IonQ (IONQ) Is Up 6.9% After 99.99% Fidelity Breakthrough and New Biotech, Defense Deals

- In late 2025, IonQ announced a series of developments, including a world-record 99.99% two-qubit gate fidelity, new quantum partnerships in biotech and defense, and an expanded international footprint through leadership appointments such as Dr. Marco Pistoia heading IonQ Italia.

- Together with its investment in Horizon Quantum Computing’s PIPE financing and its role as core technology partner for CCRM’s quantum-biotech initiatives, IonQ is increasingly positioning itself as a full-stack quantum platform spanning computing, networking, sensing, and security across multiple high-value sectors.

- Against this backdrop, we’ll examine how IonQ’s breakthrough 99.99% two-qubit gate fidelity reshapes the company’s investment narrative and perceived competitive position.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is IonQ's Investment Narrative?

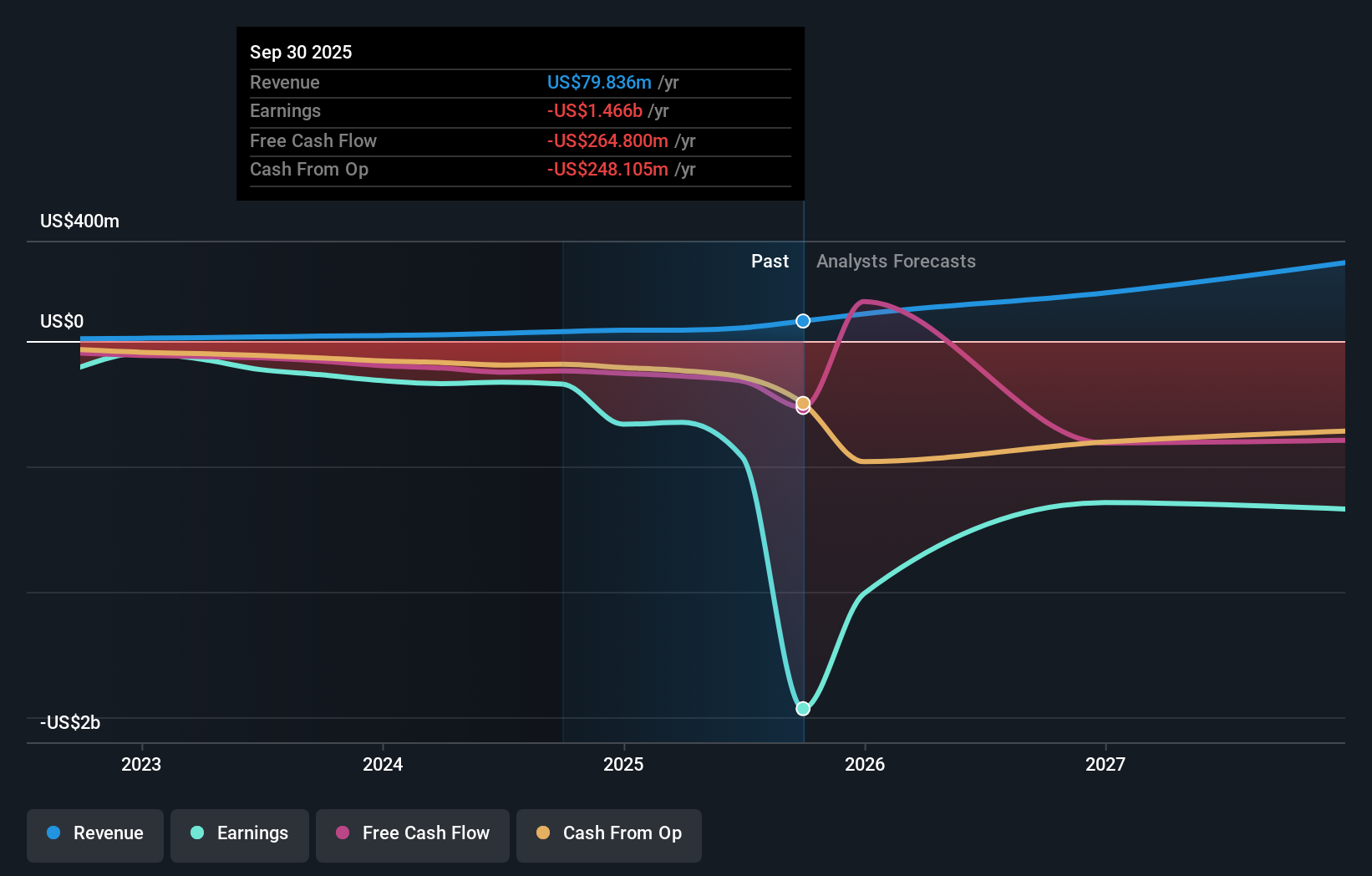

To own IonQ, you have to believe that today’s small, unprofitable pure‑play can grow into a core infrastructure provider for quantum computing, networking, sensing, and security across government and industry. Near term, the key catalysts are continued contract wins, especially from defense and national labs, plus evidence that its record 99.99% two‑qubit gate fidelity is pulling real workloads and revenue onto IonQ systems. The new CCRM quantum‑biotech partnership and the Heven AeroTech defense deal both reinforce that story, but they do not, on their own, change the fact that IonQ is still burning cash, issuing equity, and trading on very rich expectations. Instead, these announcements mainly strengthen the argument that IonQ’s platform is becoming harder for customers and partners to ignore.

However, the reliance on fresh capital and ongoing dilution is something investors should understand. Our expertly prepared valuation report on IonQ implies its share price may be too high.Exploring Other Perspectives

Explore 64 other fair value estimates on IonQ - why the stock might be worth as much as 61% more than the current price!

Build Your Own IonQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IonQ research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free IonQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IonQ's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com