Genesco (GCO) Q2 2026 Loss Deepens, Challenging Bullish Margin-Recovery Narrative

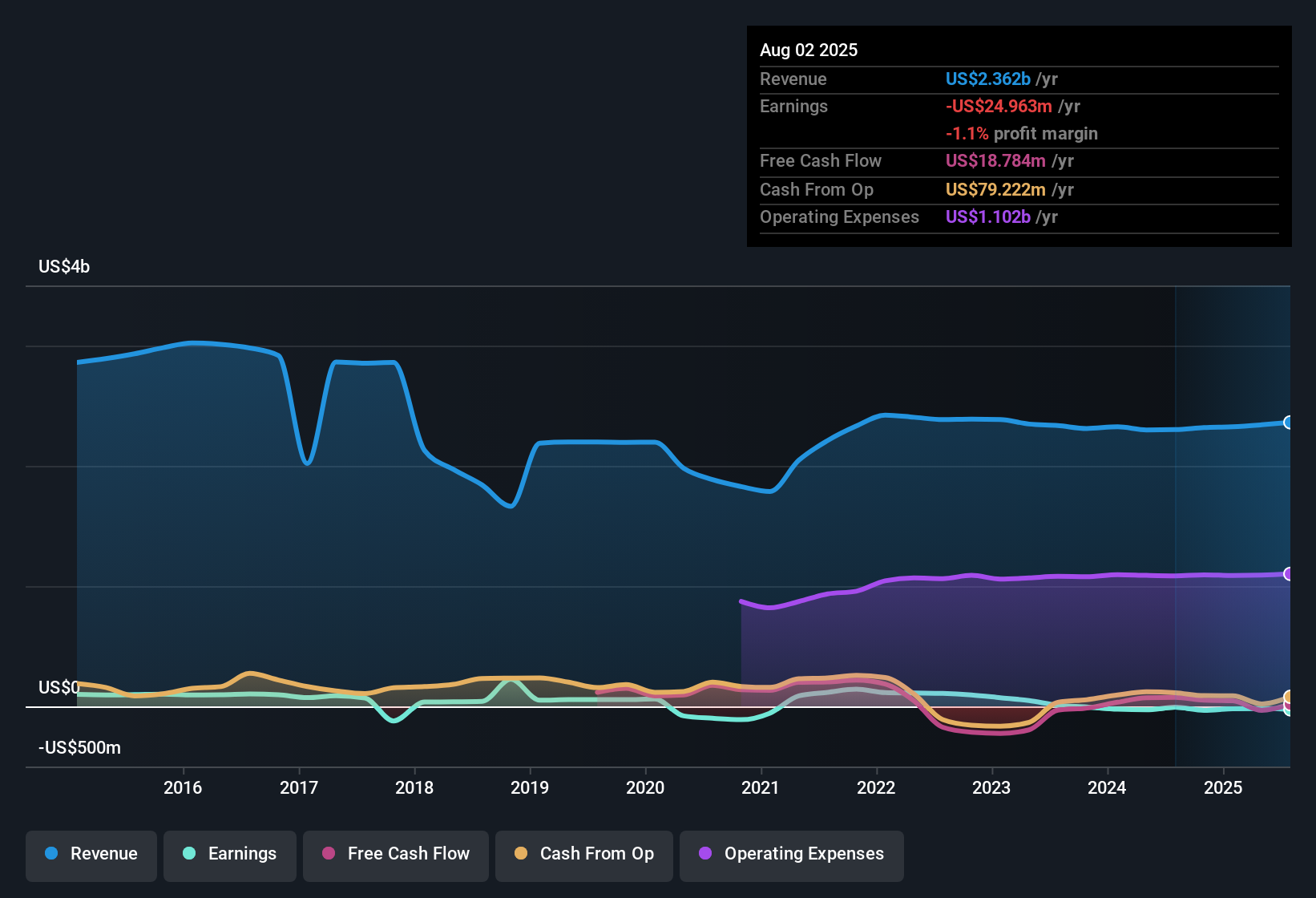

Genesco (GCO) has just posted Q2 2026 results showing revenue of $546 million and basic EPS of -$1.79, with net income from continuing operations at a loss of $18 million as the business continues to work through a period of pressured profitability. The company has seen quarterly revenue move from $525 million in Q2 2025 to $546 million in Q2 2026, while EPS stepped down from -$0.91 to -$1.79 over the same stretch, underscoring that top line progress is not yet translating into cleaner margins. With the stock trading around the latest print, investors will be closely focused on whether management can stabilize losses and start rebuilding margins from here.

See our full analysis for Genesco.With the numbers on the table, the next step is to weigh this earnings report against the prevailing narratives around Genesco, highlighting where the data supports the story and where expectations may need to shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Same-Store Sales Up 4% While Losses Persist

- Genesco reported 4% same-store sales growth in Q2 2026 on $546 million of revenue, yet net income excluding extra items remained a loss of $18.5 million, similar to the $18.8 million loss logged in Q3 2025 despite higher revenue in the current period.

- What stands out for a cautious, bearish view is that steady comp growth has not stopped multiyear earnings deterioration, with net losses widening at a 14.2% annual rate over five years. This keeps the focus squarely on whether this sales momentum can realistically translate into profit improvement.

- Bears highlight that even with revenue rising from $525 million in Q2 2025 to $546 million in Q2 2026 and same-store growth of 4% to 6% across recent quarters, the company has remained loss-making on a trailing 12 month basis at about $25 million of net loss excluding extra items.

- Critics also point to the swing from a $33.6 million profit in Q4 2025 to consecutive losses before and after that quarter as evidence that profitability has not stabilized around a sustainable level.

Trailing Losses Contrast With Holiday Profit Spike

- Over the last four reported quarters, Genesco generated about $2.4 billion of revenue but still posted an LTM net loss excluding extra items of roughly $25 million, despite earning $33.6 million in Q4 2025 alone on $746 million of seasonal revenue.

- From a bearish standpoint, the heavy reliance on that single profitable holiday quarter is a concern, because the other quarters in the period show losses between about $18 million and $24 million. This suggests that the business as currently structured struggles to cover its cost base outside peak trading.

- Skeptics argue that Q1 2026 and Q2 2026 losses of $21.2 million and $18.5 million, even after a strong Q4 2025, support the idea that the underlying earnings trend driving the 14.2% annual net loss increase remains intact.

- What is especially challenging for the bearish narrative is that this weak profit pattern has appeared despite modest LTM revenue growth from about $2.30 billion in Q1 2025 to $2.36 billion by Q2 2026, indicating that higher sales alone have not yet repaired profitability.

Deep Valuation Discount vs DCF Fair Value

- At a share price of $24.38 and a price to sales ratio of 0.1 times compared with the Specialty Retail average of 0.5 times, Genesco trades not only at a large discount to peers but also roughly 69% below an indicated DCF fair value of about $79.48 per share.

- For investors leaning more optimistic, this valuation gap is key, because it suggests that if the company can even partially arrest the 14.2% annualized earnings decline and move toward breakeven on the roughly $2.4 billion of trailing revenue, the upside implied by both the low P/S multiple and the DCF fair value estimate could be meaningful.

- Supporters note that the modest 2.8% revenue growth rate still means the top line is edging higher, which, combined with any cost discipline, might narrow losses from the current LTM net loss of around $25 million.

- Value oriented investors also point out that being priced well below both industry and peer P/S levels provides a margin of safety if management can prevent further deterioration in earnings.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Genesco's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Genesco is struggling to convert modest revenue growth into consistent profitability, with recurring losses and dependence on one strong holiday quarter to offset weaker periods.

If you want steadier performers than that, use our stable growth stocks screener (2081 results) to quickly focus on businesses already proving they can grow revenue and earnings reliably through different environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com