Is Hercules Capital’s (HTGC) Rich Dividend Yield Still Worth Its Growing Loan Risk?

- Recently, Hercules Capital was downgraded by analysts from “buy” to “hold,” as concerns grew around its high leverage and exposure to potentially risky loans to portfolio companies with weakening revenues.

- The debate now centers on whether Hercules Capital’s double-digit dividend yield adequately compensates investors for the heightened risk in its loan book and leverage profile.

- We’ll now examine how renewed scrutiny of Hercules Capital’s loan portfolio risk affects the company’s broader investment narrative and risk-reward balance.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hercules Capital Investment Narrative Recap

To own Hercules Capital, you have to believe that its tech and life sciences lending platform can keep generating enough income to support its double digit dividend, even as competition and credit risk rise. The recent downgrade focuses attention on whether leverage and exposure to weaker portfolio companies could pressure that income, which makes loan performance the key near term catalyst and potential credit losses the biggest risk. So far, the news itself does not change those fundamentals, but it sharpens the market’s focus on them.

The most relevant recent update is Hercules Capital’s Q3 2025 earnings, which showed higher revenue and net income year over year. Those results give investors fresh data to weigh against the concerns raised in the downgrade, particularly around whether current earnings and dividend coverage look resilient if some portfolio companies continue to weaken.

Yet investors should be aware that Hercules Capital’s sector concentration in technology and life sciences could quickly magnify...

Read the full narrative on Hercules Capital (it's free!)

Hercules Capital's narrative projects $677.4 million revenue and $455.0 million earnings by 2028. This requires 10.4% yearly revenue growth and about a $198.4 million earnings increase from $256.6 million today.

Uncover how Hercules Capital's forecasts yield a $21.22 fair value, a 12% upside to its current price.

Exploring Other Perspectives

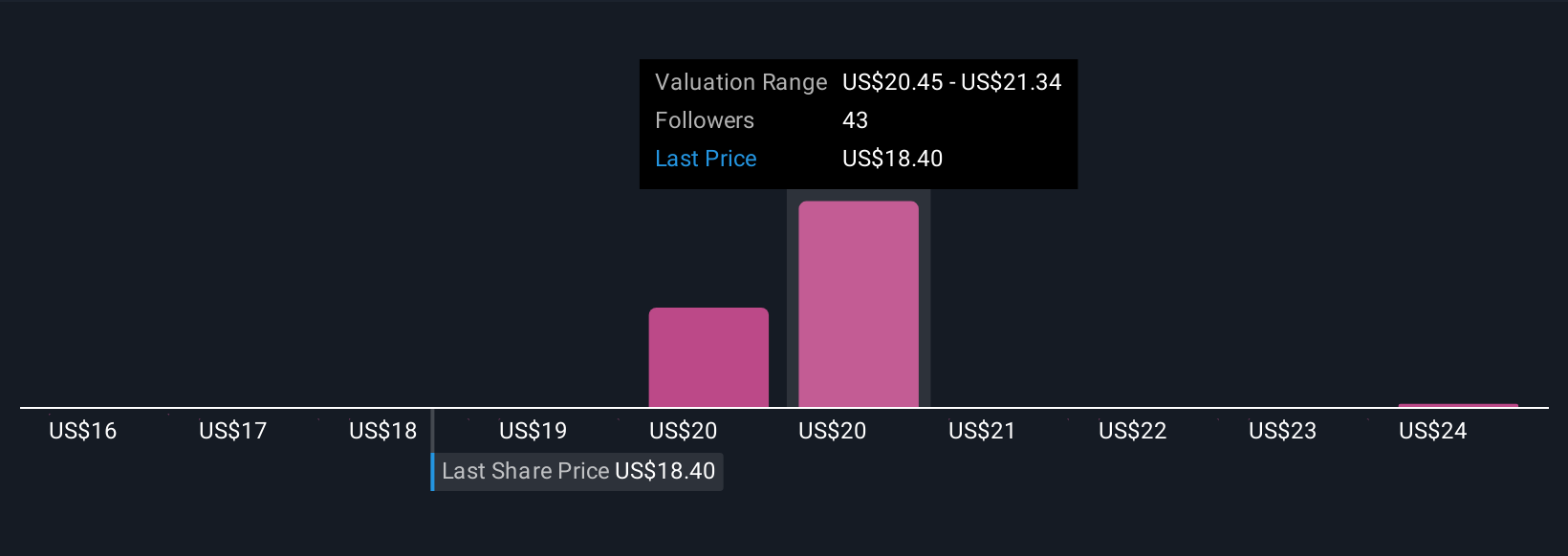

Six fair value estimates from the Simply Wall St Community span roughly US$16 to almost US$24.90 per share, underscoring how differently investors weigh Hercules Capital’s sector concentration risk and its implications for future performance.

Explore 6 other fair value estimates on Hercules Capital - why the stock might be worth as much as 31% more than the current price!

Build Your Own Hercules Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hercules Capital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hercules Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hercules Capital's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com