for defense, law enforcement, hunting, and sporting purposes. The company operates internationally, with the majority of income generated by the U.S. market from its handgun products.

A Deep Dive into Smith & Wesson Brands's Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Smith & Wesson Brands's revenue growth over a period of 3 months has faced challenges. As of 30 April, 2025, the company experienced a revenue decline of approximately -11.55%. This indicates a decrease in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Smith & Wesson Brands's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.92% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Smith & Wesson Brands's ROE stands out, surpassing industry averages. With an impressive ROE of 2.64%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Smith & Wesson Brands's ROA excels beyond industry benchmarks, reaching 1.71%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.31, Smith & Wesson Brands adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Smith & Wesson Brands visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.