What China Petroleum & Chemical (SEHK:386)'s DME Marine Fuel Push Means For Shareholders

- Earlier this month, a coalition of major Chinese state-owned enterprises and academic institutions, including China Petroleum & Chemical Corp. (Sinopec), launched an initiative to promote dimethyl ether (DME) as a cleaner and safer next-generation marine fuel, targeting advances in production, engine systems, refueling infrastructure, and safety standards.

- This alliance positions Sinopec at the center of efforts to accelerate low-emission shipping fuels, potentially reinforcing its role in China’s broader energy transition agenda.

- Against this backdrop, we’ll explore how Sinopec’s push into DME marine fuel technology could influence its longer-term investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

What Is China Petroleum & Chemical's Investment Narrative?

To own Sinopec, you really have to believe this is still a cash-generating, system-critical energy company that can steadily earn through cycles while nudging its portfolio toward cleaner fuels and higher-value chemicals. In the short term, earnings, refining margins and the very large dividend stream remain the main share price drivers, with the buyback and governance reshuffle adding a layer of support and uncertainty at the same time. The new DME marine fuel alliance fits more into the “optional upside” bucket than a near-term catalyst; it signals policy alignment and technology ambition, but is unlikely to move the needle against current margin pressure, low return on equity and a dividend that has not been well covered by free cash flow. It does, however, inch the risk mix toward execution and capital allocation choices in low-carbon projects.

China Petroleum & Chemical's shares have been on the rise but are still potentially undervalued by 48%. Find out what it's worth.Exploring Other Perspectives

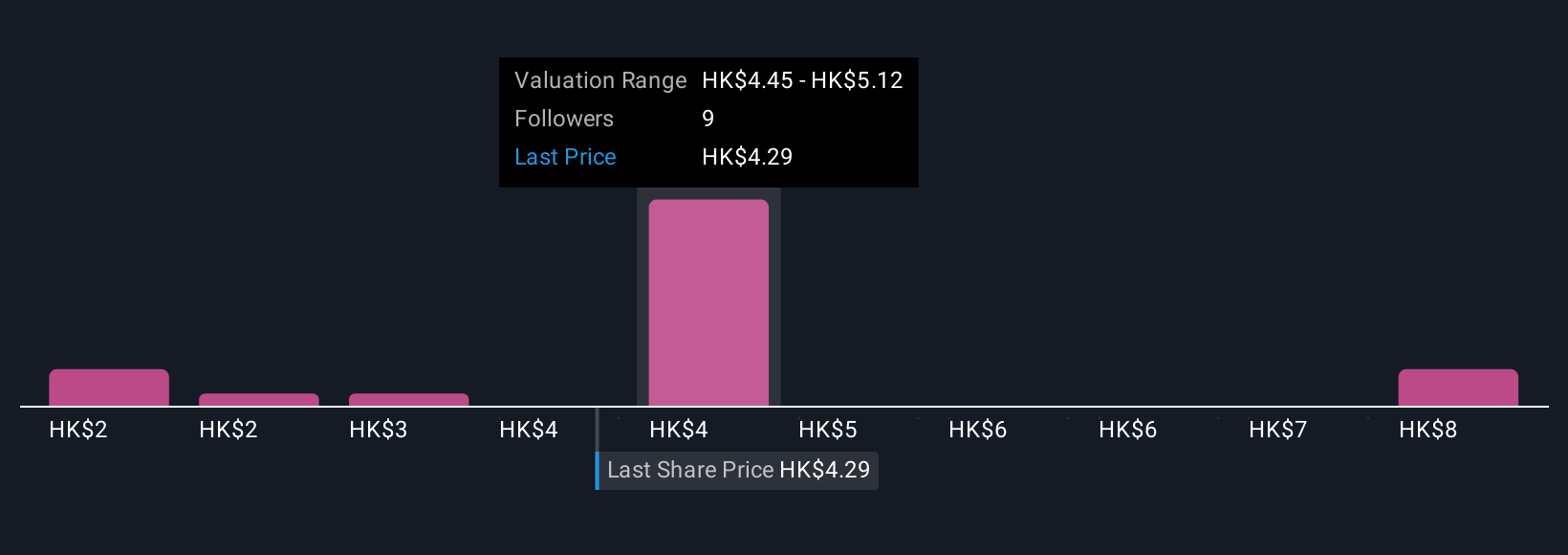

Six fair value estimates from the Simply Wall St Community span HK$1.74 to HK$8.73 per share, showing how far apart individual views can be. Set that against Sinopec’s thin profit margins, low return on equity and the emerging DME marine fuel bet, and you start to see how differently investors might weigh its income appeal against execution and governance risks.

Explore 6 other fair value estimates on China Petroleum & Chemical - why the stock might be worth less than half the current price!

Build Your Own China Petroleum & Chemical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Petroleum & Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Petroleum & Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Petroleum & Chemical's overall financial health at a glance.

No Opportunity In China Petroleum & Chemical?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com