GitLab (GTLB) Valuation Check After Q3 Beat, Softer Outlook and Leadership Changes

GitLab (GTLB) just delivered third quarter numbers that topped expectations, but the stock reaction has been choppy as investors weigh strong subscription growth against a cooler revenue outlook for the coming quarter.

See our latest analysis for GitLab.

The stock tells a more cautious story than the business does. The year-to-date share price return is down about 33 percent and the 1-year total shareholder return is off roughly 44 percent. This suggests momentum has clearly faded as investors reassess growth and execution risk despite upbeat guidance, new CFO leadership, and industry recognition for its DevOps and AI capabilities.

If GitLab’s swing in sentiment has you rethinking your tech exposure, this could be a good moment to explore other high growth tech and AI stocks that the market may be pricing more favourably.

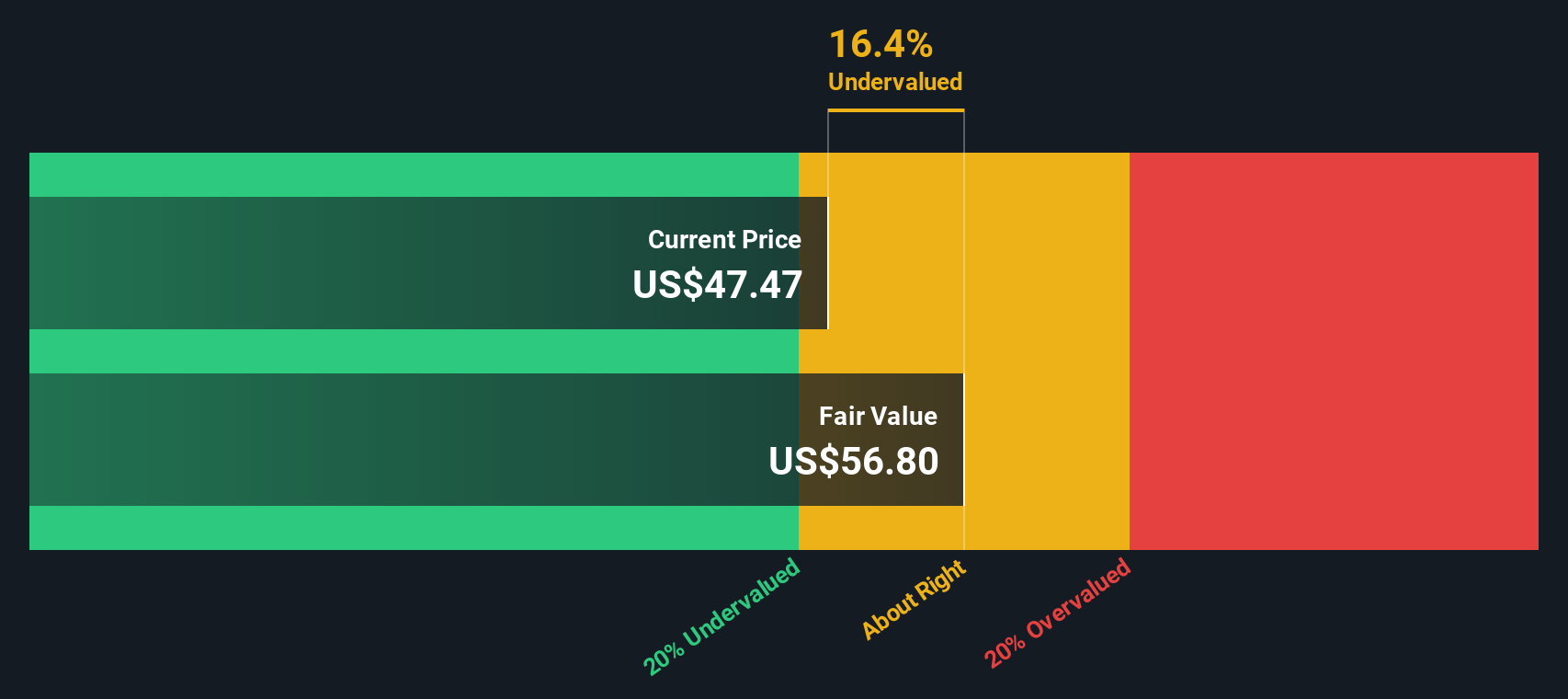

With shares now trading near 52 week lows despite double digit revenue growth and upside to analyst targets, investors face a key question: is GitLab undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 35.1% Undervalued

Compared with GitLab’s last close at $37.35, the most followed narrative points to a materially higher fair value, framing the stock as significantly discounted on future fundamentals.

GitLab's expansion of AI-driven capabilities across its DevSecOps platform, including the upcoming Duo Agent Platform with hybrid usage-based monetization, is expected to capture increased demand for automation and developer productivity tools, potentially accelerating revenue growth and expanding margins as high-value features command premium pricing and upsell opportunities.

Curious how one integrated platform, rising recurring revenue, and richer margins could justify such a gap to today’s price? See which long range growth, profitability, and valuation assumptions power this fair value call, and how a single multiple years from now drives the whole story.

Result: Fair Value of $57.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and execution risk around GitLab’s evolving go to market model could slow adoption and challenge the bullish takeover and AI driven growth narrative.

Find out about the key risks to this GitLab narrative.

Another Angle on Value

While the popular narrative leans on future earnings power and lofty price targets, our DCF model paints a similar picture from a different angle. It suggests GitLab is trading around 41 percent below its estimated fair value. If both stories point to upside, what might the market be missing today?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GitLab Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised GitLab storyline in minutes: Do it your way.

A great starting point for your GitLab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with one stock when the market is full of opportunities, use the Simply Wall Street Screener to upgrade your shortlist with focused, data driven ideas.

- Capture early stage potential with these 3573 penny stocks with strong financials that already back their stories with improving balance sheets and resilient cash flows.

- Ride structural shifts in automation and machine learning by targeting these 26 AI penny stocks positioned at the intersection of real revenue growth and scalable platforms.

- Lock in a margin of safety by scanning these 911 undervalued stocks based on cash flows where cash flow strength and current prices create compelling upside, before sentiment catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com