Is Landmark US Border-Protection Drone Contract Altering The Investment Case For Ondas Holdings (ONDS)?

- Ondas Holdings’ Ondas Autonomous Systems unit was recently chosen as prime contractor for a multi-phase government program to design and deploy an advanced autonomous border-protection drone system, expected to start with an initial order in early 2026 and scale to thousands of aircraft.

- The project positions Ondas at the center of a large, long-duration government technology effort, potentially reinforcing its role as an integrator of aerial platforms, AI, sensor fusion and command-and-control for homeland security applications.

- We’ll now examine how this major border-protection drone contract, and its multi-year scope, could reshape Ondas Holdings’ existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ondas Holdings Investment Narrative Recap

To own Ondas, you have to believe its autonomous systems platform can grow into a central supplier for defense and border security, while the company reins in losses and funding needs. The new border-protection drone award strengthens the near term revenue catalyst around Ondas Autonomous Systems, but it does not remove the key risk that ongoing operating losses and potential dilution could weigh on shareholder returns.

Against this backdrop, the recent move to double authorized common shares to 800,000,000 stands out, as it may enable Ondas to fund growth around contracts like the border program and the US$8.2 million European counter UAS order, while also amplifying the existing risk of further dilution if new equity is issued at scale.

However, investors should also be aware that continued operating losses, combined with more shares potentially coming to market, could...

Read the full narrative on Ondas Holdings (it's free!)

Ondas Holdings’ narrative projects $151.6 million in revenue and $16.3 million in earnings by 2028.

Uncover how Ondas Holdings' forecasts yield a $10.86 fair value, a 35% upside to its current price.

Exploring Other Perspectives

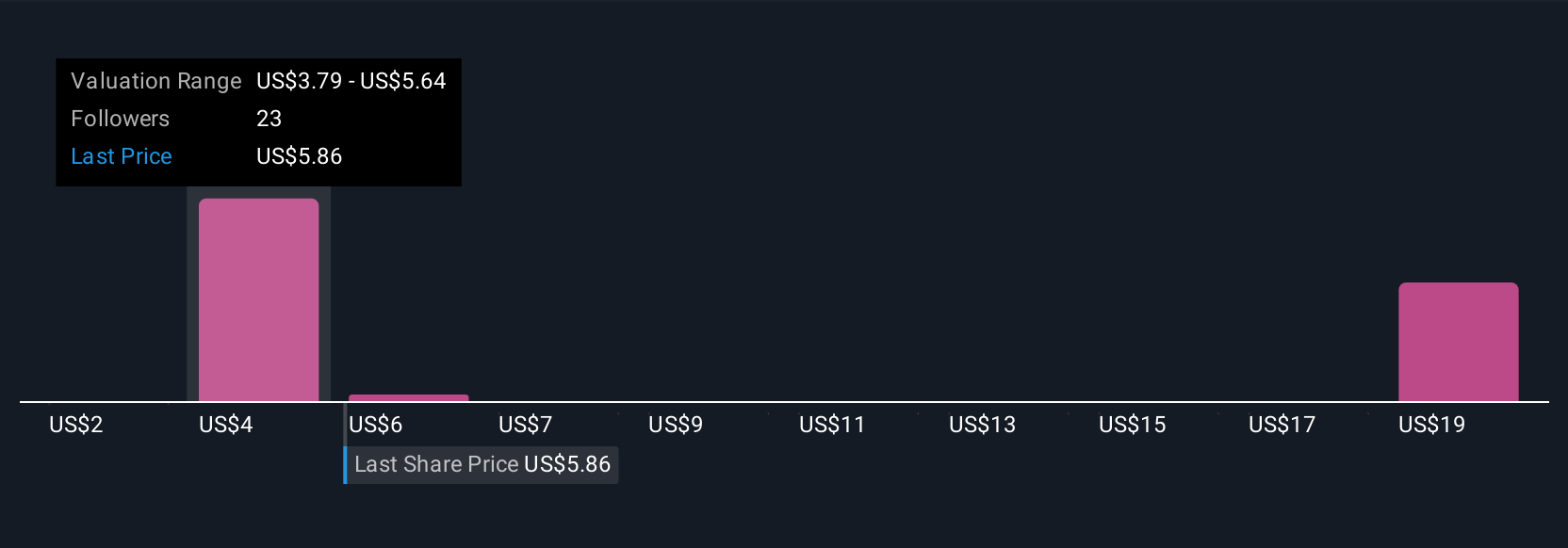

Fifteen fair value estimates from the Simply Wall St Community span roughly US$0.47 to US$17.92, showing how far apart individual views can be. As you weigh those opinions against Ondas’ dependence on turning large defense contracts into sustainable earnings, it is worth exploring several of these perspectives before deciding how the stock fits in your portfolio.

Explore 15 other fair value estimates on Ondas Holdings - why the stock might be worth less than half the current price!

Build Your Own Ondas Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ondas Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ondas Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ondas Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com