Is It Too Late to Consider Amkor After Its Strong 2025 Share Price Surge?

- Wondering if Amkor Technology is still a smart buy after its big run, or if the easy money has already been made? This breakdown will help you decide whether the current price still makes valuation sense.

- The stock has been on a tear lately, jumping 16.4% in the last week, 7.4% over the past month, and racking up a 56.3% gain year to date, on top of strong multi-year returns of 55.3% over 1 year, 62.6% over 3 years, and 194.5% over 5 years.

- Behind those moves, investors have been focusing on Amkor's positioning in outsourced semiconductor packaging and testing, especially as chipmakers ramp capacity for AI, automotive, and high performance computing. The market is treating Amkor as a key picks-and-shovels player for long term semiconductor demand, and that narrative has helped push the share price higher.

- Right now, Amkor scores a 3/6 valuation check, suggesting it looks undervalued on some metrics but not all. We will walk through the main valuation approaches to see where the opportunity really lies, and then finish with a more holistic way to think about its true worth.

Approach 1: Amkor Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows and then discounts them back to today, aiming to estimate what the entire business is worth in present dollar terms.

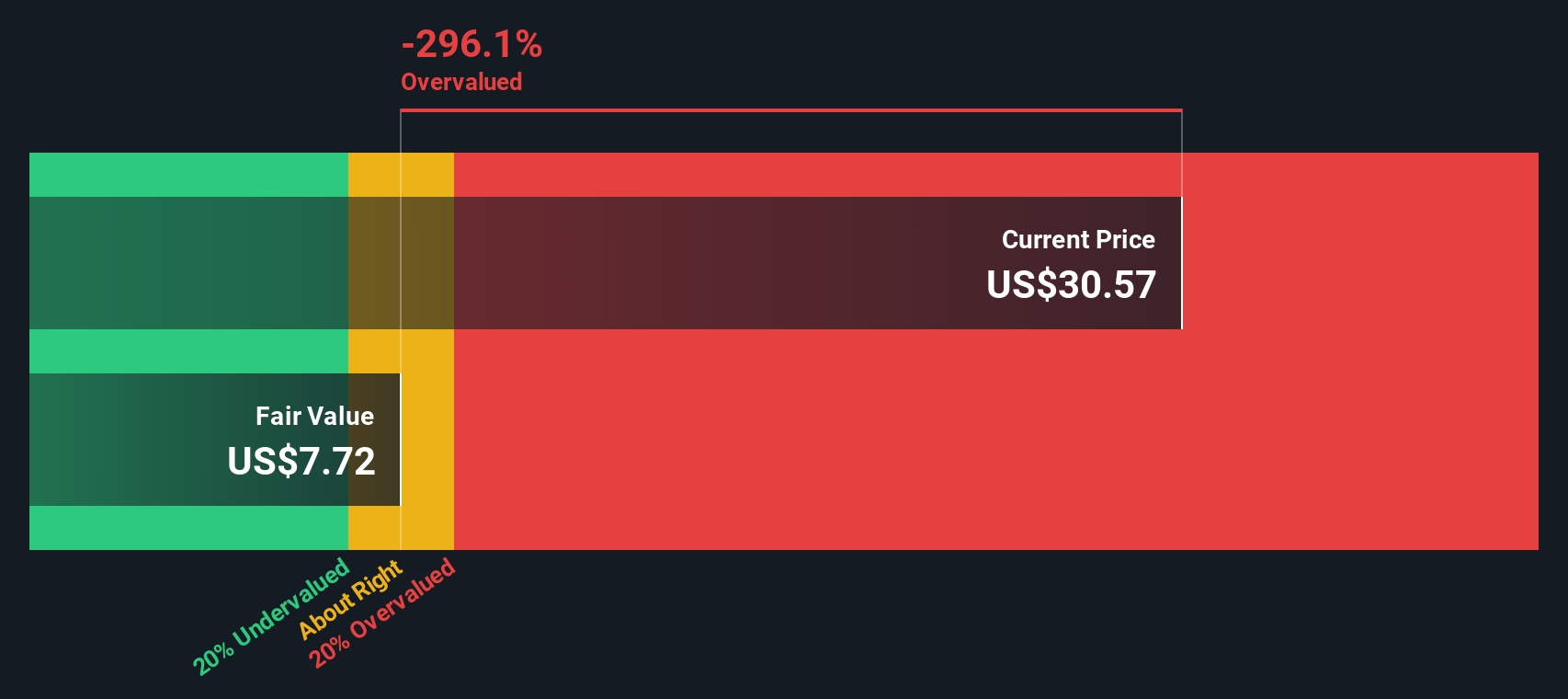

For Amkor Technology, the latest twelve month Free Cash Flow is about $230.4 million. Analyst estimates and extrapolations in this model suggest cash flows dip in 2026, then recover and grow steadily, reaching roughly $390.0 million by 2035, based on a 2 Stage Free Cash Flow to Equity framework. These projections, all in dollars, are discounted back to today to arrive at an illustrative intrinsic value per share of about $12.64 within this DCF scenario.

Compared with the current market price used in this analysis, this DCF output implies the stock is 221.6% above the value indicated by these specific cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amkor Technology may be overvalued by 221.6%. Discover 932 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Amkor Technology Price vs Earnings

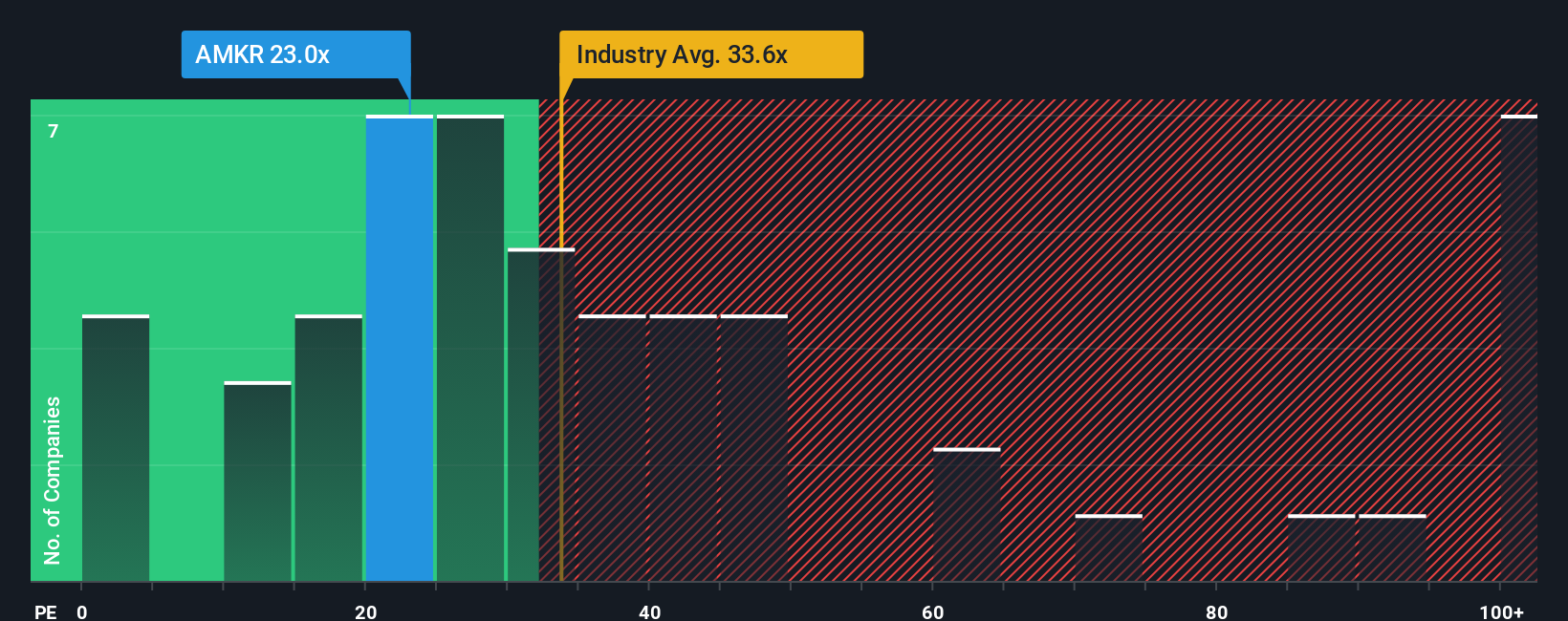

For a profitable company like Amkor Technology, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. In broad terms, higher expected growth and lower perceived risk can justify a higher, or more premium, PE multiple, while slower growth or higher risk usually calls for a discount.

Amkor currently trades on a PE of about 32.65x. That sits below the peer average of roughly 40.68x and also a bit under the broader Semiconductor industry average of about 35.69x. This suggests the market is valuing Amkor at a modest discount to many chip peers despite the strong share price run.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple a stock should reasonably trade on, given its growth outlook, profitability, risk profile, industry and market cap. For Amkor, that Fair Ratio is 35.87x. Because this approach is tailored to the company’s own fundamentals rather than generic peer comparisons, it is a more nuanced way to judge value. With the current 32.65x PE sitting below the 35.87x Fair Ratio, the shares appear modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

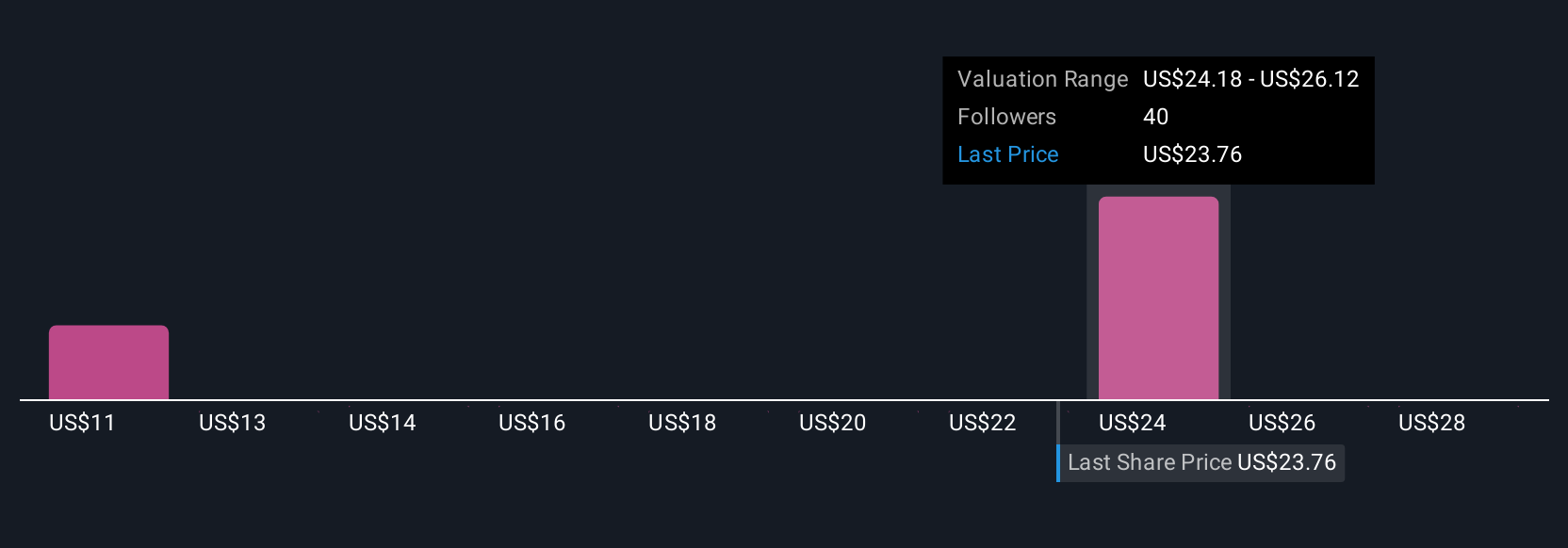

Upgrade Your Decision Making: Choose your Amkor Technology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story for a company, where you connect your view of its products, competitive position and industry outlook to concrete numbers like future revenue, earnings, margins and the fair value you think is reasonable. Instead of looking at metrics in isolation, a Narrative links Amkor Technology’s business story to a financial forecast and then to an estimated fair value, so you can clearly see why you think the stock is cheap or expensive. Narratives are easy to build and explore on Simply Wall St’s Community page, where millions of investors share and refine their views, and they automatically update as new information, such as earnings or major news, comes in. By comparing the Fair Value from a Narrative with the current share price, you can decide whether it might be time to buy, hold, or sell. For Amkor, one investor might see a conservative fair value near the low end of community estimates, while another expects much faster growth and sets a fair value near the top of the range.

Do you think there's more to the story for Amkor Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com