Assessing Campbell Soup’s (CPB) Valuation After a Prolonged Share Price Slide

Campbell's (CPB) has been a frustrating hold lately, with the stock drifting lower despite steady revenue and improving profits. That disconnect between lukewarm share performance and underlying results is what makes the setup interesting.

See our latest analysis for Campbell's.

The share price has slipped to about $29.60, and that weak 90 day share price return of around negative 13 percent and three year total shareholder return near negative 41 percent suggest momentum is still fading rather than turning.

If Campbell's slower trend has you rethinking where to find steadier growth and conviction, this could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With the stock now trading well below analyst targets and at a steep discount to some intrinsic value estimates, the key question is whether Campbell's is quietly undervalued or if the market is correctly pricing in sluggish future growth.

Most Popular Narrative Narrative: 14.4% Undervalued

With the narrative fair value sitting above Campbell's last close of $29.60, the valuation hinges on slow top line trends but improving profitability.

Analysts expect earnings to reach $868.6 million (and earnings per share of $2.96) by about September 2028, up from $602.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.2 billion in earnings, and the most bearish expecting $689 million.

Want to see what bridges flat revenues with rising profits and a higher future multiple? The narrative leans on margin rebuild and a carefully dialed earnings ramp. Curious which assumptions really drive that upside gap?

Result: Fair Value of $34.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if volume declines in core soups and snacks persist, or if higher tariffs and input costs crimp the expected margin rebuild.

Find out about the key risks to this Campbell's narrative.

Another Angle on Valuation

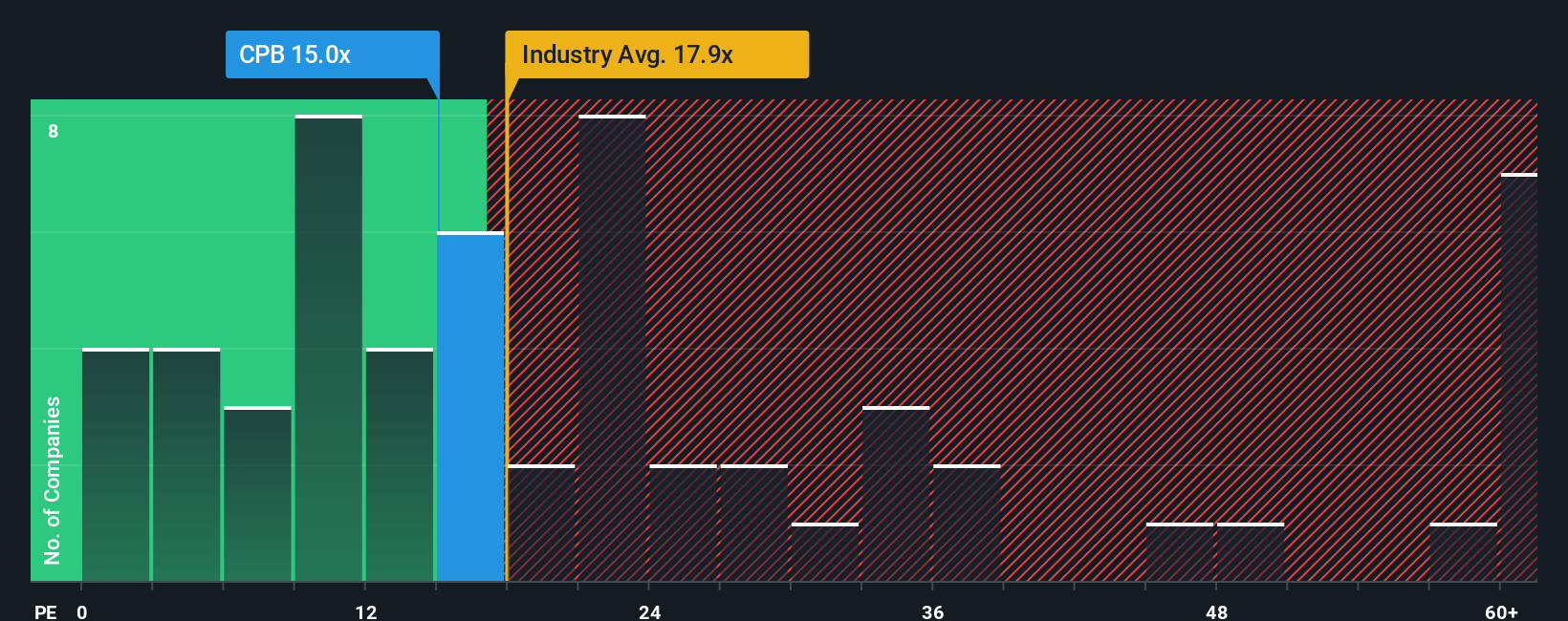

Step away from fair value models, and Campbell's looks less generous. The current price implies a price to earnings ratio of 14.6 times, slightly higher than peers at 13.9 times but below its own fair ratio of 18.7 times, which hints at limited upside if sentiment sours.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Campbell's Narrative

If you see the story differently, or simply want to test your own assumptions against the numbers, you can build a fresh view in minutes: Do it your way.

A great starting point for your Campbell's research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall Street Screener to help identify stocks that align with your strategy and may reduce guesswork.

- Explore potential multibaggers early by scanning through these 3573 penny stocks with strong financials that already show solid balance sheets and improving fundamentals.

- Review these 26 AI penny stocks that combine current revenue generation with compelling growth narratives in the AI space.

- Search for these 15 dividend stocks with yields > 3% that may enhance your portfolio with consistent cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com