Sydbank (CPSE:SYDB) Valuation Check After a Strong 72% One-Year Return

Market context and recent performance

Sydbank (CPSE:SYDB) has quietly built solid momentum, with the share price up about 3 % in the past week, 11 % over the past month, and nearly 20 % in the past 3 months.

See our latest analysis for Sydbank.

Zooming out, that recent strength builds on a powerful run, with the share price up strongly year to date and a 1 year total shareholder return of 72.3% that points to growing confidence in Sydbank's earnings and capital position.

If Sydbank's rally has you thinking about what else might be gaining traction, this could be a good moment to explore fast growing stocks with high insider ownership.

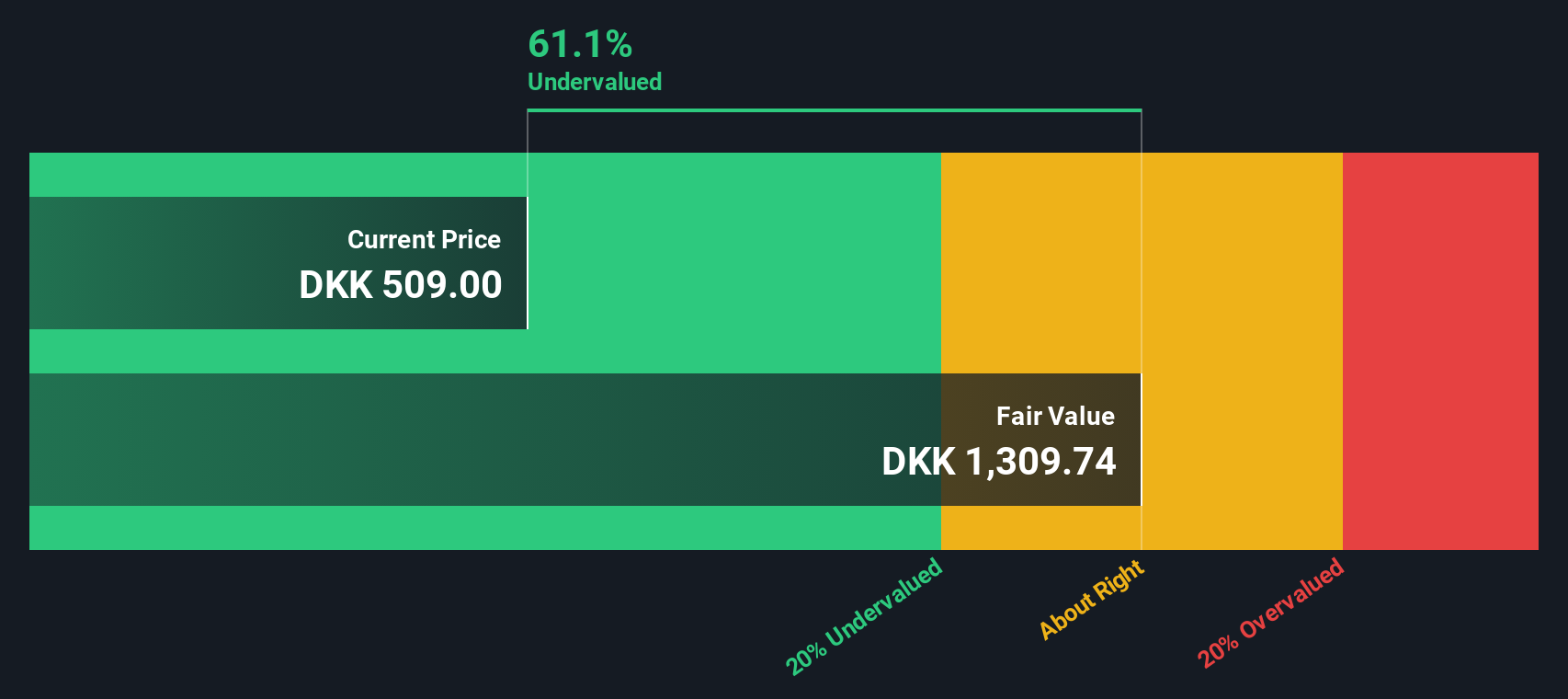

After such a powerful rally and with shares still trading below analyst targets and some intrinsic value estimates, the key question now is whether Sydbank remains undervalued or if the market is already pricing in future growth.

Price to earnings of 12.7x: Is it justified?

Sydbank trades on a price to earnings ratio of 12.7 times, which looks expensive versus key bank benchmarks despite the strong share price performance.

The price to earnings multiple compares the current share price to the company’s earnings per share. This makes it a core yardstick for valuing profitable banks like Sydbank.

In Sydbank’s case, investors are paying 12.7 times earnings, which is richer than both the Danish and wider European bank peer averages of 9.9 times and 10.3 times respectively. This suggests the market is already attaching a premium to its profit profile.

That premium also sits slightly above the 12 times fair price to earnings level implied by our fair ratio work. This hints at limited room for further multiple expansion if sentiment cools.

Explore the SWS fair ratio for Sydbank

Result: Price-to-earnings of 12.7x (OVERVALUED)

However, softer revenue and profit growth, along with any setback in analyst expectations, could quickly challenge the premium multiple the shares now command.

Find out about the key risks to this Sydbank narrative.

Another view on value

Our SWS DCF model tells a very different story. It suggests fair value near DKK 1,133.77, almost double the current DKK 579 price. That points to Sydbank trading about 49% below our estimate and raises the question: is the earnings premium masking a deeper value gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sydbank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sydbank Narrative

If these conclusions do not quite align with your view or you would rather dig into the numbers yourself, you can build a personalised narrative in just a few minutes, Do it your way.

A great starting point for your Sydbank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Sydbank, you could miss standout opportunities, so keep your edge sharp by scanning curated stock ideas tailored to different strategies and themes.

- Capture potential mispricings by targeting quality companies trading below intrinsic value with these 911 undervalued stocks based on cash flows that could rerate as the market catches up.

- Ride powerful secular trends in automation and machine learning by zeroing in on these 26 AI penny stocks poised to benefit from accelerating AI adoption.

- Lock in dependable cash flows by focusing on these 15 dividend stocks with yields > 3% that can help underpin total returns through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com