Science Applications International (SAIC) Is Up 16.7% After Boosting 2026 Outlook, Buybacks, And Dividend

- In early December 2025, Science Applications International Corporation reported Q3 results with revenue of US$1.87 billion and net income of US$78 million, raised its full-year 2026 revenue guidance, completed a US$407.16 million buyback covering 7.83% of shares, and declared a quarterly dividend of US$0.37 per share payable in January 2026.

- Amid softer year-on-year sales, SAIC’s improved earnings guidance, meaningful share repurchases, growing defense contract wins, and commitment to quarterly dividends collectively highlight management’s focus on profitability, cash returns, and reinforcing its role in mission-critical government technology services.

- Next, we’ll examine how SAIC’s raised earnings guidance and ongoing share buybacks reshape the company’s existing investment narrative and risks.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Science Applications International Investment Narrative Recap

To own SAIC, you have to believe that its core role in mission-critical U.S. government IT and defense programs, plus disciplined cost control, can offset a softer revenue backdrop and funding noise. The latest quarter’s revenue decline, paired with higher full-year guidance and a completed US$407.16 million buyback, reinforces a margin and cash return story, but does not remove the key near term risk around contract timing and budget uncertainty across defense and civilian customers.

Among the recent announcements, the new US$242 million, 5 year contract with the Naval Undersea Warfare Center feels most relevant, because it speaks directly to SAIC’s ability to keep winning complex, higher value defense work. For investors watching the raised guidance and improving margins, this win helps support the idea that a strong backlog and book to bill can partially cushion periods of muted government IT spending, even as competition and funding delays remain important watchpoints.

Yet while the contracts and guidance upgrades look encouraging, investors should still be aware of the risk that prolonged government funding delays and on contract softness could...

Read the full narrative on Science Applications International (it's free!)

Science Applications International's narrative projects $7.7 billion revenue and $344.8 million earnings by 2028. This implies 1.0% yearly revenue growth and a $54.2 million earnings decline from $399.0 million today.

Uncover how Science Applications International's forecasts yield a $113.38 fair value, a 13% upside to its current price.

Exploring Other Perspectives

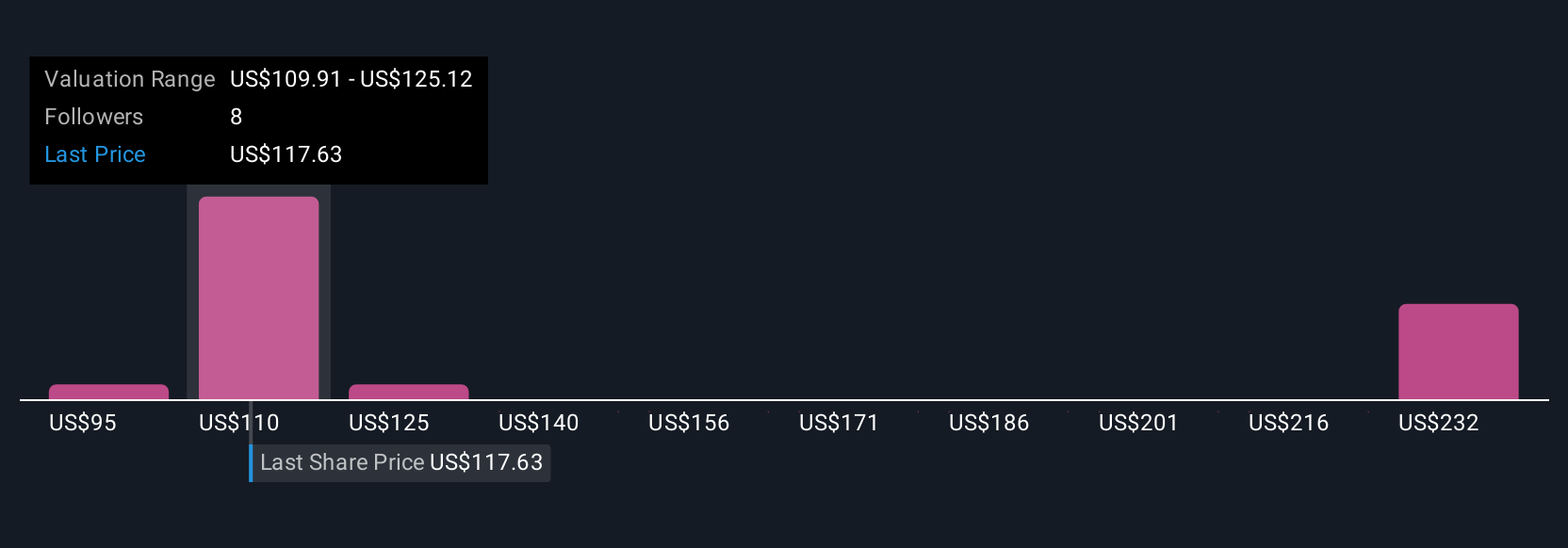

Three Simply Wall St Community fair value estimates for SAIC span roughly US$95 to US$186 per share, underlining how far apart individual views can be. Against that backdrop, the recent guidance increase amid revenue headwinds shows why you may want to compare several risk and contract pipeline scenarios before deciding how SAIC might fit into your portfolio.

Explore 3 other fair value estimates on Science Applications International - why the stock might be worth as much as 85% more than the current price!

Build Your Own Science Applications International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Science Applications International research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Science Applications International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Science Applications International's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com