Should MasTec’s Thin Margins Temper Confidence in Its Backlog-Driven Growth Story for MTZ Investors?

- MasTec recently reported solid quarterly results, continuing a multi-year run of strong performance that has helped it outperform broader market benchmarks.

- At the same time, analysts are increasingly focused on MasTec’s thin gross and operating margins and a weakening free cash flow margin, raising questions about how sustainable its capital-intensive growth model may be.

- We’ll now examine how these robust results but lingering margin concerns affect MasTec’s investment narrative built around backlog strength and future growth.

Find companies with promising cash flow potential yet trading below their fair value.

MasTec Investment Narrative Recap

To own MasTec, you need to believe its record backlog and exposure to grid, renewables, and communications build-outs can offset structurally thin margins and high capital needs. The latest strong quarter supports the growth side of that thesis, but the persistent pressure on gross, operating, and free cash flow margins keeps the biggest near term risk squarely on profitability and cash generation rather than demand, and this news does not materially change that backdrop.

The most relevant update here is MasTec’s Q3 2025 earnings release, which showed higher revenue and net income year over year and confirmed full year guidance. Those results reinforce the idea that the core demand catalysts around infrastructure and energy transition remain intact, even as the margin debate intensifies and investors watch closely to see if better scale can eventually translate into sturdier profitability.

Yet beneath the strong headline growth, investors should still be aware of...

Read the full narrative on MasTec (it's free!)

MasTec's narrative projects $17.2 billion revenue and $730.8 million earnings by 2028.

Uncover how MasTec's forecasts yield a $246.67 fair value, a 13% upside to its current price.

Exploring Other Perspectives

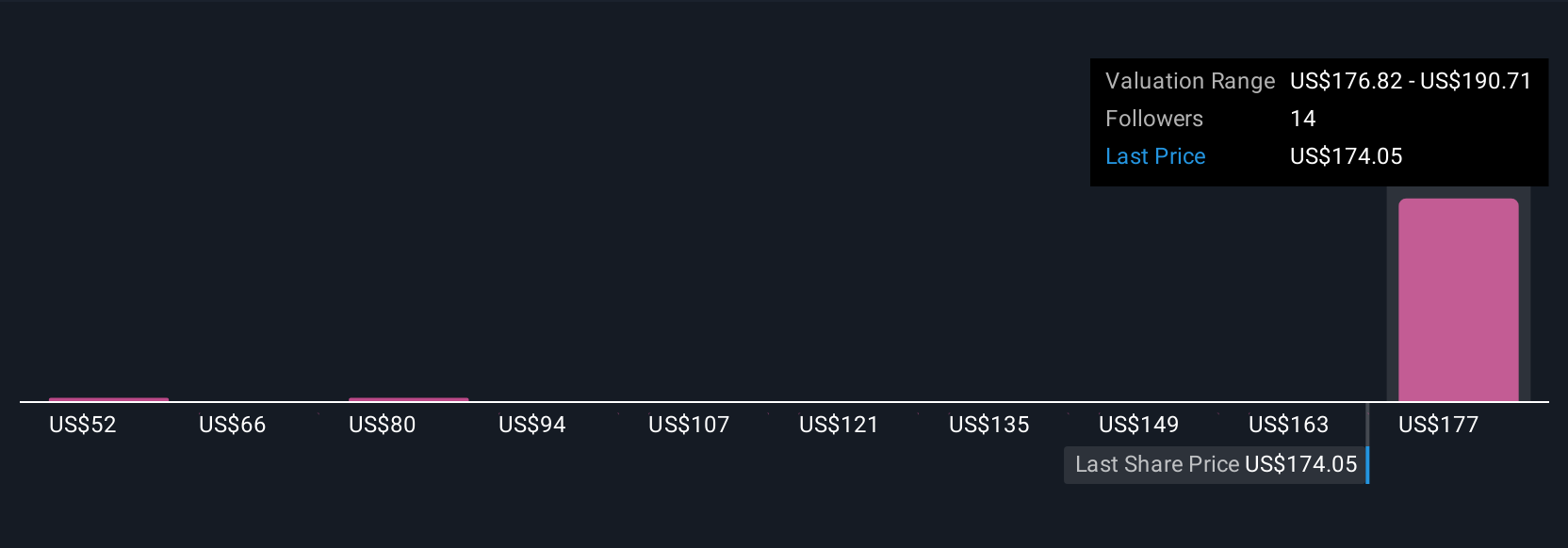

Four fair value estimates from the Simply Wall St Community span roughly US$145 to US$248 per share, showing how widely opinions can differ. Against that backdrop, concerns about thin and pressured margins give you an important alternative lens on MasTec’s recent strength and what could matter most for its future performance.

Explore 4 other fair value estimates on MasTec - why the stock might be worth 34% less than the current price!

Build Your Own MasTec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MasTec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasTec's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com