Will FactSet’s (FDS) Arcesium Deal and AWS Tie-Up Recast Its AI-Led Efficiency Narrative?

- In early December 2025, FactSet and Arcesium announced a partnership to deliver a unified, cloud-native investment management platform that connects front, middle, and back office workflows across public, private, and alternative markets, while FactSet also revealed its market intelligence is now accessible through Amazon Quick Research to streamline clients’ AI-driven research in AWS.

- Together, these moves highlight FactSet’s push to embed its data and analytics more deeply into clients’ operational and AI infrastructures, turning fragmented workflows into a consolidated, “single source of truth” environment for investment firms.

- Next, we’ll look at how this FactSet–Arcesium front-to-back integration could reshape FactSet’s investment narrative around AI-led efficiency.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

FactSet Research Systems Investment Narrative Recap

To own FactSet, you need to believe in its role as core infrastructure for investment data, analytics, and workflows, even as clients scrutinize budgets and rising tech costs pressure margins. The FactSet–Arcesium tie-up and AWS Quick Research integration both speak directly to the key near term catalyst of AI-enabled workflow efficiency, but they do little to reduce the immediate risk from cost rationalization in asset management and banking.

Among the recent developments, the Arcesium partnership looks most relevant, because it extends FactSet from being “just” a front office analytics provider into a unified front to back platform that can sit at the center of a client’s operations. If this integrated offering gains traction, it could reinforce cross sell opportunities from earlier deals like Irwin and LiquidityBook, and deepen FactSet’s role in clients’ data pipelines while they are actively looking for ways to cut duplicate systems and improve productivity.

Yet while FactSet is leaning into AI and cloud integrations, investors should also be aware of how higher technology expenses could...

Read the full narrative on FactSet Research Systems (it's free!)

FactSet Research Systems' narrative projects $2.7 billion revenue and $730.7 million earnings by 2028.

Uncover how FactSet Research Systems' forecasts yield a $335.94 fair value, a 16% upside to its current price.

Exploring Other Perspectives

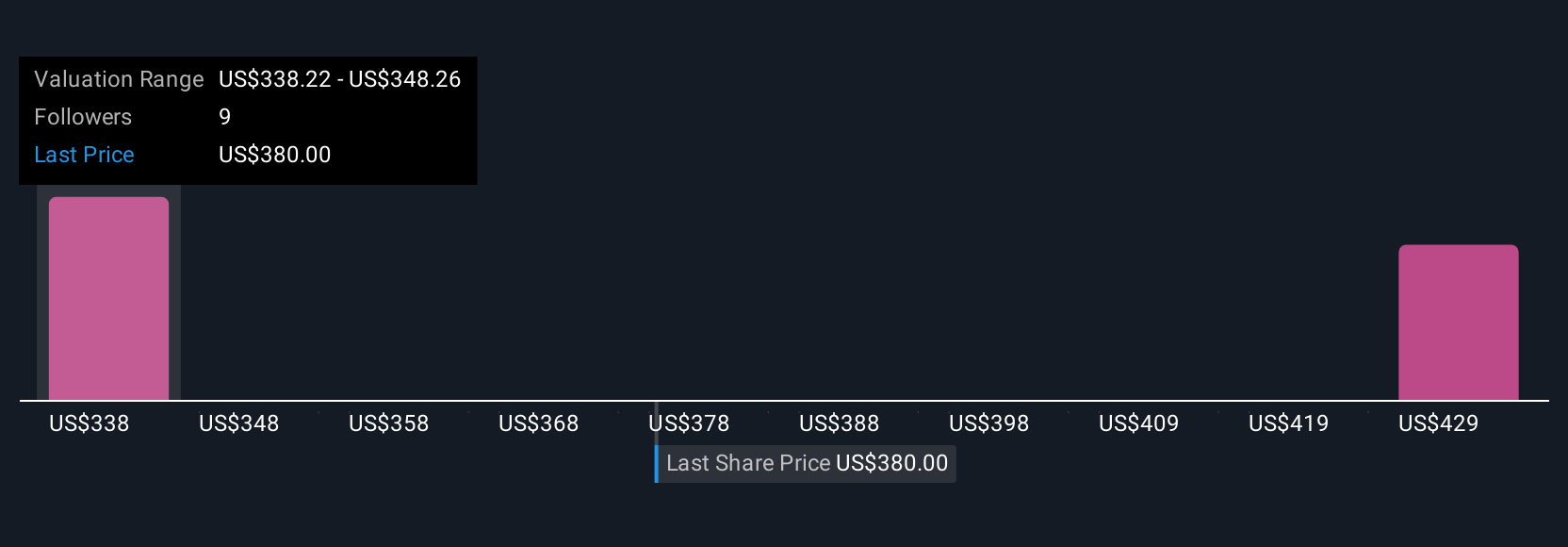

Four members of the Simply Wall St Community currently see FactSet’s fair value between US$276.99 and US$335.94, highlighting a wide range of individual views. Set those opinions against rising cloud and software costs that are already pressuring margins, and it becomes even more important to compare several different perspectives on how durable FactSet’s profitability might be.

Explore 4 other fair value estimates on FactSet Research Systems - why the stock might be worth as much as 16% more than the current price!

Build Your Own FactSet Research Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FactSet Research Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FactSet Research Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FactSet Research Systems' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com