Guidewire (GWRE) Margin Expansion Reinforces Bullish Cloud Profitability Narrative in Q1 2026

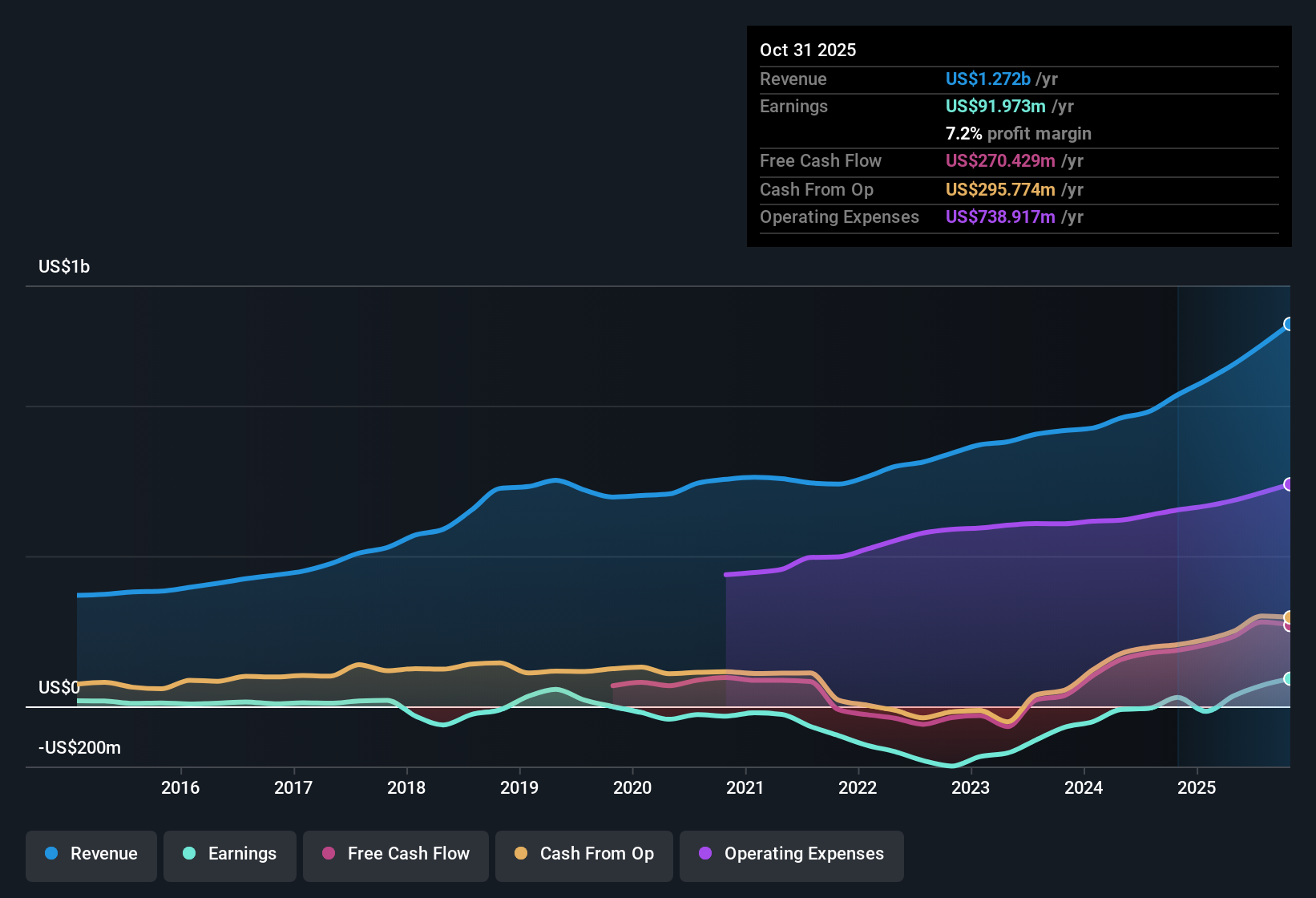

Guidewire Software (GWRE) has kicked off Q1 2026 with total revenue of about $332.6 million and basic EPS of $0.37, setting the tone for investors digesting its latest set of numbers. The company has seen revenue move from roughly $262.9 million and EPS of $0.11 in Q1 2025 to $332.6 million and $0.37 in Q1 2026, while trailing twelve month EPS lifted from $0.36 to $1.09 as revenue climbed from about $1.0 billion to $1.3 billion. This provides useful context around its earnings trajectory and scale. With net income and margins tracking higher on a trailing basis, the quarter lands as another data point in a profitability story that investors will now weigh against Guidewire’s growth runway.

See our full analysis for Guidewire Software.With the headline figures on the table, the next step is to see how they align with the big narratives around Guidewire’s growth, profitability, and risk that have taken shape over the past year.

See what the community is saying about Guidewire Software

Margins Climb To 7.2 Percent

- Over the last 12 months, net profit margin was 7.2 percent compared with 2.9 percent a year earlier, helped by trailing net income rising to about 92 million dollars on roughly 1.3 billion dollars of revenue.

- Analysts consensus narrative expects margin gains from cloud adoption and efficiency, and the recent data partly backs that up:

- The trailing net profit margin improvement from 2.9 percent to 7.2 percent aligns with the view that operating efficiency is improving as more customers move to Guidewire Cloud.

- At the same time, the one off loss of 55.7 million dollars in the last 12 months shows that not all profitability drivers are smooth, which is a nuance sometimes glossed over in bullish discussions of margin expansion.

Earnings Growth Outpaces Revenue

- Trailing twelve month earnings grew 205.5 percent year over year as net income reached about 92 million dollars, while trailing revenue increased to around 1.3 billion dollars and is forecast to grow about 12.3 percent per year.

- Bulls point to this gap between earnings and revenue growth as evidence of operating leverage, and the recent figures offer support with caveats:

- EPS on a trailing basis moved from roughly 0.36 dollars to 1.09 dollars while revenue stepped up from about 1.0 billion dollars to 1.3 billion dollars, which fits the bullish idea that margins are scaling with cloud and analytics adoption.

- However, the presence of a 55.7 million dollar one off loss in the same period means some of that earnings swing is tied to unusual items, so investors need to separate sustainable profit trends from one time noise when they apply that bullish thesis.

Rich Valuation Versus DCF Fair Value

- Guidewire trades at a price to sales ratio of 14.1 times, above the US software industry average of 4.9 times and peer average of 8.4 times, and the current share price of 211.07 dollars sits well above a DCF fair value estimate of 138.18 dollars.

- Skeptics focus on this valuation gap, and the numbers give their concerns concrete backing:

- With revenue expected to grow about 12.3 percent per year and earnings around 23.1 percent per year, the 14.1 times sales multiple means Guidewire would need to continue to deliver on those forecasts rather than just matching the broader US market.

- The spread between the 211.07 dollar share price and the 138.18 dollar DCF fair value implies investors are already paying up for years of growth, which challenges any bearish view that the stock is priced like an average software name rather than a premium one.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Guidewire Software on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures that others might miss? Use that angle to build a complete narrative in just a few minutes: Do it your way.

A great starting point for your Guidewire Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Guidewire’s premium valuation versus DCF fair value, reliance on aggressive growth assumptions, and earnings noise from one off items raise questions about downside protection.

If you do not want to pay up for uncertainty, use our these 908 undervalued stocks based on cash flows to quickly spot companies where cash flow support and upside potential look far more balanced.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com