How Investors Are Reacting To Cmb.Tech (ENXTBR:CMBT) Softer Earnings And Steady Interim Dividend Plan

- Cmb.Tech NV has reported earnings for the nine months ended 30 September 2025, with sales rising to US$1,077.1 million but revenue and net income falling to US$1,248.43 million and US$71.64 million respectively compared with the same period a year earlier.

- Alongside weaker profitability and a sharp drop in earnings per share from continuing operations, CMB.TECH still plans to propose an interim dividend of US$0.05 per share, highlighting a continued commitment to shareholder payouts.

- With recent returns under pressure, we’ll explore how softer earnings alongside the planned interim dividend proposal shape Cmb.Tech’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Cmb.Tech's Investment Narrative?

To own Cmb.Tech after this latest update, you need to believe the core shipping and energy-transition story can absorb a very weak profit year without permanently denting its long-term potential. The nine‑month figures show revenue holding up but earnings collapsing, confirming earlier concerns about one‑off items and thinner margins, and putting more weight on near‑term catalysts like vessel deliveries, asset sales and charter extensions to rebuild profitability. The board’s decision to maintain a US$0.05 interim dividend, even as net income drops sharply, underlines a desire to keep the income story alive, but also sharpens questions around cash coverage and balance sheet resilience. Combined with recent index removals and already volatile trading, this earnings reset looks material enough to bring funding costs, governance stability and execution risk firmly back into focus.

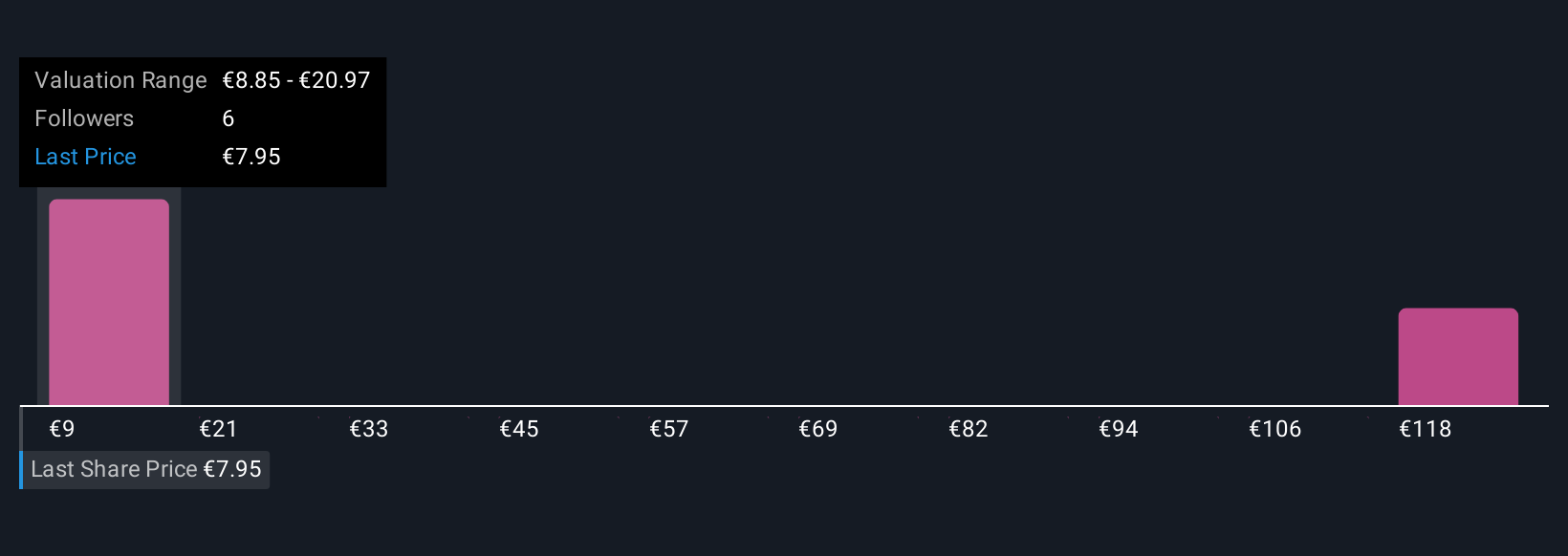

However, the gap between earnings pressure and dividend ambition is something investors should not ignore. Despite retreating, Cmb.Tech's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 6 other fair value estimates on Cmb.Tech - why the stock might be worth 5% less than the current price!

Build Your Own Cmb.Tech Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cmb.Tech research is our analysis highlighting 2 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Cmb.Tech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cmb.Tech's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com