What Aeris Resources (ASX:AIS)'s High-Profile Board Departure Means For Shareholders

- Aeris Resources has confirmed that Mr. Robert Millner AO resigned as a Non-Executive Director for personal reasons on 1 December 2025, with the company now beginning a formal search for his replacement.

- Given Mr. Millner’s profile and influence, his departure raises fresh questions about board composition and how governance decisions might shape Aeris Resources’ next phase.

- We’ll now examine how the loss of a high-profile non-executive director could influence Aeris Resources’ investment narrative and governance outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Aeris Resources Investment Narrative Recap

To own Aeris Resources, you need to believe its copper and gold assets can convert recent operational gains into stronger, sustainable cash flows, despite project and commodity price uncertainty. Robert Millner’s exit does not appear to materially alter near term production catalysts or the key risk around execution at Murrawombie and Constellation, though it does sharpen the focus on how the board refresh strengthens oversight of capital allocation and project delivery.

The recent A$80,000,000 equity raising at A$0.45 per share is especially relevant in this context, as it provides additional funding capacity for high capex projects like Murrawombie Pit and Constellation. With a new director to be appointed, investors may watch how the refreshed board approaches future funding decisions and project prioritisation, given the balance between growth ambitions and pressure on liquidity and margins.

Yet behind the operational upside, investors should be aware of the risk that high capital expenditure commitments could strain cash flows if...

Read the full narrative on Aeris Resources (it's free!)

Aeris Resources' narrative projects A$510.9 million revenue and A$4.0 million earnings by 2028. This implies a 4.0% yearly revenue decline and an earnings decrease of A$41.2 million from A$45.2 million today.

Uncover how Aeris Resources' forecasts yield a A$0.618 fair value, a 20% upside to its current price.

Exploring Other Perspectives

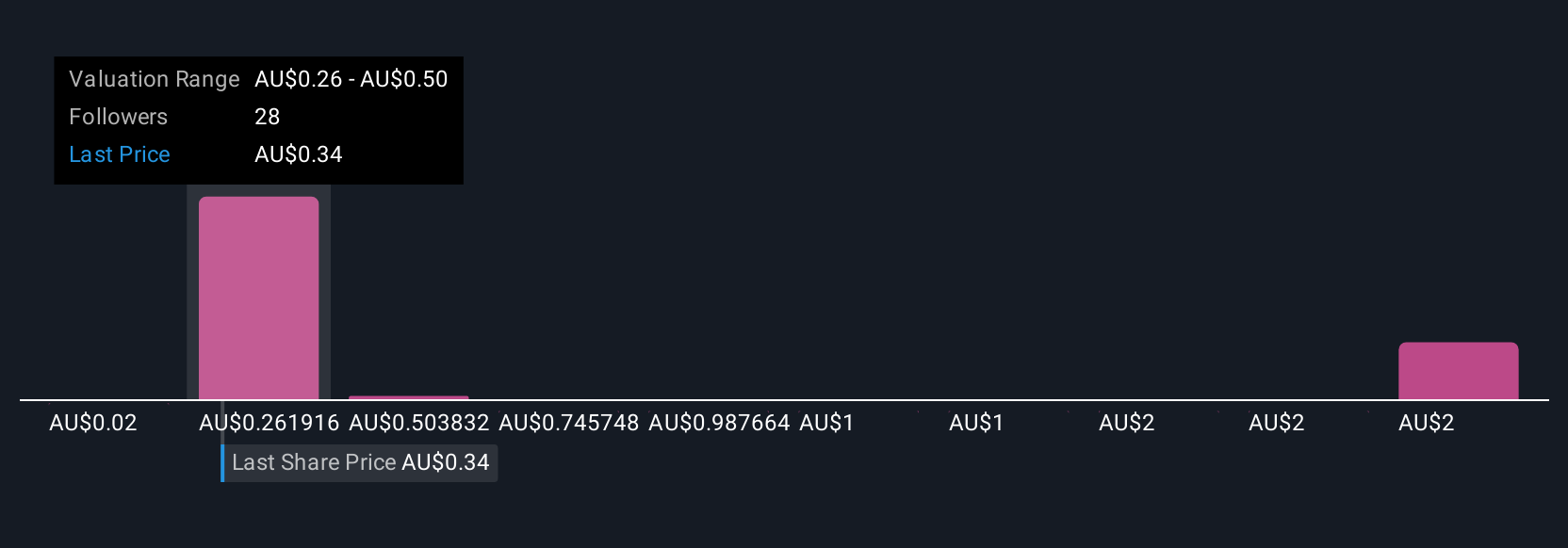

Seven Simply Wall St Community fair value estimates for Aeris span from A$0.29 to A$2.69, showing how widely opinions can differ. Against this backdrop, the high capital expenditure required for Murrawombie and Constellation remains a key factor that could influence how these different expectations about Aeris’ future performance play out over time.

Explore 7 other fair value estimates on Aeris Resources - why the stock might be worth over 5x more than the current price!

Build Your Own Aeris Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeris Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aeris Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeris Resources' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com