How FIT Hon Teng’s Circular Delay Tests Disclosure Discipline and Execution Confidence for SEHK:6088 Investors

- Earlier in December 2025, FIT Hon Teng Limited announced that it would postpone the dispatch of a circular on framework agreements and related transactions from December 5 to December 16, 2025, to complete the necessary information.

- This extra preparation time highlights how documentation quality and disclosure timing can affect shareholder expectations around upcoming deals and corporate actions.

- We’ll explore how the delayed circular on framework agreements could shape FIT Hon Teng’s investment narrative and investor confidence in its execution.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is FIT Hon Teng's Investment Narrative?

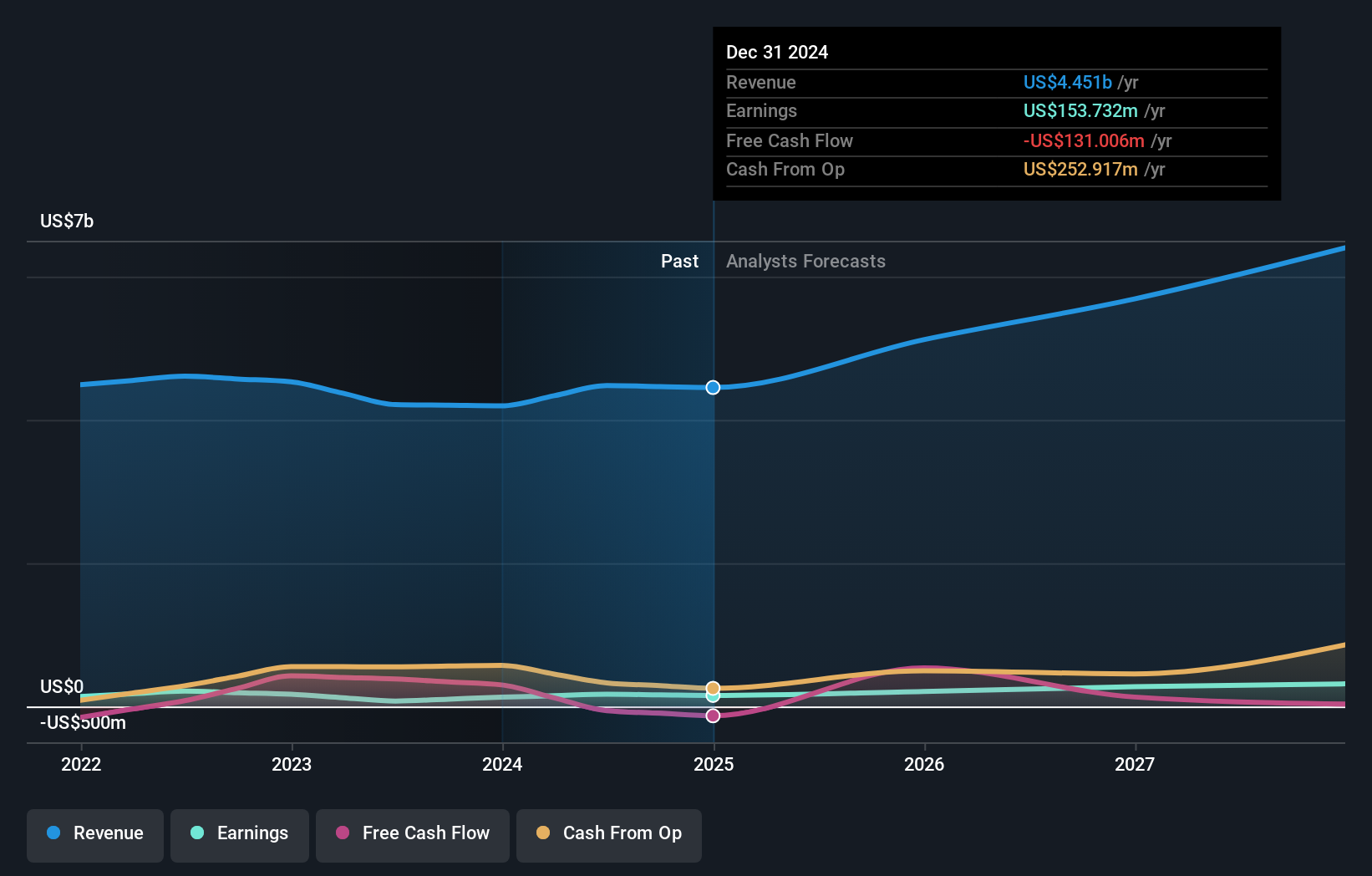

To own FIT Hon Teng, you have to believe in its role as a connector maker that can convert solid top-line growth into more durable profitability, even with relatively thin margins and a premium earnings multiple. The recent share price strength, together with consensus and community fair values that sit above the market price, suggests that expectations are already elevated. In the short term, the bigger catalysts still look tied to execution in higher-value interconnects for AI and data infrastructure, and to how much of the current earnings uplift is genuinely recurring rather than one-off. Against that backdrop, the delayed circular on framework agreements feels more like a governance and communication test than a fundamental shock, but any further slippage or vague disclosure could quickly feed into perceptions of execution risk.

However, one key business risk here is easy to overlook. FIT Hon Teng's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on FIT Hon Teng - why the stock might be worth just HK$5.21!

Build Your Own FIT Hon Teng Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FIT Hon Teng research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FIT Hon Teng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FIT Hon Teng's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com