Is Ascletis Pharma (SEHK:1672) Quietly Reframing Its Obesity Strategy With ASC37’s Oral Triple Agonist?

- In late November 2025, Ascletis Pharma announced it had selected ASC37, an oral GLP-1R/GIPR/GCGR triple peptide agonist developed with its POTENT and AI-assisted technologies, as a clinical development candidate and outlined plans to file a US FDA Investigational New Drug application for obesity treatment in 2026.

- The company highlighted that ASC37 showed much higher in vitro potency and substantially improved oral bioavailability versus existing incretin drugs in non-human primate studies, underscoring Ascletis’ ambition to compete in advanced oral obesity therapies.

- We’ll now examine how ASC37’s enhanced oral bioavailability and planned US FDA IND submission shape Ascletis Pharma’s broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Ascletis Pharma's Investment Narrative?

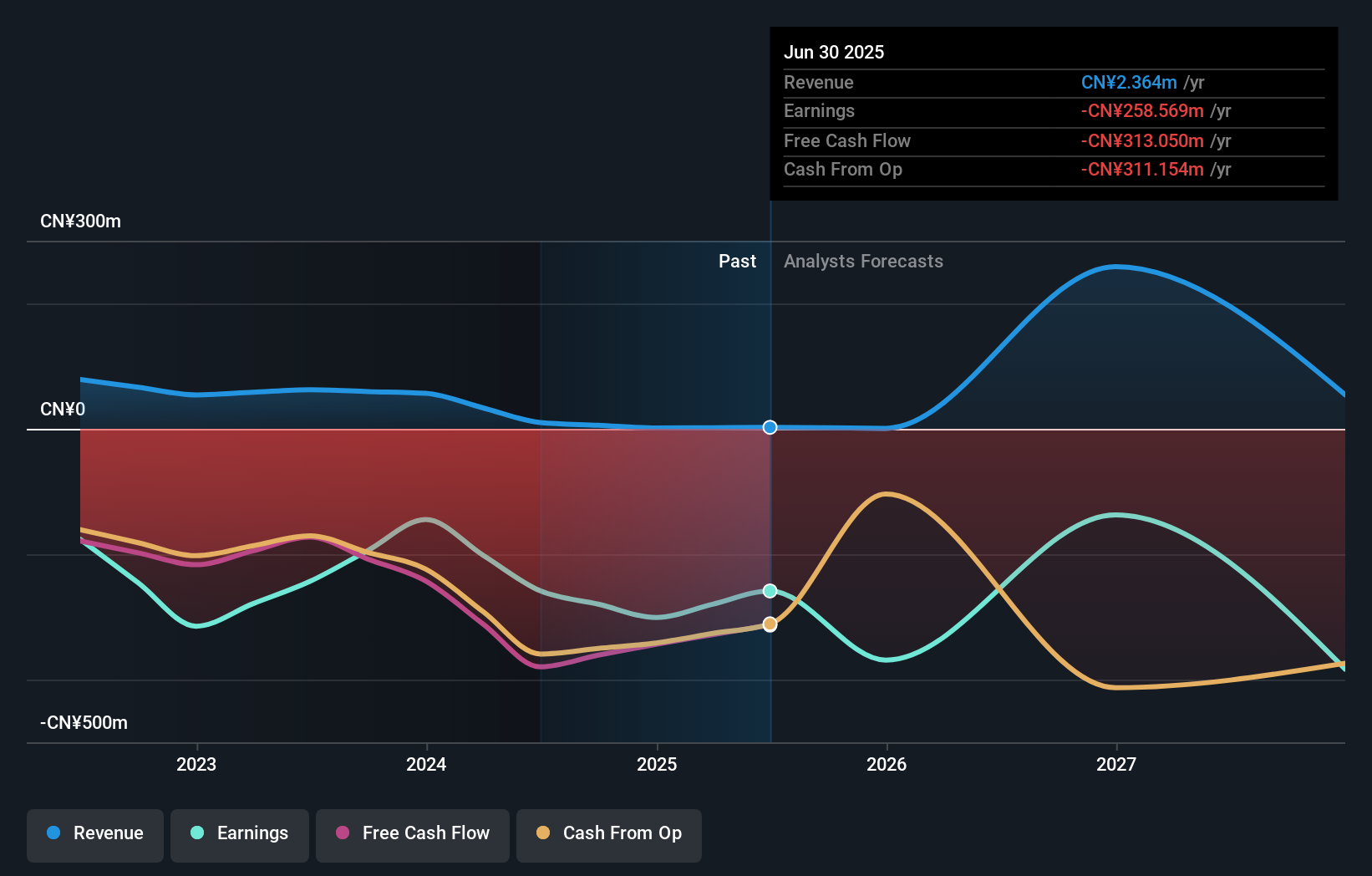

To own Ascletis Pharma, you really have to buy into its pipeline-first story and the idea that obesity and metabolic drugs can eventually justify today’s losses and rich price-to-book multiple. The ASC37 announcement feeds directly into that belief: it strengthens Ascletis’ positioning in oral incretin obesity therapies and potentially adds a fresh medium-term catalyst on top of ASC30 and other programs. In the short term, the planned 2026 US FDA IND filing is more about perception than revenue, but it could matter for sentiment after a very large 1‑year total return and recent volatility. At the same time, this deepening obesity focus raises execution risk around funding multiple trials, sustaining R&D, and progressing from compelling non-human primate data to human proof-of-concept while the company remains unprofitable.

However, one key funding and dilution risk tied to this expanded pipeline is easy to overlook. The analysis detailed in our Ascletis Pharma valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore another fair value estimate on Ascletis Pharma - why the stock might be worth as much as HK$0.022!

Build Your Own Ascletis Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ascletis Pharma research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Ascletis Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ascletis Pharma's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com