DBS makes a second go

DISCUSSIONS between government officials from Malaysia and Singapore on the Johor-Singapore Special Economic Zone (JS-SEZ) are said to include a banking and finance track.

Singapore officials advocate for DBS Group Holdings Ltd, the country’s largest bank and also the largest in South-East Asia, to establish a stronger presence in the JS-SEZ. This move, they argue, would facilitate smoother business operations for Singaporean companies in the economic zone.

In this context, it seems logical to consider allowing DBS to proceed with its proposed acquisition of Malaysia’s Alliance Bank Bhd. This is particularly significant given that DBS’ major shareholder is also a key stakeholder in Alliance Bank.

Consequently, discussions between the two governments are said to include provisions for enabling DBS to acquire a stake in Alliance Bank.

DBS’ entry could allow Singapore to make more concessions, ensuring Malaysia gets the full benefit of the JS-SEZ’s utopia.

The speculation of DBS’ interest in Alliance Bank has been around for some time.

Recall that Singapore state investor Temasek Holdings Pte Ltd owns 49% in Vertical Theme Sdn Bhd, which in turn holds a 29.06% stake in Alliance Bank. This stake is worth close to RM2.3bil, going by Alliance Bank’s market cap of RM7.7bil.

But 51% of Vertical Theme is owned by three individual Malaysians – hotelier Ong Beng Seng, private equity player Ong Tiong Sing and corporate adviser Seow Lun Hoo.

Technically therefore, Alliance Bank is majority controlled by Malaysian parties, while Singapore’s Temasek only has an indirect minority stake.

The three Malaysians own the Alliance stake through Langkah Bahagia Sdn Bhd, an entity said to be related to the late Tun Daim Zainuddin.

While the links are not proven, it does seem more than coincidental that merger and acquisition (M&A) talk involving Alliance Bank surfaced months following Daim’s passing last year.

The JS-SEZ angle

What is different now is the JS-SEZ angle. Without Singapore’s full participation and buy-in, the promise of the JS-SEZ may not reach fruition.

JS-SEZ is designed to combine the strengths of Johor, such as its abundant land, lower cost base and space for industrial activity, with the strengths of Singapore in the areas of finance, logistics, global connectivity, skilled services and its reputation for stability.

The agreement explicitly frames the zone as a bilateral cooperation to “work together on the basis of mutual benefit to strengthen economic co-operation, facilitate cross-border movement of people and goods, improve ease of doing business, and support talent development” in the JS-SEZ.

Singapore’s participation is therefore not just symbolic.

As one government official close to the workings of the JS-SEZ tells StarBiz 7, “If the Singapore side, in the form of its companies and investors don’t actively engage in the plan by moving their operations into the zone, then the entire project would lose its edge. In some ways, this was the problem when the Iskandar region was launched 20 years ago”.

Implications on local banking landscape

What is the big issue then with allowing DBS’ entry into Alliance Bank?

Bloomberg this week speculated that DBS had withdrawn its earlier application to acquire a 49% stake in Alliance Bank, replacing it with a new bid targeting a 30% stake, presumably the stake held by Vertical Theme.

It has been reported that the earlier application by DBS did not get Bank Negara Malaysia’s (BNM) approval.

Interestingly, the 30% bid does not transgress any shareholding requirement in Malaysia as there is no limit to any foreign party owning banks here.

Local regulations, enforced by BNM, require that any new shareholder coming into a bank needs a strong value proposition. This could take the form of new products for the local market, filling any gap present.

The application will also be looked upon favourably if it promotes high-value economic activities, introduces innovative solutions that enhances Malaysia’s competitiveness and leads to the creation of high skilled jobs.

DBS’ entry could be ticking all these boxes.

DBS was transformed under Piyush Gupta, the bank’s chief executive officer (CEO) who retired in March after a tenure that began in 2009.

Piyush led the bank through a cultural transformation from a stodgy institution to one in which technology plays a central role in customer experience.

The bank also adopted artificial intelligence early by hiring data scientists to deliver more personalised services.

Most governments and regulators aggressively protect their banking sectors. It is because banking is a country’s lifeline and this protection is accepted around the world.

Yet, some foreign entities are allowed into domestic banking sectors but within some limitations. The aim is also to encourage local players to compete better, resulting in a more efficient banking sector.

In fact, Singapore banks already have a significant presence in Malaysia, namely Oversea-Chinese Banking Corporation Ltd (OCBC) and United Overseas Bank Ltd (UOB) which have a total of 38 and 55 branches here respectively.

Only one Malaysian bank – Malayan Banking Bhd – has a qualifying full bank (QFB) licence in Singapore. CIMB Group Holdings Bhd, which is Malaysia’s second-largest bank by assets, has yet to be issued a QFB licence despite many years of trying.

Foreign banks with a QFB are allowed to offer a multitude of financial services as well as operate from a total of 25 locations.

But even if a QFB in Singapore is granted to CIMB or any other Malaysian bank as a quid pro quo for DBS’ entry into Malaysia, is that a fair deal?

Local bankers are uneasy about this development.

“If this is government to government, then the Malaysian side will need to explain why this is good for its people or domestic banks as two Singaporean banks are already operating here.

“There is more to lose than to gain by having a third one as the market is crowded,” a banker says, adding that if Alliance Bank is up for grabs, then a local bank should be considered.

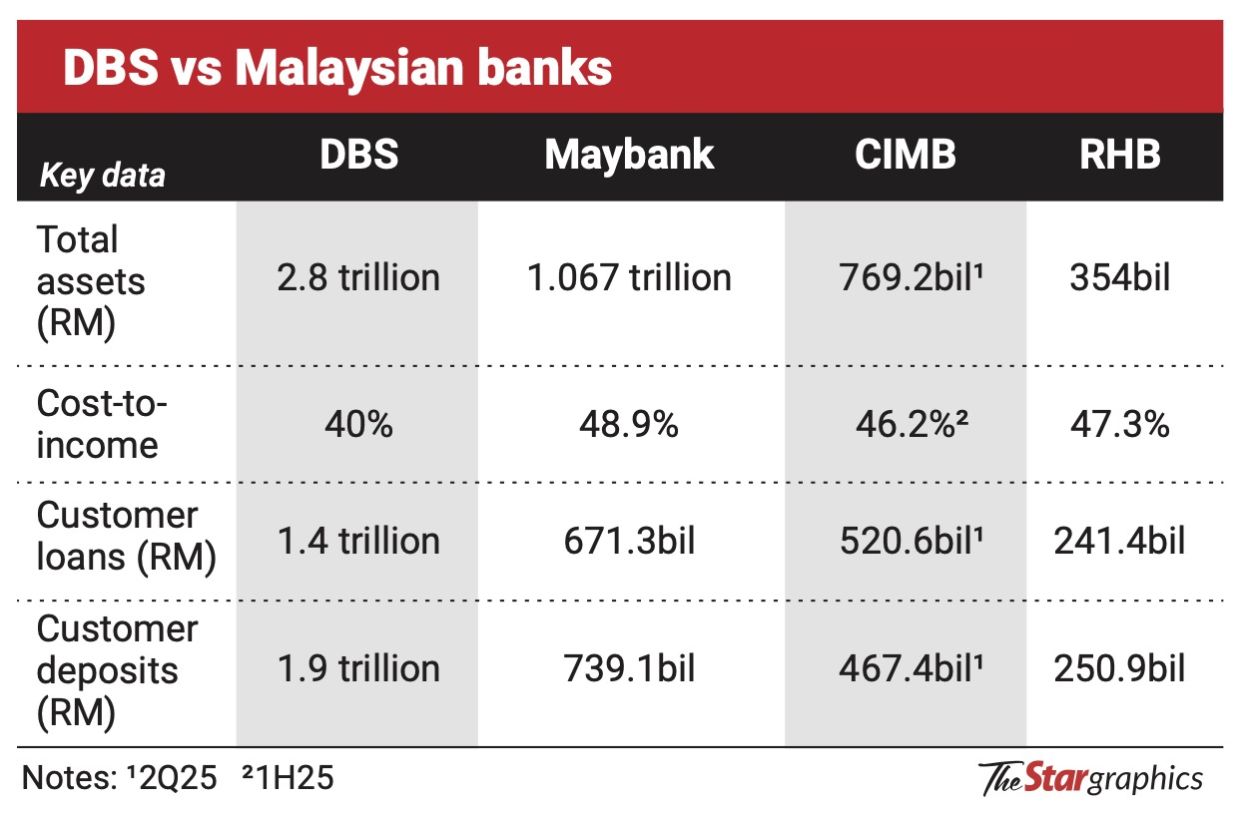

A former investment banker adds: “You could potentially have a de-rating of Malaysia’s big banks if DBS gets entry into the Malaysian banking scene via Alliance Bank,” adding: “Just look at DBS’ cost income ratios. They are more efficient than Malaysian banks and this would put them in a very strong competitive position and give them the ability to take away market share”.

One effect is that many Malaysian Chinese customers would likely opt to bank with DBS in Malaysia, rather than the Maybanks or CIMBs, he notes.

But the former head of an international bank in Malaysia is less worried. “I don’t see DBS as a big threat to Malaysian banks if they enter Malaysia directly or via Alliance Bank”.

He opines that DBS’ advantage in Singapore compared to OCBC Bank or UOB is partially due to government support, given Temasek’s stake in DBS.

“If they really manage to take a controlling stake in Alliance Bank, then we will see another equally strong and innovative foreign bank in Malaysia, but this will not displace or even take substantial market share from the top three Malaysian banks. At most, Alliance Bank may chip off a bit of the market share,” he says.

If allowed in, DBS is poised to become a strong competitor in an already crowded banking sector, which includes 10 local banks.

As of the third quarter of 2025 (3Q25), DBS’ cost-to-income ratio stood at 40%, significantly lower than Maybank’s 48.9%. CIMB’s stood at 46.2% as at the first half of 2025. Additionally, DBS surpasses local banks in market capitalisation and asset base.

CIMB Research notes that DBS’ entry into Alliance Bank could moderately intensify competition, particularly in small and medium enterprise banking, digital solutions and product innovation, are areas where DBS holds a competitive edge.

The research house adds that Malaysian banks are well-equipped to compete, having invested heavily in digital transformation, automation, data analytics and customer experience over the past decade, supported by regular technology upgrades.

“These efforts have strengthened incumbents’ competitiveness versus regional peers entering the market, while their scale advantages and deep local relationships remain intact in a relatively mature industry with a high banking penetration rate,” CIMB Research says.

It points to Malaysia’s regulatory environment, which emphasises disciplined pricing and prudent competition, that may limit the extent of disruptive behaviour from new entrants.

No local takers

Meanwhile, Alliance Bank recently announced its highest earnings in 13 quarters for the second quarter ended Sept 30. Net profit increased by 8.8% to RM206.6mil compared to the same period last year.

Group CEO Kellee Kam attributes this growth to strong loan expansion and higher fee-based income.

Despite the bank’s solid performance, a question arises: why haven’t other local banks bid to acquire Vertical Theme’s stake in Alliance Bank, if it was indeed up for sale?

It is believed that the Sarawak government engaged in preliminary discussions with Alliance Bank before choosing Affin Bank Bhd.

It wouldn’t make much sense for local banks to bid on Alliance Bank, according to one analyst.

“Paying say RM2.3bil for 30% of Alliance Bank would not necessarily move the needle for local banks. Many of these banks already have growth plans in place that overlap with Alliance Bank’s.

“In contrast, buying into Alliance Bank is a whole different story for DBS. Beauty is in the eye of the beholder,” he quips.

Malaysian banks have been slow to consolidate.

Following the Asian financial crisis of 1997/1998, BNM initiated a plan to reduce the number of domestic banks from over 50 to just 10. However, progress has been sluggish since then.

In 2014, a proposed merger between CIMB, RHB Capital Bhd, and Malaysia Building Society Bhd aimed to create the fourth-largest bank in South-East Asia, but the deal ultimately fell through.

Speculation about further consolidation has persisted.

However, challenges such as shareholding structures tied to founders and their families, as well as commercial and cultural compatibility issues, have made mergers and acquisitions complex.

Sovereignty issues

With its complex shareholding and relatively modest size, Alliance Bank is likely to remain a local bank that is a prime candidate for M&A activity.

However, this situation is further complicated by the intricate Malaysia-Singapore relationship.

Some argue that allowing DBS to acquire 30% or a larger stake in Alliance Bank is significant, as the bank is technically majority-owned by Malaysians.

Such a deal would transform a Malaysian-owned financial institution into one owned by Singapore. What would the implications of this be?

Additionally, using the JS-SEZ angle to justify DBS’s entry raises questions, as both OCBC and UOB already have a strong presence in Johor and can serve the needs of Singaporean and Malaysian entities operating in this ambitious economic zone.

DBS’s supposed interest in entering the Malaysian market mirrors its 2012 attempt to acquire a majority stake in Indonesia’s PT Bank Danamon from Temasek’s Fullerton Financial Holdings.

While the deal initially received regulatory approvals, it ultimately fell through due to Indonesia’s restrictions on foreign bank ownership.

This failure highlighted the complexities of cross-border banking M&A in South-East Asia – complexities that remain relevant in Malaysia’s context today.