How Investors May Respond To Azenta (AZTA) Delaying Its 10-K Filing And Financial Disclosures

- On 2 December 2025, Azenta, Inc. disclosed that it would miss the SEC deadline for filing its next Form 10-K annual report, signaling a delay in its formal financial disclosures.

- This kind of filing delay can heighten investor scrutiny of the company’s financial reporting processes, internal controls, and overall transparency at a sensitive time for life sciences businesses.

- We’ll now explore how Azenta’s delayed 10-K filing may affect the previously outlined investment narrative, particularly around earnings quality and governance.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Azenta Investment Narrative Recap

To own Azenta, you need to believe its life sciences storage and services platform can translate steady, modest revenue growth into improving earnings quality over time. The delayed 10-K filing raises questions around reporting reliability, but does not directly change the near term demand picture or the main risk that end market budget pressures could keep revenue growth and margins uneven.

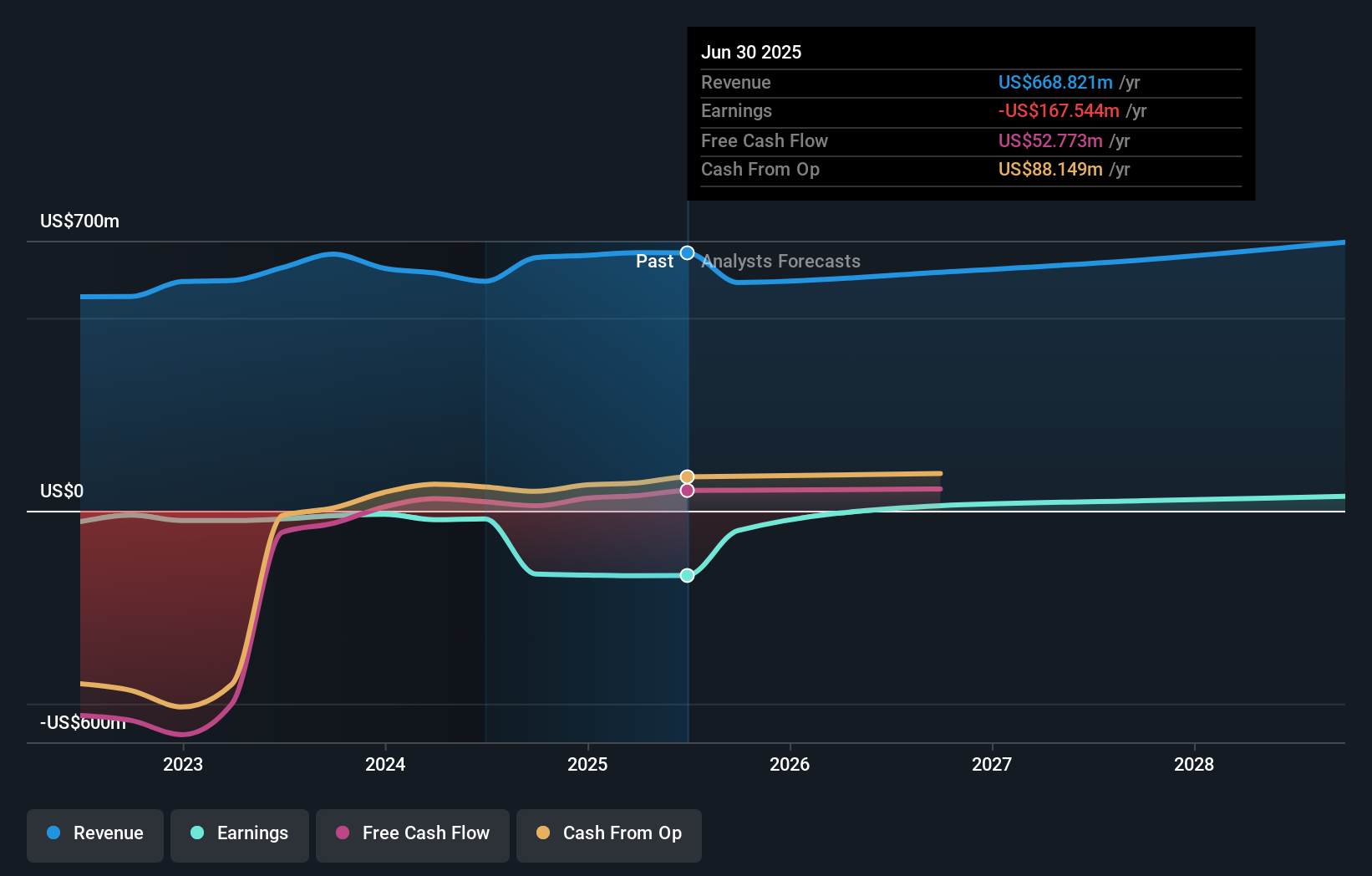

The recent Q4 2025 earnings release is particularly relevant here, as it showed Azenta returning to profitability with US$159.19 million in quarterly revenue and US$47.14 million in net income. Until the delayed 10-K is filed, however, some investors may treat those results and the company’s 3% to 5% organic growth guidance more cautiously, given existing concerns about earnings quality and reliance on favorable mix and cost controls.

But investors should also be aware that if order delays in higher margin products persist...

Read the full narrative on Azenta (it's free!)

Azenta's narrative projects $684.6 million revenue and $34.5 million earnings by 2028. This requires a 0.8% yearly revenue decline and a $202.0 million earnings increase from $-167.5 million today.

Uncover how Azenta's forecasts yield a $39.83 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster between US$36.38 and US$39.83, reflecting differing views on Azenta’s potential. You can set those side by side with the renewed scrutiny around the late 10-K filing and decide how governance risk might influence the company’s longer term performance.

Explore 2 other fair value estimates on Azenta - why the stock might be worth just $36.38!

Build Your Own Azenta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Azenta research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Azenta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Azenta's overall financial health at a glance.

No Opportunity In Azenta?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com