What Analysts Are Saying About Charter Communications Stock

In the latest quarter, 9 analysts provided ratings for Charter Communications (NASDAQ:CHTR), showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 4 | 2 | 1 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 1 |

| 2M Ago | 0 | 0 | 2 | 2 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

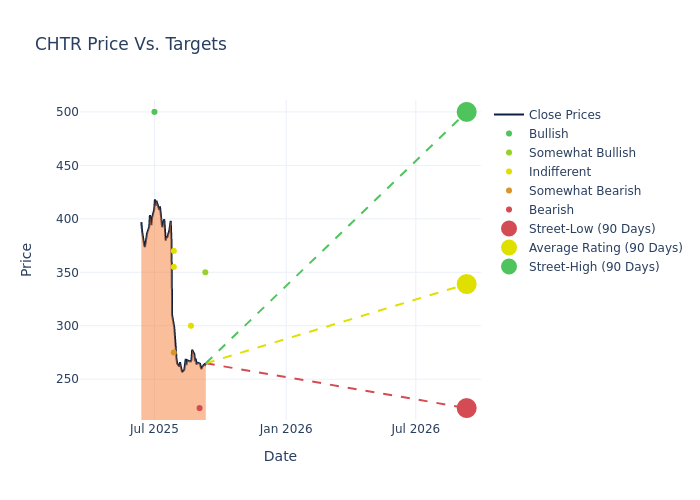

Analysts have set 12-month price targets for Charter Communications, revealing an average target of $348.78, a high estimate of $500.00, and a low estimate of $223.00. This current average has decreased by 11.09% from the previous average price target of $392.29.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Charter Communications among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Laurent Yoon | Bernstein | Lowers | Outperform | $350.00 | $380.00 |

| Michael Ng | Goldman Sachs | Announces | Sell | $223.00 | - |

| Steven Cahall | Wells Fargo | Announces | Equal-Weight | $300.00 | - |

| John Hodulik | UBS | Lowers | Neutral | $355.00 | $425.00 |

| Jonathan Atkin | RBC Capital | Lowers | Sector Perform | $370.00 | $430.00 |

| Kannan Venkateshwar | Barclays | Lowers | Underweight | $275.00 | $341.00 |

| Kannan Venkateshwar | Barclays | Raises | Underweight | $341.00 | $320.00 |

| Jessica Ehrlich | B of A Securities | Raises | Buy | $500.00 | $450.00 |

| John Hodulik | UBS | Raises | Neutral | $425.00 | $400.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Charter Communications. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Charter Communications compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Charter Communications's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Charter Communications's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Charter Communications analyst ratings.

Discovering Charter Communications: A Closer Look

Charter is the product of the 2016 merger of three cable companies, each with a decades-long history in the business: Legacy Charter, Time Warner Cable, and Bright House Networks. The firm now holds networks capable of providing television, internet access, and phone services to roughly 58 million US homes and businesses, around 35% of the country. Across this footprint, Charter serves 29 million residential and 2 million commercial customer accounts under the Spectrum brand, making it the second-largest US cable company behind Comcast. The firm also owns, in whole or in part, sports and news networks, including Spectrum SportsNet (Los Angeles Lakers), SportsNet LA (Los Angeles Dodgers), SportsNet New York (New York Mets), and Spectrum News NY1. Charter plans to acquire cable peer Cox.

Charter Communications's Financial Performance

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining Charter Communications's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.59% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Communication Services sector.

Net Margin: Charter Communications's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.45% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 8.02%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Charter Communications's ROA excels beyond industry benchmarks, reaching 0.86%. This signifies efficient management of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 5.94, Charter Communications faces challenges in effectively managing its debt levels, indicating potential financial strain.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.