Workiva (WK): Evaluating Valuation After Recent Double-Digit Share Price Rebound

Workiva (WK) has quietly put up double digit gains over the past month, even as its year to date return is still in the red. That mix of recent strength and longer term lag sets up an interesting entry point.

See our latest analysis for Workiva.

With the share price now around $92 and a strong 30 day share price return offsetting a weaker year to date performance, the recent 90 day upswing suggests momentum is quietly rebuilding as investors re rate Workiva's growth story and risk profile.

If this kind of rebound catches your eye, it is a good moment to see what else fits the bill by exploring high growth tech and AI stocks.

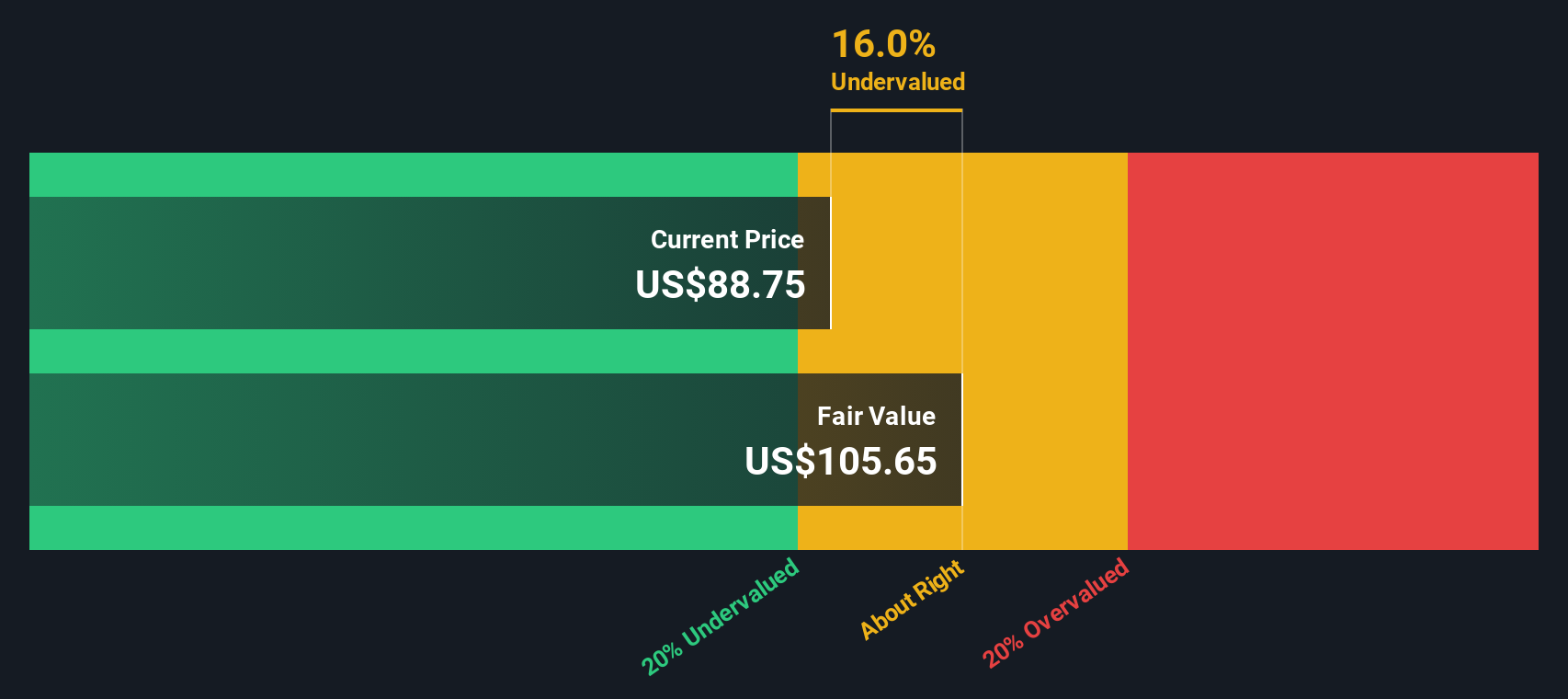

With revenue still growing at mid teens rates, mounting progress toward profitability and the shares trading below both intrinsic value estimates and analyst targets, is Workiva quietly offering a mispriced entry point, or has the market already pencilled in its next chapter of growth?

Most Popular Narrative: 13.6% Undervalued

With Workiva closing at $92.37 versus a narrative fair value of $106.90, the gap hints at meaningful upside if the projected roadmap plays out.

The continued integration and success of AI capabilities within Workiva's platform is expected to improve operational efficiencies, potentially boosting net margins by streamlining workflows and increasing customer engagement.

Curious how steady revenue expansion, a sharp swing into profitability, and a rich future earnings multiple can all coexist in one story? Unpack the full narrative to see which long term forecasts are doing the heavy lifting behind that fair value.

Result: Fair Value of $106.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting regulations in Europe and a weaker macro backdrop could slow sustainability demand and digital transformation budgets, which could challenge Workiva's upbeat growth narrative.

Find out about the key risks to this Workiva narrative.

Another Angle on Value

Analysts see Workiva as only modestly undervalued, but our DCF model is more optimistic, implying the shares trade about 35% below fair value. If the cash flow story proves right, today’s hesitation could be tomorrow’s missed opportunity, or a value trap in disguise.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Workiva Narrative

If you would rather dig into the numbers yourself or challenge these assumptions, you can craft a personalized view of Workiva in just minutes: Do it your way.

A great starting point for your Workiva research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more opportunities?

Before you move on, lock in your next moves by using the Simply Wall St Screener to spot fresh ideas that others will only notice later.

- Capture potential bargains early by reviewing these 909 undervalued stocks based on cash flows where strong cash flows and discounted prices intersect.

- Ride powerful technology trends by focusing on these 26 AI penny stocks that could reshape entire industries with intelligent automation.

- Strengthen your income stream by targeting these 15 dividend stocks with yields > 3% that aim to reward shareholders with consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com