Sarepta Therapeutics (SRPT): Valuation Check After New ENDEAVOR Dosing Approval and SRP-1003 Pipeline Milestones

Sarepta Therapeutics (SRPT) just cleared two important clinical hurdles, with the FDA greenlighting dosing for Cohort 8 in its ENDEAVOR gene therapy study and fresh progress in its SRP 1003 RNA program for myotonic dystrophy.

See our latest analysis for Sarepta Therapeutics.

Those twin updates land at a tense moment for Sarepta, with the stock showing a 19.23% 1 month share price return but a steep 82.63% 1 year total shareholder return decline. This suggests sentiment is stabilising from a very depressed base.

If this kind of binary biotech risk reward appeals to you, it is worth exploring other specialised healthcare stocks that could benefit as sentiment shifts across the sector.

With sales under pressure, mounting losses and a deep pipeline that could transform its fortunes, is Sarepta now trading below its long term potential, or are markets already pricing in every ounce of future growth?

Most Popular Narrative Narrative: 11.8% Overvalued

With Sarepta shares last closing at $22.26 against a narrative fair value of $19.91, the storyline leans cautious on upside from here.

The analysts have a consensus price target of $23.96 for Sarepta Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $5.0.

Want to see what justifies that wide spread between best and worst case outcomes? The narrative leans on shrinking losses, margin expansion and a richer future earnings multiple. Curious how those moving parts combine into a single fair value line, and what has to go right along the way? Dive in to unpack the full playbook behind this call.

Result: Fair Value of $19.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, safety concerns around Elevidys and lingering administrative bottlenecks in gene therapy access could easily derail even cautiously optimistic growth assumptions.

Find out about the key risks to this Sarepta Therapeutics narrative.

Another Lens on Valuation

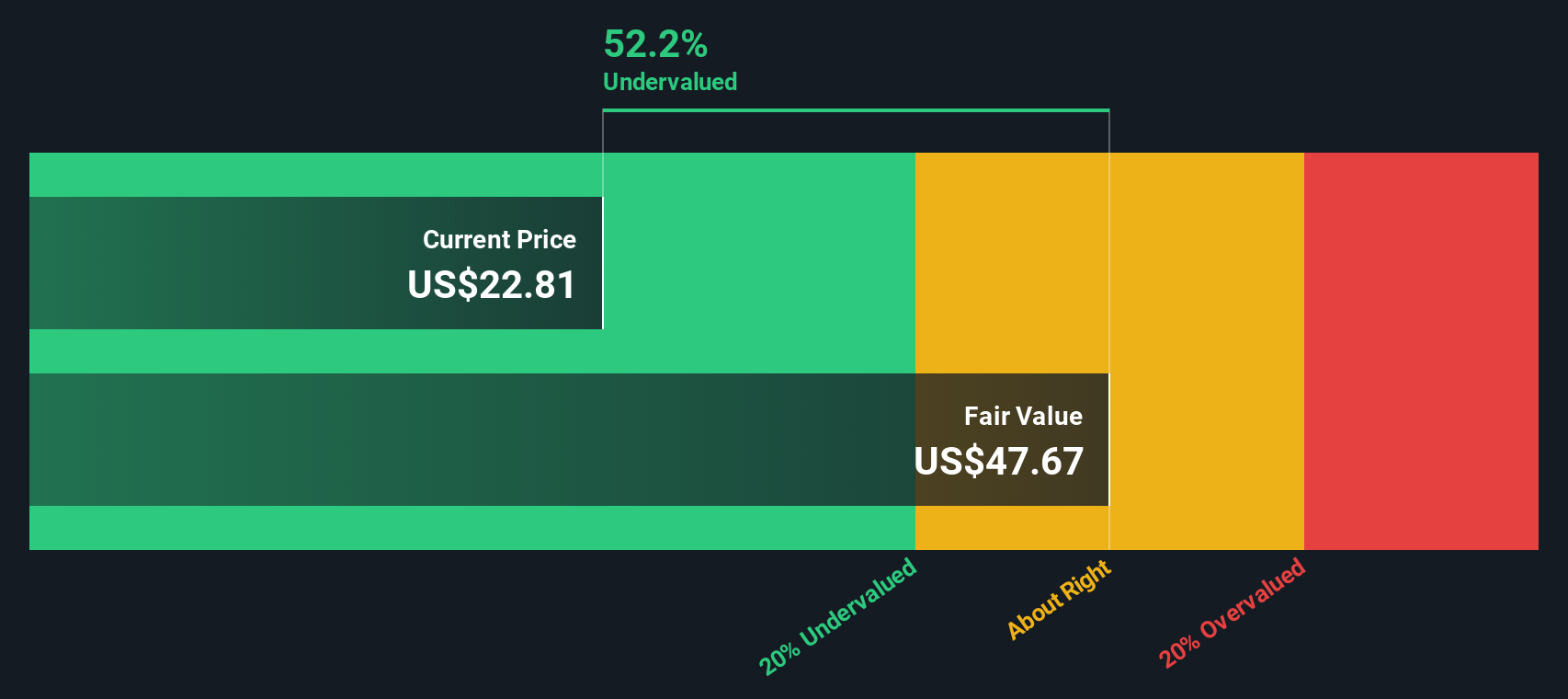

While the narrative fair value suggests Sarepta is 11.8% overvalued, our cash flow work tells a different story. The SWS DCF model pegs fair value closer to $59.65, implying the current $22.26 price is deeply discounted. Is the market overreacting to near term risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sarepta Therapeutics Narrative

If you would rather question these assumptions and dig into the numbers yourself, you can quickly build a tailored view in minutes using Do it your way.

A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to sharpen your edge beyond Sarepta? Use the Simply Wall St Screener to pinpoint stocks that match your strategy before the crowd catches on.

- Capture high potential growth by scanning these 3575 penny stocks with strong financials that pair smaller market caps with improving fundamentals and room for revaluation.

- Ride structural trends in automation and data by targeting these 30 healthcare AI stocks at the intersection of medicine, software and scalable AI platforms.

- Lock in income and stability by focusing on these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios and resilient balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com