DXC Technology (DXC) Is Up 7.0% After Showcasing Major Cloud Migration Win With ivari

- At AWS re:Invent, DXC Technology announced that Canadian life insurer ivari has completed a large-scale migration of about 732,000 policies to the DXC Assure Platform on Amazon Web Services, achieving a 22% reduction in operating costs and supporting four new product launches without business disruption.

- This go-live showcases DXC’s ability to execute complex, cloud-enabled transformations in insurance, strengthening its position in core policy administration modernization and business process services.

- We’ll now examine how this successful, large-scale ivari migration and its cost-efficiency gains might influence DXC Technology’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DXC Technology Investment Narrative Recap

To own DXC, you need to believe a legacy IT outsourcer can steadily replace declining infrastructure work with higher value cloud and insurance platforms, while protecting already thin margins. The ivari go-live is encouraging for this shift, but does not yet change the near term picture of falling organic revenue and pressure in the GIS segment, which remains the key risk to watch.

Among recent announcements, the pricing of €650,000,000 of 4.250% Senior Notes due 2030 stands out in this context, as it speaks to balance sheet flexibility while DXC invests in cloud-enabled modernization like the ivari and other Assure platform wins. How effectively that capital supports execution on complex transformations will matter for turning strong bookings into more stable revenues and margins.

Yet behind these encouraging transformation headlines, investors still need to be aware of the persistent organic revenue declines and what they could mean for...

Read the full narrative on DXC Technology (it's free!)

DXC Technology’s narrative projects $12.1 billion revenue and $208.6 million earnings by 2028. This implies a 1.7% yearly revenue decline and an earnings decrease of $170.4 million from $379.0 million today.

Uncover how DXC Technology's forecasts yield a $14.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

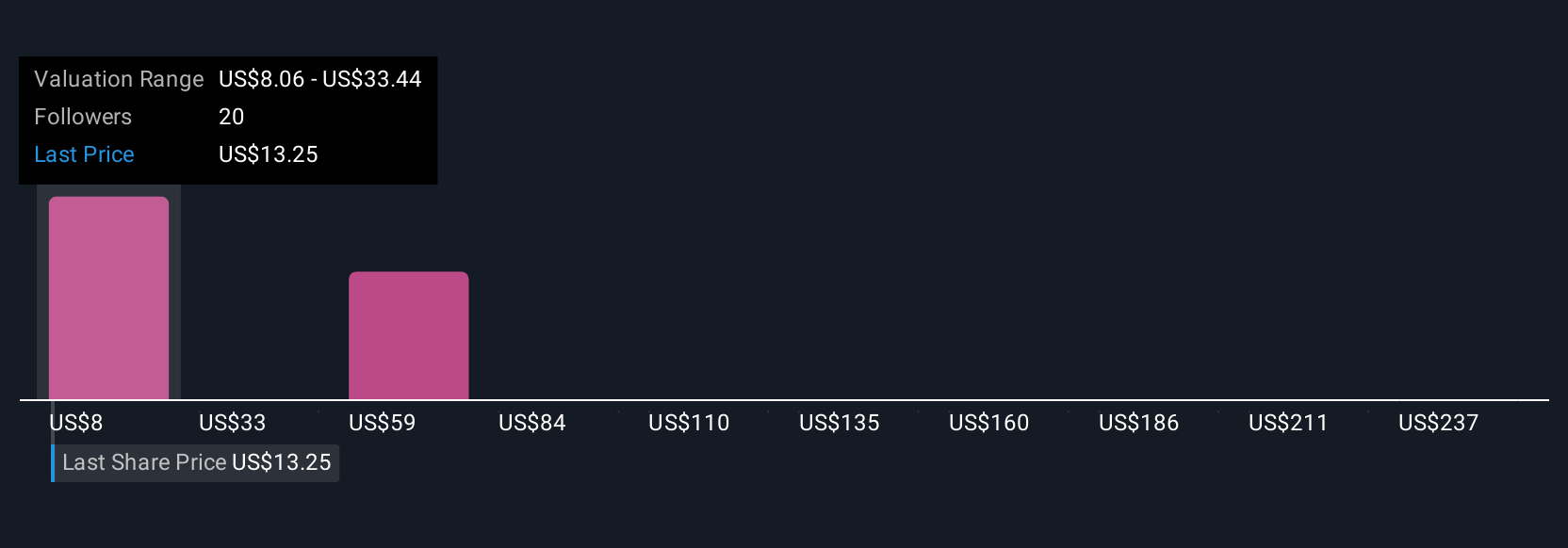

Five members of the Simply Wall St Community value DXC between US$8.06 and US$261.89 per share, highlighting very different expectations. Against this spread, ongoing organic revenue declines remain a central issue that could influence whether those projections prove too cautious or too optimistic, so it helps to weigh several of these viewpoints side by side.

Explore 5 other fair value estimates on DXC Technology - why the stock might be a potential multi-bagger!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DXC Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DXC Technology's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com