The Bull Case For Madrigal Pharmaceuticals (MDGL) Could Change Following New Two-Year Rezdiffra Cirrhosis Data

- Earlier this month, Madrigal Pharmaceuticals reported positive two-year Phase 3 data for its Rezdiffra treatment in patients with compensated MASH cirrhosis, while also granting equity inducement awards to 24 new non-executive employees under its 2025 Inducement Plan.

- The new data strengthened investor focus on Rezdiffra’s potential role in advanced liver disease just as executives continued preset stock sale programs and analysts reiterated confidence in the drug’s commercial opportunity.

- We’ll now examine how the encouraging two-year Rezdiffra cirrhosis data could reshape Madrigal’s investment narrative and long-term growth assumptions.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Madrigal Pharmaceuticals Investment Narrative Recap

To own Madrigal today, you have to believe Rezdiffra can become a foundational treatment across MASH stages while the company manages high spending and competitive pressure. The new two year cirrhosis data supports the key near term catalyst around expanding Rezdiffra’s use in advanced liver disease, but it does not remove the central risk of relying so heavily on a single asset and future trial readouts.

The recent presentation of positive two year MAESTRO NAFLD 1 F4c data is most relevant here, because it directly informs expectations for Rezdiffra in compensated cirrhosis, where outcomes and safety will shape any future label expansion and commercial reach.

Yet investors should also weigh how Madrigal’s dependence on Rezdiffra leaves them exposed if longer term safety or efficacy data in cirrhosis were to...

Read the full narrative on Madrigal Pharmaceuticals (it's free!)

Madrigal Pharmaceuticals' narrative projects $2.5 billion revenue and $822.9 million earnings by 2028. This requires 68.6% yearly revenue growth and about a $1.1 billion earnings increase from -$281.9 million today.

Uncover how Madrigal Pharmaceuticals' forecasts yield a $563.80 fair value, in line with its current price.

Exploring Other Perspectives

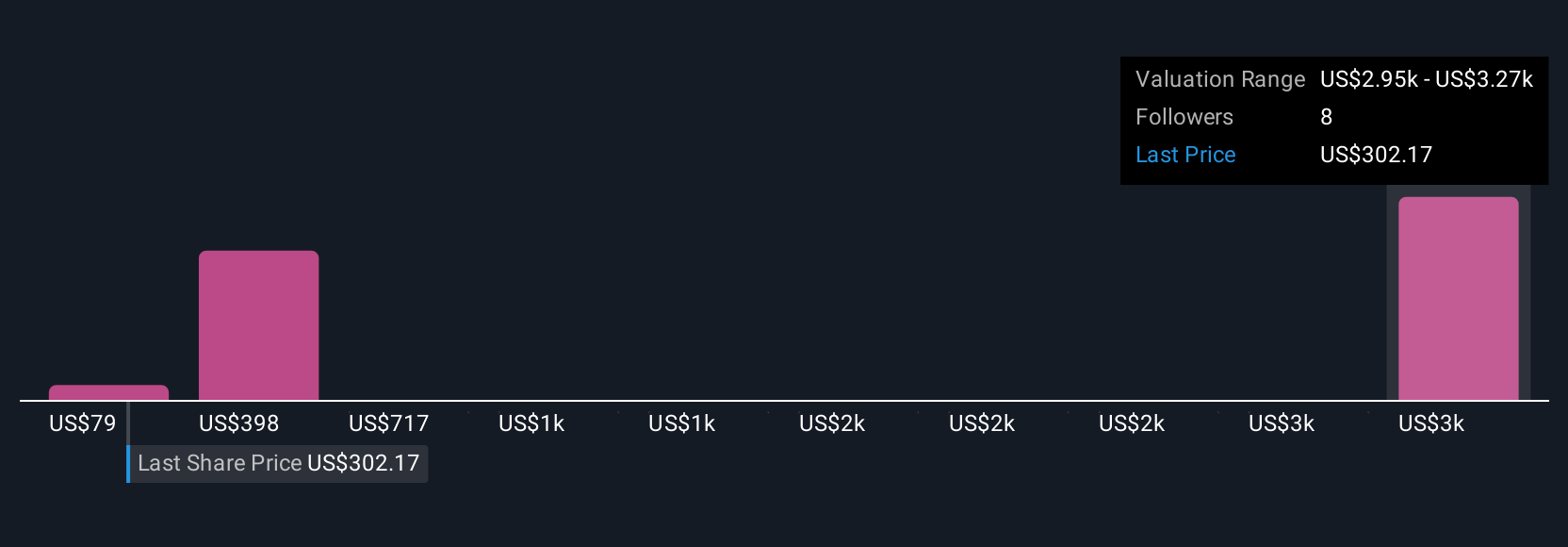

Six Simply Wall St Community fair value estimates for Madrigal range from US$460 to almost US$2,935 per share, underscoring very different views on upside. When you set those side by side with the central risk of Madrigal’s heavy reliance on Rezdiffra, it becomes even more important to compare several perspectives before forming an opinion.

Explore 6 other fair value estimates on Madrigal Pharmaceuticals - why the stock might be worth over 5x more than the current price!

Build Your Own Madrigal Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Madrigal Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Madrigal Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Madrigal Pharmaceuticals' overall financial health at a glance.

No Opportunity In Madrigal Pharmaceuticals?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com