What Neogen (NEOG)'s Portfolio Simplification and Divestitures Strategy Means For Shareholders

- Neogen recently moved to simplify its portfolio and accelerate deleveraging by divesting lower-quality businesses tied to its 2022 merger with 3M’s Food Safety division, while working through the final stages of integration.

- This shift, driven by new leadership and a tighter focus on higher-growth areas such as bovine-related products, highlights a push to improve operational efficiency and concentrate resources on the company’s strongest food and animal safety franchises.

- We’ll now examine how Neogen’s renewed focus on higher-growth segments and divestiture of non-core operations could reshape its investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Neogen Investment Narrative Recap

To own Neogen, you need to believe that food and animal safety testing remains an essential, growing need and that the company can translate its broad portfolio into consistent, profitable growth. The recent divestitures and focus on higher growth bovine products feed directly into the key short term catalyst of improving margins and cash generation, while also amplifying the main risk around execution on the still unfinished 3M Food Safety integration and related cost structure.

Among recent developments, Neogen’s appointment of Bryan Riggsbee as CFO stands out as particularly relevant. With the company working through integration challenges, goodwill impairments and portfolio reshaping, fresh financial leadership is central to managing debt reduction, transition costs from divestitures and capital allocation, all of which feed into how quickly the integration catalyst can translate into cleaner earnings and a clearer equity story.

But while the refocus and new leadership may look encouraging, investors should also be aware of ongoing integration inefficiencies and the potential for lingering stranded costs...

Read the full narrative on Neogen (it's free!)

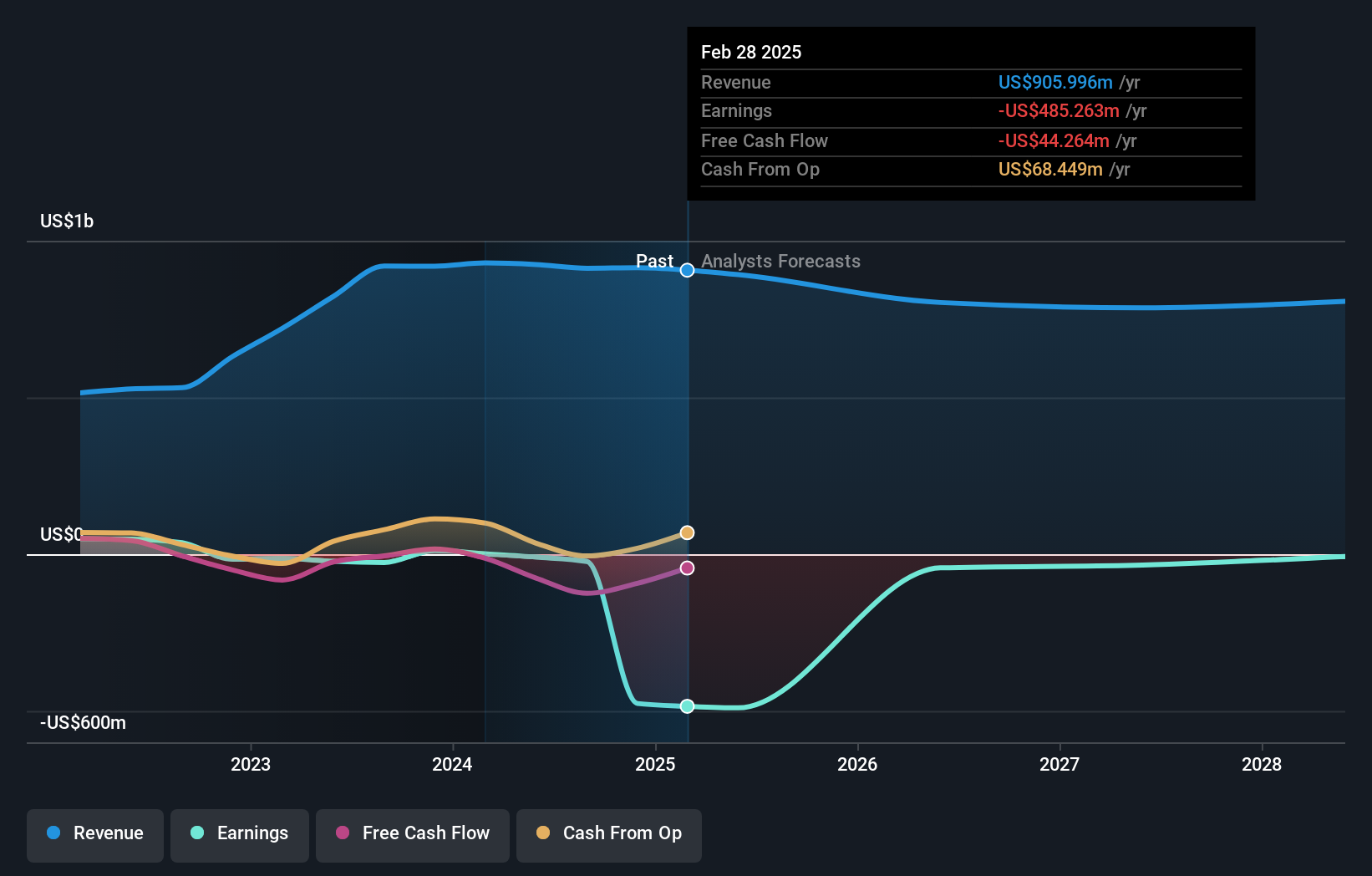

Neogen's narrative projects $859.1 million revenue and $107.3 million earnings by 2028. This requires a 1.3% yearly revenue decline and an earnings increase of about $1.2 billion from $-1.1 billion today.

Uncover how Neogen's forecasts yield a $8.17 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for Neogen span from US$8.17 to US$14.15, underlining how far apart individual views can be. Set these against the ongoing execution risk around the 3M Food Safety integration and you start to see why it can pay to compare several independent perspectives before deciding how Neogen might fit into your portfolio.

Explore 2 other fair value estimates on Neogen - why the stock might be worth over 2x more than the current price!

Build Your Own Neogen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neogen research is our analysis highlighting 1 important warning sign that could impact your investment decision.

- Our free Neogen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neogen's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com