Stock Market Today: Dow Jones, Nasdaq Futures Slide As Supreme Court Questions Trump's Tariffs—Coherent, Marvell Tech, Applovin, Apple In Focus

U.S. stock futures fell on Thursday after Wednesday’s positive close. Futures of major benchmark indices were lower.

This followed the doubts raised by the U.S. Supreme Court regarding President Donald Trump's authority to impose sweeping tariffs using a decades-old emergency powers law, on Wednesday.

The 10-year Treasury bond yielded 4.14% and the two-year bond was at 3.61%. The CME Group's FedWatch tool‘s projections show markets pricing a 67.3% likelihood of the Federal Reserve cutting the current interest rates during its December meeting.

| Futures | Change (+/-) |

| Dow Jones | -0.06% |

| S&P 500 | -0.02% |

| Nasdaq 100 | -0.06% |

| Russell 2000 | -0.19% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 0.031% at $677.79, while the QQQ advanced 0.018% to $623.39, according to Benzinga Pro data.

Stocks In Focus

Airbnb

- Airbnb Inc. (NASDAQ:ABNB) rose 0.041% in premarket on Thursday ahead of its earnings scheduled to be released after the closing bell. Analysts expect it to report earnings of $2.34 per share on revenue of $4.08 billion.

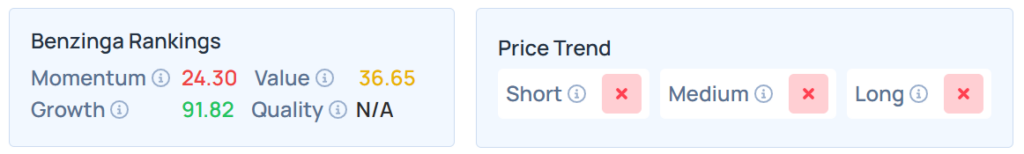

- Benzinga’s Edge Stock Rankings indicate that ABNB maintains a weaker price trend over the short, medium, and long terms, with a moderate value ranking. Additional performance details are available here.

Apple

- Apple Inc. (NASDAQ:AAPL) fell 0.27% after the news that it was finalizing a deal to pay Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) about $1 billion yearly for AI technology to rebuild Siri, using the partnership as a temporary fix until 2026.

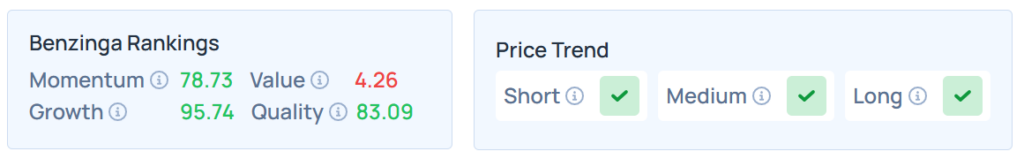

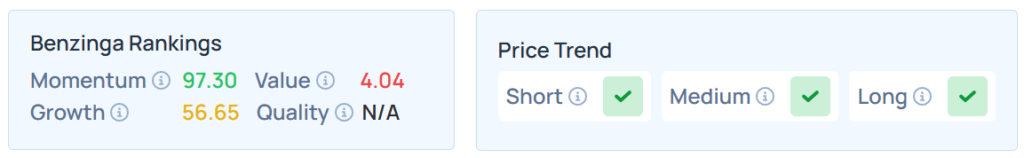

- AAPL maintained a stronger price trend over the short, medium, and long terms, with a solid growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Marvell Technology

- Marvell Technology Inc. (NASDAQ:MRVL) soared 8.55% as Bloomberg reported that SoftBank Group explored a potential takeover of U.S. chipmaker earlier this year.

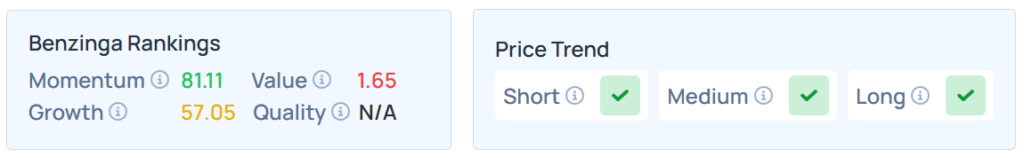

- It maintained a stronger price trend over the long, short, and medium terms, with a poor value ranking. Additional performance details, as per Benzinga's Edge Stock Rankings, are available here.

Coherent

- Coherent Corp. (NYSE:COHR) climbed 14.31% after it reported revenue of $1.58 billion, up 17% year over year, and earnings of $1.16, compared to $0.67 from the same quarter in the previous fiscal year.

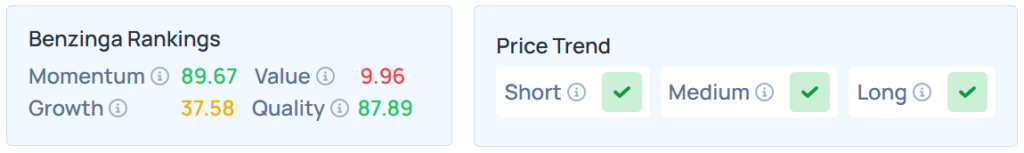

- COHR maintains a stronger price trend over the short, medium, and long term, with a robust quality ranking. Additional information is available here.

Applovin

- Applovin Corp. (NASDAQ:APP) jumped 6.17% after reporting revenue of $1.41 billion, missing analyst estimates of $1.34 billion and earnings of $2.45 per share, beating analyst estimates of $2.41 per share.

- APP maintained a stronger price trend over short, medium, and long terms, with a moderate growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Cues From Last Session

Sectors recording the biggest gains on Wednesday included communication services, consumer discretionary, and materials, leading most S&P 500 segments to close positively.

Bucking the overall market trend, however, were consumer staples and information technology, which both closed the session lower.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.65% | 23,499.80 |

| S&P 500 | 0.37% | 6,796.29 |

| Dow Jones | 0.48% | 47,311.00 |

| Russell 2000 | 1.54% | 2,464.78 |

Insights From Analysts

Sean Peche, Founder of Ranmore Fund Management, views the current stock market as dangerously overvalued, drawing direct parallels between the present-day AI hype and Japan's late-1980s valuation bubble.

He points to "lofty valuations and a sense of euphoria," driven by the overwhelming dominance of US tech.

Peche challenges traditional metrics, arguing that the Magnificent 7’s high capital expenditure makes net income a misleading measure. He calculates the group trades at 58x free cash flow (FCF), his preferred metric.

This valuation worsens significantly when adjusting for stock-based compensation—which he calls "a real cost to shareholders"—rising to 77x FCF.

While the catalyst for a correction is unknown, Peche warns that history shows the odds are stacked against investors at these levels.

"History has repeatedly shown us that the odds of generating attractive real returns over the medium to long term are not on your side when you pay high valuations," he states, suggesting investors should reconsider their heavy reliance on the U.S. market.

See Also: How to Trade Futures

Upcoming Economic Data

Here's what investors will be keeping an eye on Thursday;

- The initial jobless claims data for the latest week will be delayed, along with third-quarter U.S. productivity data and September’s wholesale inventories data.

- Fed governor Michael Barr and New York Fed President John Williams will speak at 11:00 a.m., Fed governor Christopher Waller at 3:30 p.m., Philadelphia Fed President Anna Paulson at 4:30 p.m., and St. Louis Fed President Alberto Musalem at 5:30 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 1.06% to hover around $60.23 per barrel.

Gold Spot US Dollar rose 0.83% to hover around $4,012.21 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was 0.25% lower at the 99.9520 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 1.01% higher at $102,968.08 per coin.

Asian markets closed higher on Thursday, except India’s NIFTY 50 index. South Korea's Kospi, Japan's Nikkei 225, Australia's ASX 200, Hong Kong's Hang Seng, and China’s CSI 300 indices rose. European markets were also lower in early trade.

Read Next:

Photo courtesy: Shutterstock